Key Takeaways

- Heavy reliance on California production and new drilling projects brings regulatory, permitting, and maturity risks, potentially causing cash flow volatility and output uncertainty.

- High shareholder payouts may limit reinvestment in diversification or emissions-reducing efforts, hindering adaptation to the evolving energy landscape.

- Heavy dependence on California operations, regulatory scrutiny, and mature oil fields threatens Berry's margins, future production, and ability to reposition in an evolving energy market.

Catalysts

About Berry- Operates as an independent upstream energy company in the western United States.

- Although ongoing global population growth and persistent industrialization may continue to support underlying oil demand-creating an opportunity for Berry's stable production base to drive revenue growth-accelerating energy transition policies and advancements in alternative energy could put steady long-term downward pressure on oil demand, potentially eroding revenue as renewables gain a larger market share.

- While Berry's operational efficiency initiatives, such as enhanced oil recovery and cost controls, have already delivered lower lease operating expenses and improved free cash flow in the near-term, rising environmental standards and the introduction of stricter regulatory requirements in California could increase compliance costs and capex needs, ultimately squeezing net margins over time.

- Although the company touts constructive regulatory momentum and successful permit acquisition, Berry's heavy concentration in California exposes it to renewed permitting risks and the threat of future production restrictions, which could lead to volatility in output, declining EBITDA, and long-term uncertainty in production forecasts.

- While the company's growing inventory of high-return drilling projects in the thermal diatomite and the Uinta position suggest a runway for future production and cash flow, declining output from mature fields-if not continually offset by successful new wells or acquisitions-could result in revenue stagnation or decline as assets mature and reservoir pressure diminishes.

- Despite efforts to balance shareholder returns with prudent capital allocation, Berry's high payout policies through dividends and buybacks could constrain reinvestment in diversification and emissions-reducing technologies, risking insufficient adaptation to changing energy markets and undermining long-term earnings growth.

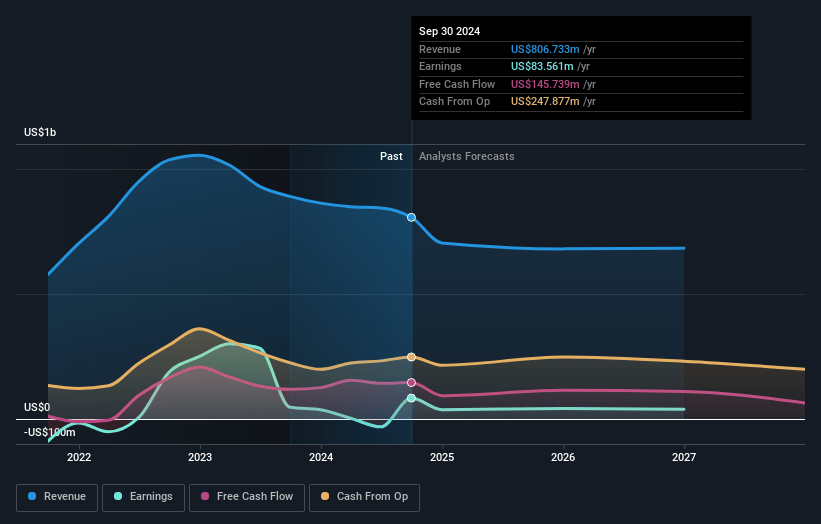

Berry Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Berry compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Berry's revenue will decrease by 1.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -5.0% today to 2.8% in 3 years time.

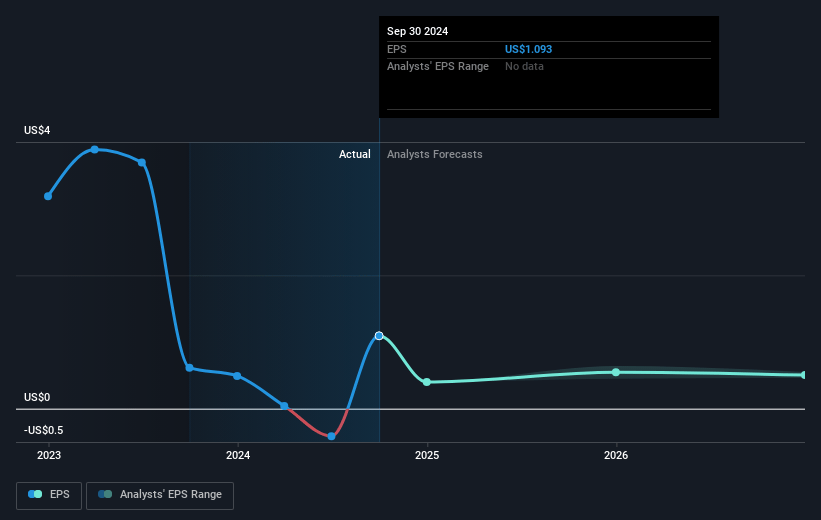

- The bearish analysts expect earnings to reach $20.0 million (and earnings per share of $0.26) by about July 2028, up from $-37.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 17.9x on those 2028 earnings, up from -6.6x today. This future PE is greater than the current PE for the US Oil and Gas industry at 12.3x.

- Analysts expect the number of shares outstanding to grow by 0.85% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.89%, as per the Simply Wall St company report.

Berry Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Berry's concentration in California, a state known for escalating environmental regulations, exposes it to the risk of stricter permitting, higher compliance costs, or future production caps, all of which could reduce operating margins and compress net earnings over the long term.

- Ongoing global decarbonization trends and the accelerating adoption of alternative energy sources threaten to structurally undermine long-term demand for oil, potentially resulting in sustained lower oil prices and therefore weaker revenues and profit margins for Berry.

- High dividend payouts and ongoing debt reduction efforts may constrain Berry's ability to reinvest in technology or diversify away from mature oil assets, increasing the risk of declining production and flatlining free cash flow and top-line revenue over time.

- The company's reliance on mature fields, including its extensive thermal diatomite inventory, means that failure to consistently secure new permits or replace reserves through new discoveries could lead to declining production levels and therefore pressure on future revenue growth.

- Intensifying focus from regulators and investors on ESG performance and water management in Western oil-producing regions could drive up capital and operating costs, squeezing margins and reducing Berry's financial flexibility and earnings resilience in a changing industry landscape.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Berry is $3.5, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Berry's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $6.5, and the most bearish reporting a price target of just $3.5.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $711.0 million, earnings will come to $20.0 million, and it would be trading on a PE ratio of 17.9x, assuming you use a discount rate of 8.9%.

- Given the current share price of $3.2, the bearish analyst price target of $3.5 is 8.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.