Narratives are currently in beta

Key Takeaways

- Strategic acquisitions and innovations position Patterson-UTI for growth, enhancing revenue and operational capabilities in oilfield services.

- International ventures and efficient technology investments boost profitability, despite industry fluctuations, ensuring stable and potentially increased revenue.

- Fluctuating oil prices and equipment challenges threaten revenue, while a significant goodwill impairment highlights overvaluation risks and could impact net earnings.

Catalysts

About Patterson-UTI Energy- Through its subsidiaries, engages in the provision of contract drilling services to oil and natural gas operators in the United States and internationally.

- Patterson-UTI Energy's strategic acquisitions of Ulterra and NexTier have significantly enhanced its operational capabilities, positioning it for future growth through integration and commercial synergies in the oilfield services sector. This is expected to bolster future revenue growth as the company taps into a broader customer base with its integrated services.

- The introduction of performance-based agreements and fully integrated drilling and completion arrangements signal a shift towards more profitable operations. This strategy is likely to enhance the company’s net margins due to increased efficiencies and a more comprehensive service offering.

- With Patterson-UTI’s large customer programs and Tier 1 high-spec rigs likely maintaining steady activity levels, the company is well-positioned to sustain revenue per day despite industry fluctuations, suggesting a stable revenue outlook.

- The shift towards electric fracturing fleets, combined with investments in high-grade equipment, supports higher average returns and efficiency. As these fleets increasingly replace older machinery, they are expected to strengthen profitability and possibly net margins in the Completion Services segment.

- The joint venture with ADNOC in the UAE represents a strategic entry into a promising international market that could drive significant revenue growth. This venture creates an opportunity for extended multi-year unconventional drilling and completion activity, potentially leading to an expanded revenue stream and earnings diversification.

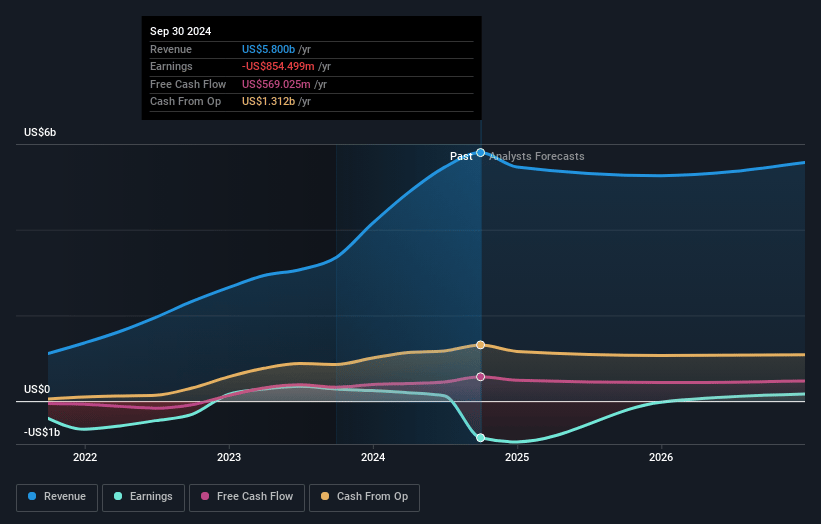

Patterson-UTI Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Patterson-UTI Energy's revenue will grow by 3.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from -14.7% today to 8.4% in 3 years time.

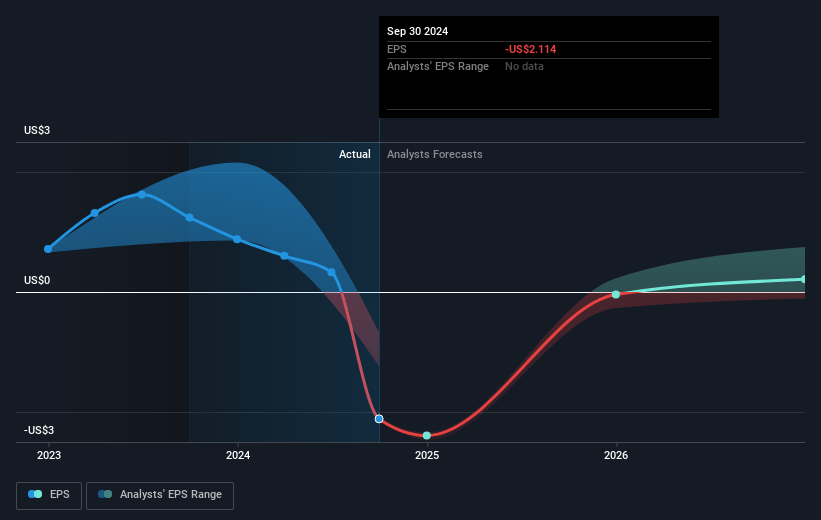

- Analysts expect earnings to reach $538.5 million (and earnings per share of $0.3) by about November 2027, up from $-854.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 48.4x on those 2027 earnings, up from -3.7x today. This future PE is greater than the current PE for the US Energy Services industry at 16.6x.

- Analysts expect the number of shares outstanding to grow by 66.63% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.87%, as per the Simply Wall St company report.

Patterson-UTI Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Fluctuations in oil and natural gas prices, and shifting industry activity across key basins, could reduce demand and impact revenues and profit margins.

- The expectation that the average activity levels in 2025 could be slightly lower than in 2024, leading to potential reductions in revenue and net earnings.

- The $885 million goodwill impairment charge related to the NexTier merger indicates potential overvaluation risks that can impact net earnings and shareholder equity.

- Ongoing natural gas takeaway constraints from the Permian Basin could limit growth opportunities, possibly affecting revenues and profit margins.

- Equipment supply challenges and the need for further CapEx investments, especially in the face of retiring older equipment, could strain free cash flow and net earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $11.21 for Patterson-UTI Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $15.0, and the most bearish reporting a price target of just $9.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $6.4 billion, earnings will come to $538.5 million, and it would be trading on a PE ratio of 48.4x, assuming you use a discount rate of 8.9%.

- Given the current share price of $8.11, the analyst's price target of $11.21 is 27.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives