Last Update07 May 25Fair value Decreased 34%

Key Takeaways

- Strong capital restructuring and investment-grade ratings could lower capital costs, improve net margins, and enhance earnings.

- Strategic hedging and production increases aim to manage risk and boost revenue and cash flow.

- Market volatility, operational cost pressures, and expansion plans pose risks to revenue, margins, and cash flow, especially amid uncertain assumptions and competitive pressures.

Catalysts

About Expand Energy- Operates as an independent natural gas production company in the United States.

- Expand Energy plans to achieve approximately $400 million in synergies by the end of 2025 and $500 million by the end of 2026, which is expected to positively impact net margins.

- The company has eliminated approximately $1 billion in gross debt since the merger, which strengthens their capital structure and is likely to enhance earnings by reducing interest expenses.

- Expand Energy has joined the S&P 500 Index and achieved investment-grade ratings, which can lead to a lower cost of capital, potentially improving net margins and overall earnings.

- The company anticipates a significant increase in free cash flow next year as they exit 2025 at a production rate of 7.2 Bcf/day with plans to grow production to 7.5 Bcf/day by 2026, which should boost revenue.

- Their continued focus on hedging with 740 Bcf of new hedges added will manage commodity price risk, allowing them to capitalize on market volatility while securing predictable cash flows to underpin free cash flow and earnings.

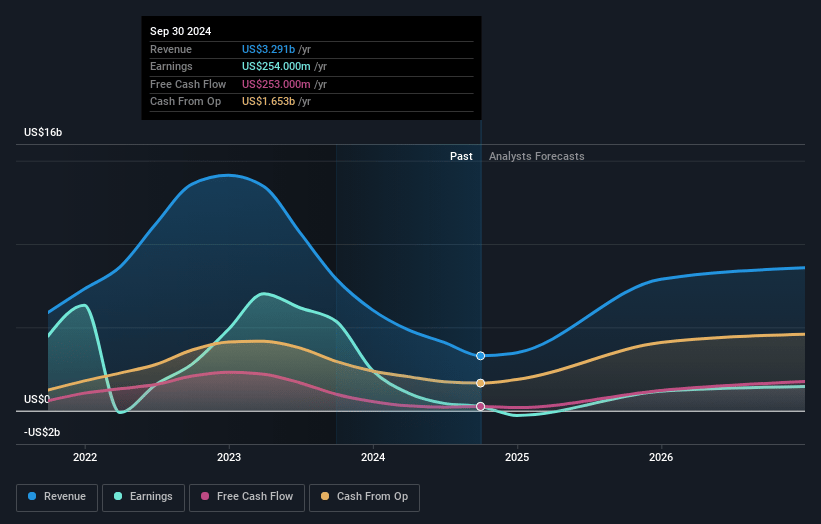

Expand Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Expand Energy's revenue will grow by 20.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from -15.1% today to 35.8% in 3 years time.

