Narratives are currently in beta

Key Takeaways

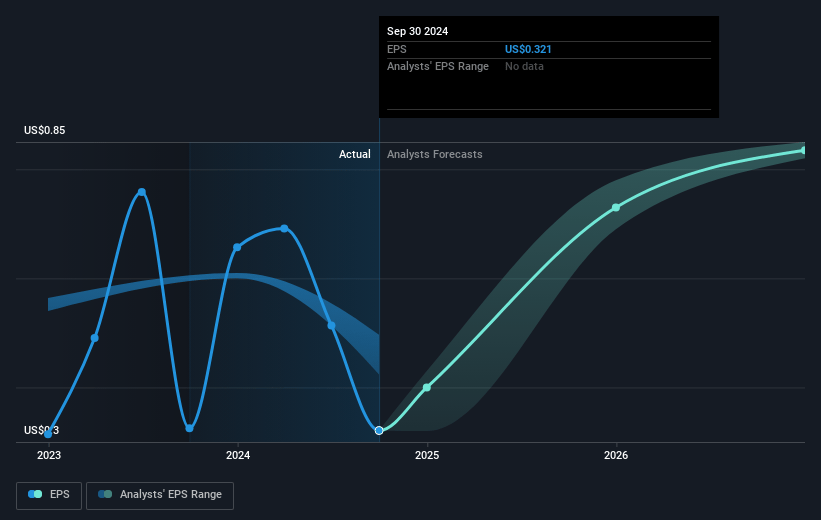

- Accretive financial transactions and disciplined capital management are poised to increase EPS and improve financial structure.

- Record AUM and business expansion into tokenization promise revenue growth and diversified income streams.

- Significant outflows and increased expenses from convertible notes might challenge revenue growth, while blockchain initiatives risk higher costs with uncertain short-term returns.

Catalysts

About WisdomTree- Through its subsidiaries, operates as an exchange-traded funds (ETFs) sponsor and asset manager.

- The recent accretive transactions, such as the retirement of a gold royalty obligation and repurchase of preferred stock, enhanced the company's financial structure, potentially leading to an increase in earnings per share (EPS).

- Record assets under management (AUM) of $113 billion are driving revenue growth and expanding margins, suggesting further enhancement of revenue and net margins.

- The Models business expansion, with an expected increase in advisors from 70,000 to 85,000, signals potential for increased revenue streams from model portfolios, providing more stable and predictable income.

- The entry into the tokenization space, with platforms like WisdomTree Prime and WisdomTree Connect, indicates future revenue growth opportunities by capturing new market segments in blockchain-enabled finance.

- The company's disciplined capital management, by reducing interest rates on convertible notes and conducting strategic stock buybacks, is likely to boost future EPS by reducing diluted shares and interest expenses.

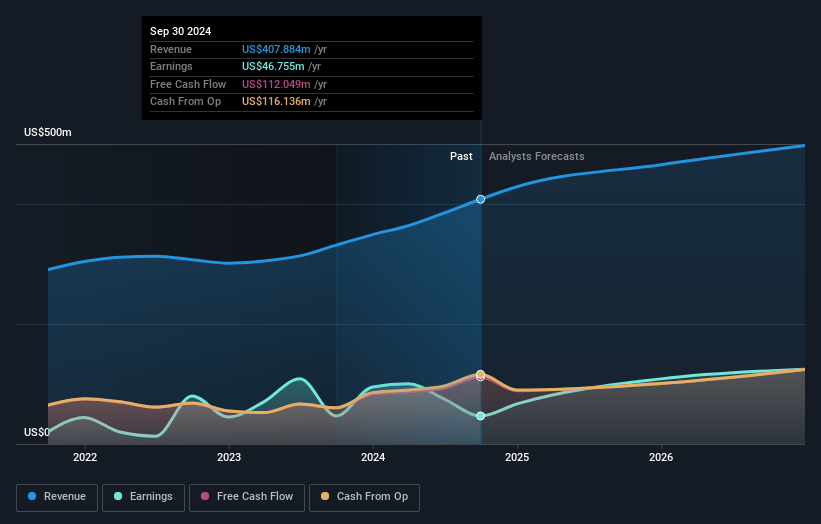

WisdomTree Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming WisdomTree's revenue will grow by 9.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 11.5% today to 32.2% in 3 years time.

- Analysts expect earnings to reach $171.0 million (and earnings per share of $1.16) by about November 2027, up from $46.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.9x on those 2027 earnings, down from 34.2x today. This future PE is lower than the current PE for the US Capital Markets industry at 24.2x.

- Analysts expect the number of shares outstanding to grow by 1.3% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.39%, as per the Simply Wall St company report.

WisdomTree Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Significant outflows experienced during the third quarter from key products like the Japan product DXJ and the floating rate treasury product USFR could challenge ongoing asset under management (AUM) growth, potentially impacting future revenue and net margins.

- The decision to repurchase preferred stock required raising substantial new convertible notes, increasing interest expense guidance, which might constrain net income or necessitate further capital management actions, possibly affecting earnings.

- WisdomTree Prime and other tokenization initiatives represent a financial commitment in a nascent and unregulated industry. This could lead to increased discretionary spending without immediate returns, affecting net margins in the short term.

- The cost of maintaining high interest rates from convertible notes and repurchases without equivalent revenue growth from digital and blockchain initiatives may continue to impact adjusted interest expense, affecting overall earnings.

- Heavy reliance on market conditions and global economic factors such as interest rates and currency valuation means the firm’s revenue and earnings are subject to external economic volatility, which can adversely affect financial performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $13.12 for WisdomTree based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $15.0, and the most bearish reporting a price target of just $10.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $531.6 million, earnings will come to $171.0 million, and it would be trading on a PE ratio of 13.9x, assuming you use a discount rate of 7.4%.

- Given the current share price of $11.33, the analyst's price target of $13.12 is 13.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives