Narratives are currently in beta

Key Takeaways

- Operational efficiencies and strategic acquisitions could drive revenue growth, enhance net margins, and improve financial performance.

- Financial certainty from resolved claims and improved leverage supports efficient capital allocation and increased shareholder returns.

- Ongoing legal settlements, insurance claims, and market uncertainties pose financial risks, while dependence on producer efficiencies and acquisitions may challenge growth and stability.

Catalysts

About Plains GP Holdings- Through its subsidiary, Plains All American Pipeline, L.P., owns and operates midstream infrastructure systems in the United States and Canada.

- Plains GP Holdings expects to be at the top end of its 2024 adjusted EBITDA guidance range, driven by solid Permian volume growth and operational efficiencies, which could positively impact future revenue and earnings.

- The Fort Saskatchewan Fractionation expansion project is on schedule and on budget for completion in the first half of 2025, which is expected to enhance NGL processing capabilities and improve future revenue.

- Strategic bolt-on acquisitions, like the recent purchase of the Fivestones Permian gathering system, are anticipated to create incremental growth opportunities and improve financial performance, impacting both revenue and net margins.

- The resolution of material claims related to the 2015 oil spill in California and anticipated insurance reimbursement provide financial certainty, which could enhance net margins and overall future cash flow.

- The company’s improved financial outlook and lower leverage could allow more efficient capital allocation, which is expected to enhance earnings and increase return of capital to shareholders over the long term.

Plains GP Holdings Future Earnings and Revenue Growth

Assumptions

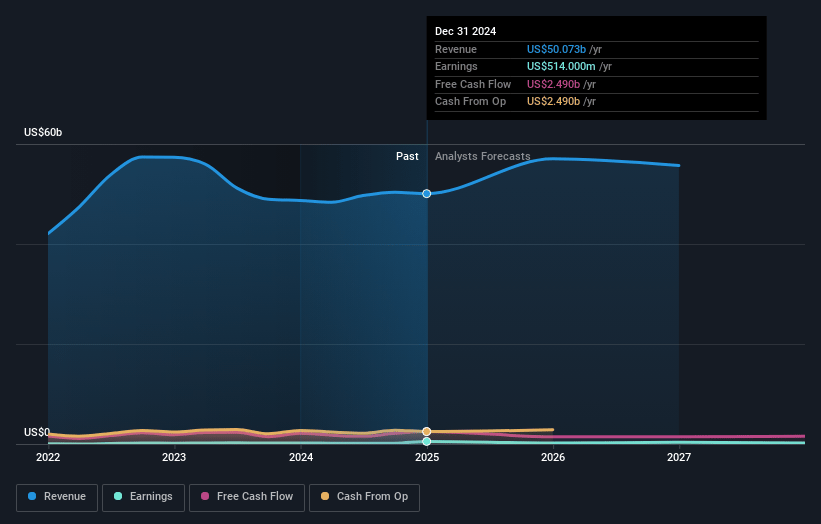

How have these above catalysts been quantified?- Analysts are assuming Plains GP Holdings's revenue will grow by 4.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.3% today to 0.4% in 3 years time.

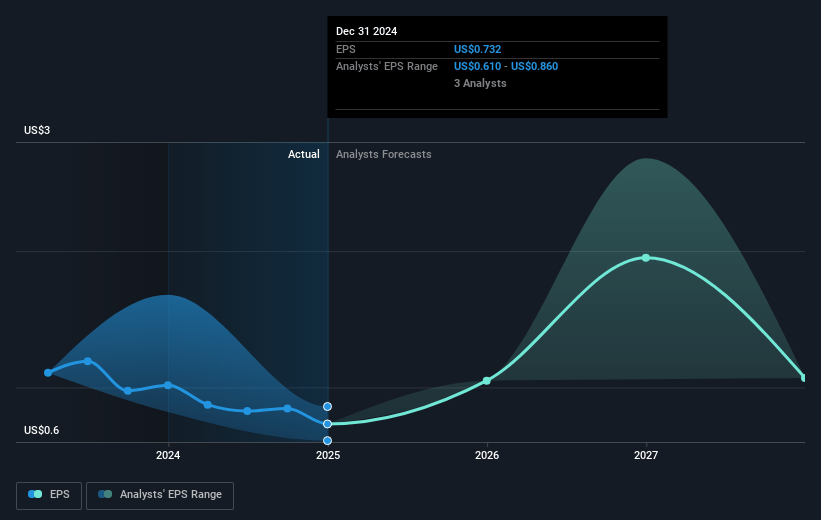

- Analysts expect earnings to reach $226.1 million (and earnings per share of $1.22) by about December 2027, up from $166.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $355.1 million in earnings, and the most bearish expecting $194 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 23.1x on those 2027 earnings, up from 22.4x today. This future PE is greater than the current PE for the US Oil and Gas industry at 10.9x.

- Analysts expect the number of shares outstanding to decline by 7.34% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.86%, as per the Simply Wall St company report.

Plains GP Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company recently settled two lawsuits related to the 2015 oil spill in California and booked a charge of $120 million, with ongoing contingencies that could impact future cash flows and net margins.

- Plains GP Holdings is awaiting resolution of a $225 million reimbursement claim from insurance carriers with a significant amount still unresolved, creating uncertainty that could affect earnings stability.

- The Permian volume growth forecast is heavily reliant on producer efficiencies despite lower horizontal rig counts, indicating potential risks to revenue if efficiencies do not materialize as expected.

- While focused on bolt-on acquisitions for growth, there is an inherent risk of overpaying or failing to achieve anticipated synergies, which could adversely impact revenue and financial flexibility.

- Geopolitical unrest and potential changes in OPEC supply could create volatile market conditions that affect both revenue projections and earnings stability for Plains GP Holdings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $20.69 for Plains GP Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $24.0, and the most bearish reporting a price target of just $17.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $57.7 billion, earnings will come to $226.1 million, and it would be trading on a PE ratio of 23.1x, assuming you use a discount rate of 10.9%.

- Given the current share price of $18.8, the analyst's price target of $20.69 is 9.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives