Narratives are currently in beta

Key Takeaways

- Robust fee and revenue growth, driven by servicing fees and State Street Alpha, is supporting long-term business onboarding and expansion.

- Capital returns and productivity initiatives improve margins and EPS, showcasing financial strength and strategic investments.

- Market volatility and geopolitical tensions may challenge revenue growth, while leadership changes and economic factors could pressure earnings stability.

Catalysts

About State Street- Through its subsidiaries, provides a range of financial products and services to institutional investors worldwide.

- State Street is experiencing strong fee and total revenue growth, supported by robust servicing fee momentum, which is expected to drive continued revenue growth as new business is onboarded.

- The transformation and productivity savings initiatives are contributing to expense control and funding significant business investments, potentially improving net margins.

- The implementation of the State Street Alpha platform is leading to significant new client wins and deeper existing client relationships, supporting long-term revenue growth.

- Strong performance in the FX trading and securities finance businesses, coupled with share gains, are expected to drive continued earnings growth.

- Continued capital returns, including share repurchases, demonstrate financial strength and are expected to enhance EPS growth over time.

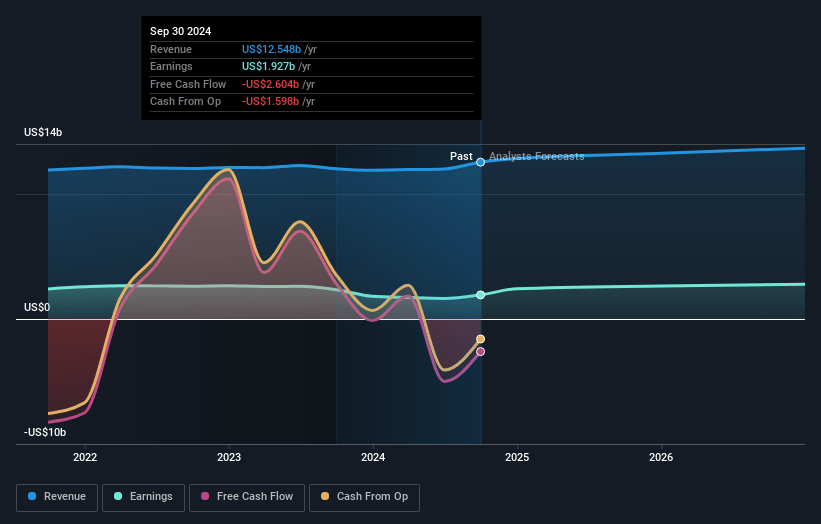

State Street Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming State Street's revenue will grow by 3.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 15.4% today to 22.7% in 3 years time.

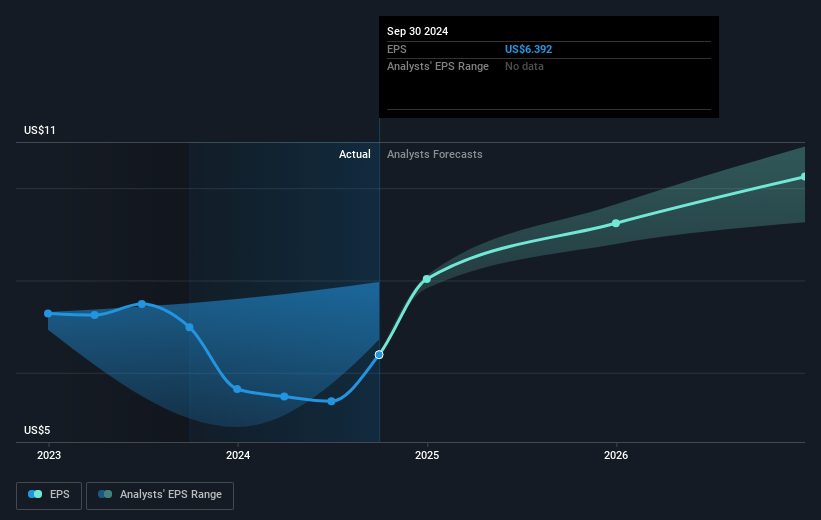

- Analysts expect earnings to reach $3.1 billion (and earnings per share of $10.65) by about November 2027, up from $1.9 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.6x on those 2027 earnings, down from 14.5x today. This future PE is lower than the current PE for the US Capital Markets industry at 24.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.03%, as per the Simply Wall St company report.

State Street Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The unwinding of the carry trade and geopolitical tensions resulted in negative market sentiment and volatility, which could impact future revenue and net margins.

- Concerns over tech valuations and fears of a U.S. recession may influence investor decisions, potentially affecting fee revenue and earnings growth.

- Pricing headwinds and lower client activity, including shifts in asset mix, could hinder servicing fee revenue growth and overall margins.

- Continued deposit rotation and lower short-end rates due to central bank actions present headwinds for net interest income, which could affect earnings.

- The departure of the CFO and associated transition risks could temporarily disrupt strategic continuity and financial planning, influencing future earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $98.27 for State Street based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $108.0, and the most bearish reporting a price target of just $84.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $13.8 billion, earnings will come to $3.1 billion, and it would be trading on a PE ratio of 11.6x, assuming you use a discount rate of 8.0%.

- Given the current share price of $95.17, the analyst's price target of $98.27 is 3.2% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives