Key Takeaways

- Strong demand in lending niches and a rise in loan originations position Velocity Financial to capture market share and boost revenue.

- Robust liquidity and favorable credit performance enhance profitability, supporting sustained earnings growth and the ability to fund future expansion.

- Dependence on real estate lending exposes Velocity Financial to market shifts, high nonperforming loans, and potential equity dilution, threatening earnings and growth stability.

Catalysts

About Velocity Financial- Operates as a real estate finance company in the United States.

- Velocity Financial is experiencing strong demand in its lending niches, as traditional banks have become more restrictive, positioning the company to capture market share and potentially increase revenue.

- The company has shown a 64% increase in loan originations, signaling continued growth in its loan portfolio which could lead to higher net revenue.

- With improving conditions in the securitization market and tighter spreads post the presidential election, Velocity Financial can achieve high returns on equity, likely enhancing net margins.

- Continued strong credit performance with a disciplined credit process and favorable non-performing loan resolutions could support profitability and sustain strong earnings growth.

- A robust liquidity position, including a significant capacity in warehouse lines, supports Velocity Financial's ability to fund future growth, which can drive increased earnings.

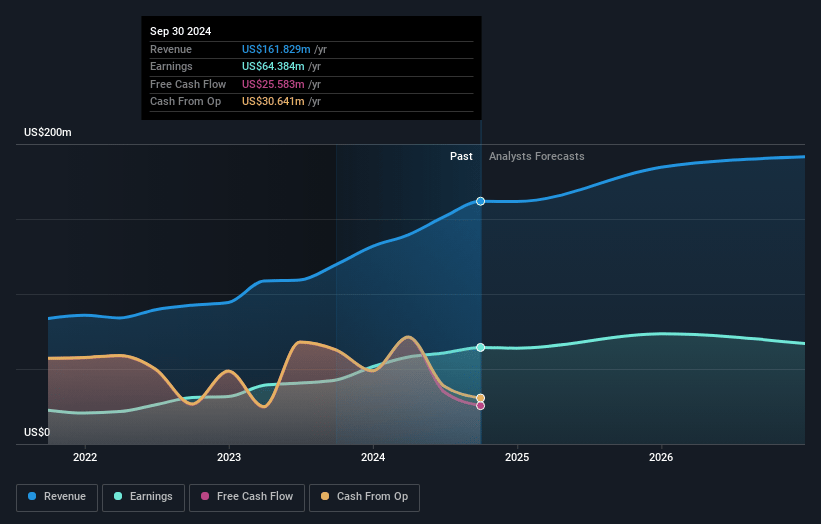

Velocity Financial Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Velocity Financial's revenue will grow by 15.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 38.0% today to 26.5% in 3 years time.

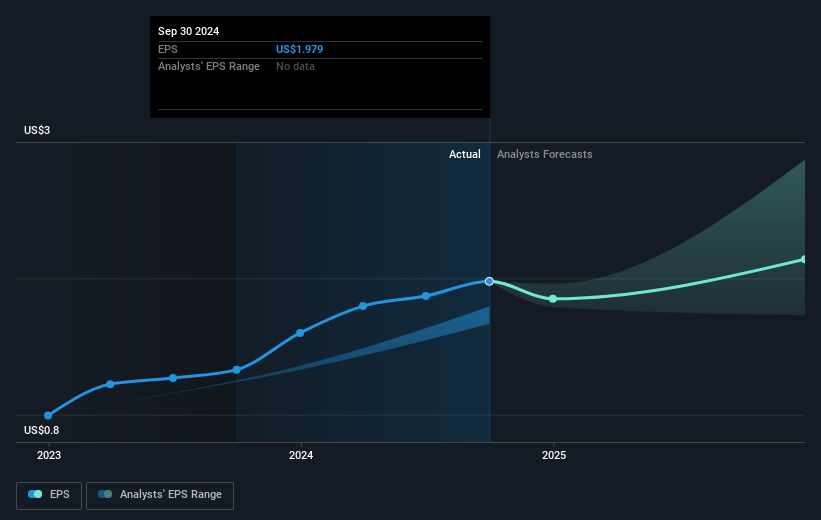

- Analysts expect earnings to reach $72.7 million (and earnings per share of $2.49) by about March 2028, up from $67.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.3x on those 2028 earnings, up from 9.5x today. This future PE is lower than the current PE for the US Diversified Financial industry at 15.4x.

- Analysts expect the number of shares outstanding to grow by 3.12% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.41%, as per the Simply Wall St company report.

Velocity Financial Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's business is highly reliant on lending activities in the real estate market, making it vulnerable to shifts in market conditions. Economic downtrends or decreases in real estate market demand could negatively impact loan originations, affecting revenue and net margins.

- The nonperforming loan (NPL) rate is relatively high at around 10.7%. While current resolution efforts are favorable, any changes in the economic environment could result in increased NPLs, negatively impacting earnings.

- The company's ability to continue growing depends significantly on the capital markets, including the securitization market. Wider spreads or reduced investor participation could increase the cost of funds, squeezing net interest margins.

- Velocity Financial's growth strategy involves issuing equity to support capital needs. This could lead to shareholder dilution if additional equity needs arise, potentially impacting earnings per share.

- The company has a portion of its loan portfolio extended to commercial real estate, a sector with unique risks. Changes in this sector's demand or increasing delinquencies could affect portfolio performance, subsequently impacting earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $21.75 for Velocity Financial based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $274.6 million, earnings will come to $72.7 million, and it would be trading on a PE ratio of 15.3x, assuming you use a discount rate of 11.4%.

- Given the current share price of $18.8, the analyst price target of $21.75 is 13.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.