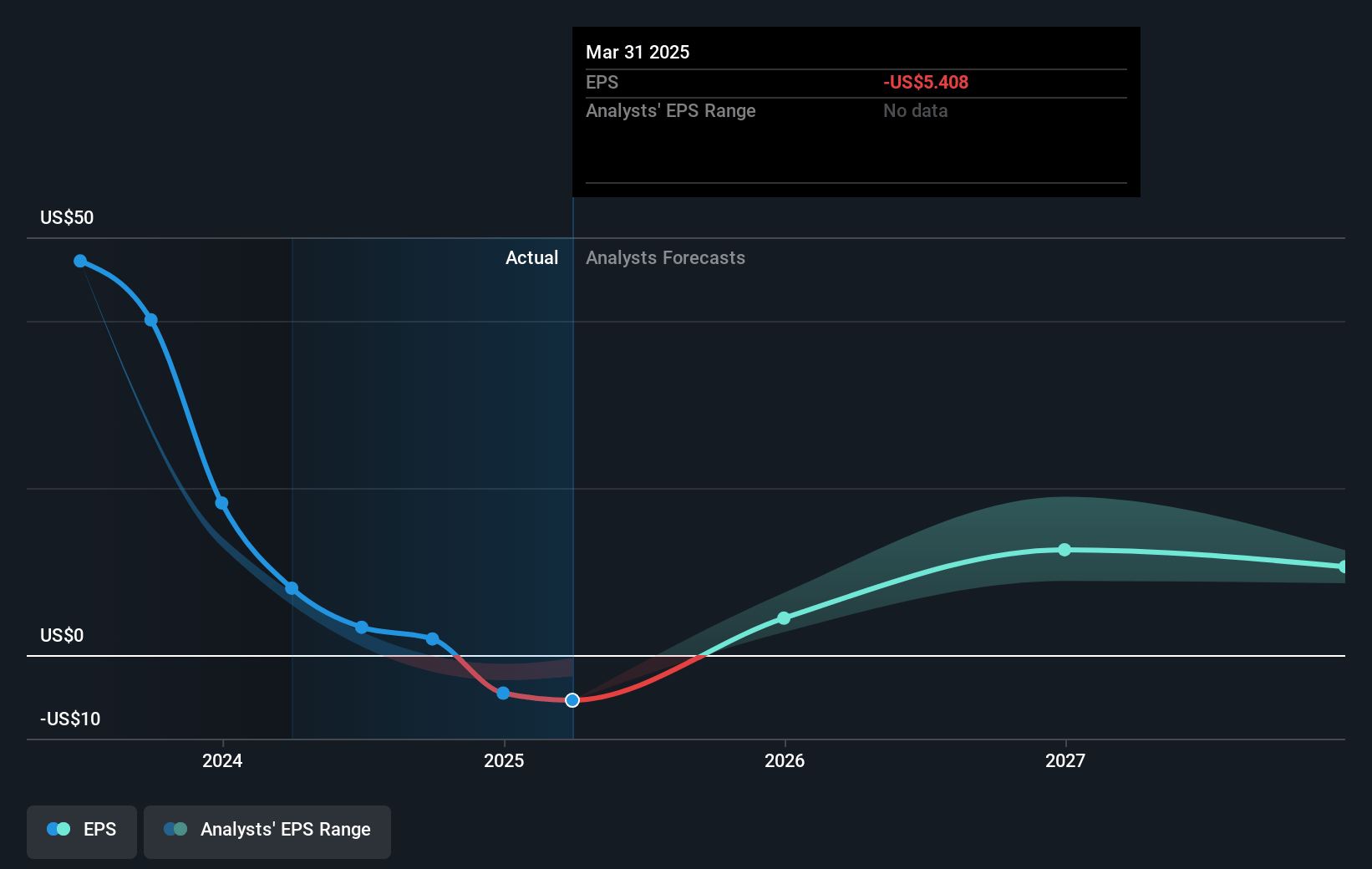

- Analysts expect earnings to reach $4.1 billion (and earnings per share of $9.54) by about May 2028, up from $-989.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.5x on those 2028 earnings, up from -26.1x today. This future PE is lower than the current PE for the US Oil and Gas industry at 11.3x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.3%, as per the Simply Wall St company report.

Expand Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Recent market volatility and lower-than-expected spot prices could negatively impact revenue projections if similar conditions persist, especially since the company is operating with a mid-cycle gas price projection of $3.50 to $4 and faces market uncertainties.

- Persistent tariffs on imported materials, such as casing, could increase operational costs once contracts are renegotiated, potentially compressing net margins if not offset by efficiencies or price increases.

- The dependency on forward-looking statements and the inherent uncertainties in their assumptions pose risks to expected financial performance, potentially impacting earnings if assumptions do not materialize as forecasted.

- Expansion plans may increase capital spending, especially with planned additional productive capacity, which could strain financial resources and impact free cash flow if gas prices do not align with expectations.

- Increased competition and potential overproduction risks in the Haynesville region could affect the company's ability to maintain favorable margins, especially in light of uncertain market demands and varying price realizations.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $124.038 for Expand Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $170.0, and the most bearish reporting a price target of just $103.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $11.5 billion, earnings will come to $4.1 billion, and it would be trading on a PE ratio of 10.5x, assuming you use a discount rate of 6.3%.

- Given the current share price of $108.51, the analyst price target of $124.04 is 12.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.