Narratives are currently in beta

Key Takeaways

- Strategic acquisitions and repricing efforts are set to boost Voya's market share, revenue growth, and profitability in retirement and Stop Loss services.

- Strong capital generation and returns, alongside strategic investments in wealth management, are expected to drive earnings growth and market presence.

- Adverse outcomes in Health Solutions and net outflows in Wealth Solutions highlight pricing errors and client retention issues, potentially impacting future revenue and margins.

Catalysts

About Voya Financial- Engages in the provision of workplace benefits and savings products in the United States and internationally.

- The acquisition of OneAmerica's full-service retirement business is set to provide a strategic fit and financial attractiveness, potentially adding at least $75 million in pretax operating earnings and over $200 million in net revenue in the first year. This should contribute to Voya Financial’s revenue growth as well as improve earnings through increased market share in retirement services.

- Voya Financial is actively repricing its Stop Loss business, targeting significantly higher rate increases to improve margins materially for the next year. This focus on margin over premium growth should enhance net underwriting results and increase earnings, supporting profitability.

- Continued commercial momentum in Wealth and Investment Management is driving revenue and margin improvements ahead of targets. With organic growth from positive net flows and higher institutional and retail revenues, these segments are expected to support higher overall earnings.

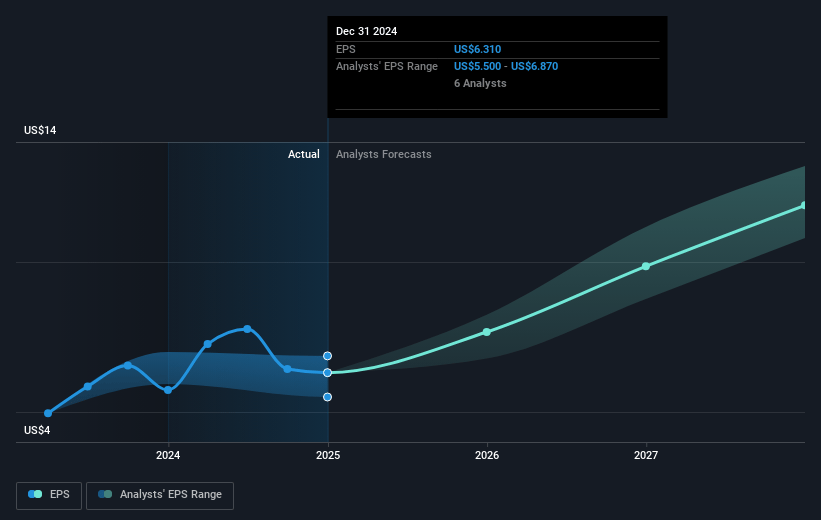

- Voya is planning to return $800 million in excess capital to shareholders in 2024 and is well-positioned for a substantial increase in excess capital generation for 2025. The strong capital return strategy could drive EPS growth by reducing share count and thus increasing earnings per share.

- Strategic investments in expanding retail wealth management, including enhancing lead management and rolling out new solutions, are expected to extend Voya's market presence and boost out-of-plan assets and revenues, ultimately leading to higher future revenue and margins.

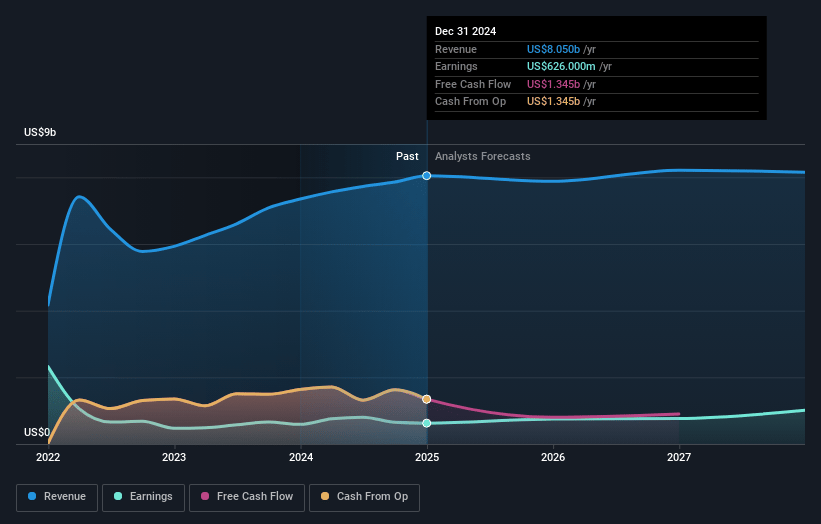

Voya Financial Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Voya Financial's revenue will grow by 2.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.3% today to 12.2% in 3 years time.

- Analysts expect earnings to reach $1.0 billion (and earnings per share of $12.13) by about November 2027, up from $651.0 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $878.4 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.1x on those 2027 earnings, down from 11.8x today. This future PE is lower than the current PE for the US Diversified Financial industry at 18.5x.

- Analysts expect the number of shares outstanding to decline by 4.38% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.8%, as per the Simply Wall St company report.

Voya Financial Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Adverse Stop Loss results led to a disappointing outcome in Health Solutions, indicating pricing errors and higher-than-expected claims, which could negatively impact the company's net margins and earnings.

- Despite strategic investments and acquisitions, the company's experience of net outflows in Wealth Solutions could signal underlying issues in client retention, potentially affecting future revenue and net inflows.

- The focus on margin improvement over premium growth in Stop Loss business might result in lower sales and premiums, which could impact future revenue growth.

- The integration of OneAmerica’s retirement business, although potentially beneficial, includes risks related to retention assumptions and transitional challenges that may impact expected revenue and profit forecasts.

- Competitive pressures and elevated claims in the Stop Loss market, if industry-wide, could hinder the company’s ability to implement necessary pricing strategies, affecting future revenue and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $88.33 for Voya Financial based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $95.0, and the most bearish reporting a price target of just $75.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $8.4 billion, earnings will come to $1.0 billion, and it would be trading on a PE ratio of 9.1x, assuming you use a discount rate of 7.8%.

- Given the current share price of $79.93, the analyst's price target of $88.33 is 9.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives