Key Takeaways

- Automation, product innovation, and a commercial reset position DMC for sustained margin expansion and durable market share gains above analyst expectations.

- Exposure to long-term infrastructure trends and disciplined financial management support premium pricing, optionality for strategic acquisitions, and multi-year revenue acceleration.

- DMC faces declining demand, cost pressures, market concentration risk, and margin threats due to industry shifts toward renewables, automation, and ongoing economic volatility.

Catalysts

About DMC Global- Provides various products and engineered solutions for the construction, energy, industrial processing, and transportation markets worldwide.

- While analyst consensus highlights operational improvements and margin expansion from automation and product innovation at DynaEnergetics, they may be substantially underestimating the long-term uplift, as these initiatives can unlock step-change reductions in workforce costs and enable DMC to outcompete peers on pricing and reliability, translating to outsized gains in both net margins and market share.

- Analysts broadly agree the strategic reset at Arcadia will strengthen sales and margins, but this overlooks how Arcadia's reinforced commercial focus and cost discipline are likely to cement enduring share gains in the fast-growing infrastructure and institutional construction segments, driving multi-year revenue growth beyond current expectations.

- Surging demand for advanced metal solutions fueled by multi-year infrastructure investment and the global push to modernize energy and industrial assets positions DMC to benefit from a structural, multi-cycle order tailwind, setting the stage for sustained top-line expansion and higher order visibility.

- The company's expertise in explosion welding and composite metals places it at the forefront of next-generation LNG and hydrogen infrastructure buildouts, providing access to high-growth, specification-driven markets that should command premium pricing and fuel incremental EBITDA margin expansion.

- DMC's disciplined balance sheet management and low leverage create significant optionality for targeted acquisitions in niche, high-margin sectors such as aerospace, defense, or cryogenics, offering the potential for transformative revenue and earnings acceleration.

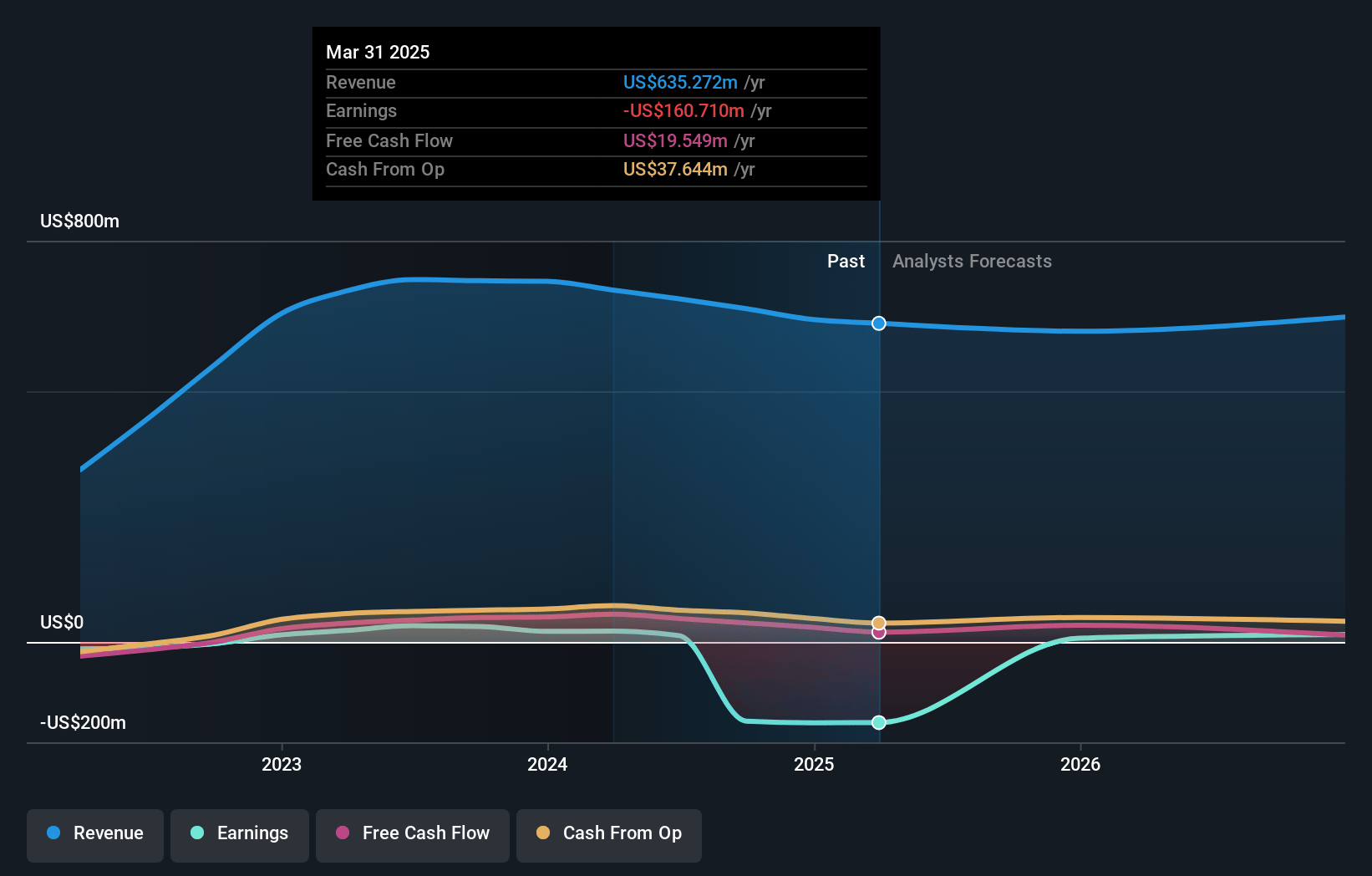

DMC Global Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on DMC Global compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming DMC Global's revenue will grow by 2.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -25.3% today to 10.0% in 3 years time.

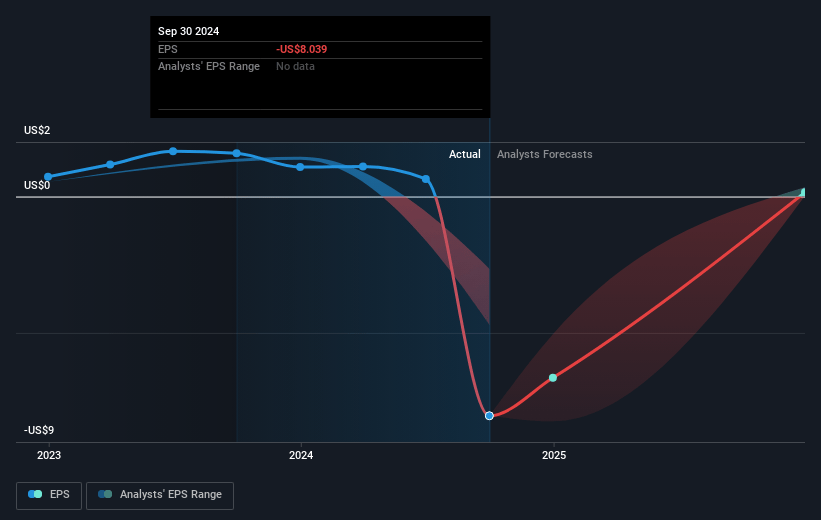

- The bullish analysts expect earnings to reach $67.7 million (and earnings per share of $3.36) by about July 2028, up from $-160.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 4.7x on those 2028 earnings, up from -1.0x today. This future PE is lower than the current PE for the US Energy Services industry at 11.3x.

- Analysts expect the number of shares outstanding to grow by 2.26% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.27%, as per the Simply Wall St company report.

DMC Global Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The decarbonization trend and global transition away from fossil fuels is eroding long-term demand for DMC's key oilfield services and energy product segments, which threatens to structurally reduce future revenue streams as energy markets continue to shift toward renewables.

- DMC's business is highly sensitive to macroeconomic volatility and cyclical downturns in core energy and construction markets, with management explicitly noting rapidly decreasing visibility and softness in end-market demand, which could drive greater earnings volatility and depress top-line growth in the long run.

- Increased tariffs and ongoing input cost inflation, including steel and professional services, are straining DMC's ability to maintain gross margins as organic pricing power remains uncertain and DMC acknowledges limited success in fully passing along cost surcharges to customers, thus pressuring future net margins.

- A high dependence on North American markets and large, non-recurring projects exposes DMC to revenue concentration risk, as demonstrated by the substantial impact of the recently completed commercial project in California and the significant drop in NobelClad's order backlog, potentially restricting sustainable topline growth and consistent EBITDA generation.

- Accelerating automation, digitization and industry consolidation across energy and manufacturing may commoditize some of DMC's traditional engineered products and push the company into lower-margin niches, threatening both competitive positioning and the ability to defend pricing, thereby impacting long-term profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for DMC Global is $12.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of DMC Global's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $12.0, and the most bearish reporting a price target of just $8.5.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $674.5 million, earnings will come to $67.7 million, and it would be trading on a PE ratio of 4.7x, assuming you use a discount rate of 8.3%.

- Given the current share price of $8.0, the bullish analyst price target of $12.0 is 33.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.