Narratives are currently in beta

Key Takeaways

- Strong client recruitment and retention in the Private Client Group and asset management growth are expected to drive significant future revenue.

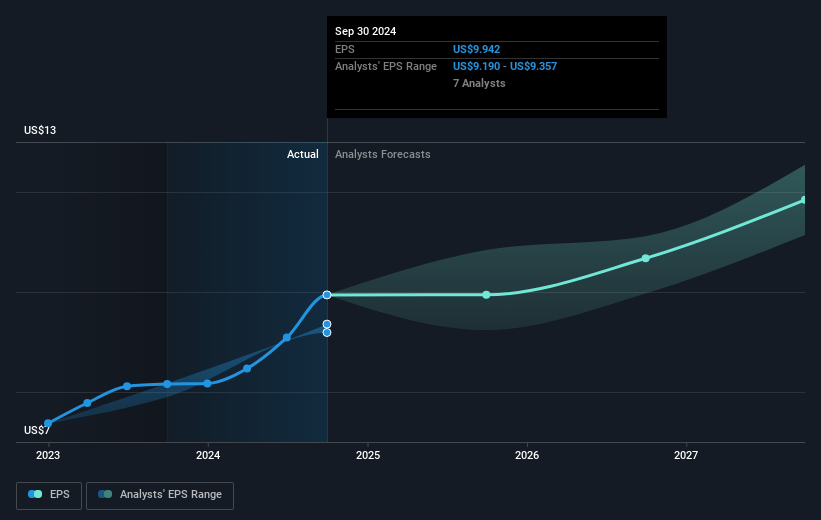

- Strategic capital deployment and investment in technology suggest positive impacts on future earnings and EPS.

- Natural disasters, integration challenges, interest rate fluctuations, and high recruitment costs pose risks to margins and limit growth despite potential operational contributions.

Catalysts

About Raymond James Financial- A diversified financial services company, provides private client group, capital markets, asset management, banking, and other services to individuals, corporations, and municipalities in the United States, Canada, and Europe.

- Record net revenue and income suggest the company is well-positioned for future growth, as reflected in their investment in people and technology, likely impacting future revenue positively.

- Strong recruiting efforts in the Private Client Group and robust retention could drive future growth in client assets under administration, thereby increasing future revenue.

- With a solid pipeline in M&A, improved market conditions, and continued investments, the Capital Markets segment is expected to see revenue growth as transactions in the industry pick up.

- Asset growth in the Raymond James Investment Management and net inflows, along with a healthy pipeline in the Asset Management segment, indicate potential for increased revenue and earnings.

- The company's strategic capital deployment, including share repurchases and potential investments, is expected to positively influence future earnings per share (EPS).

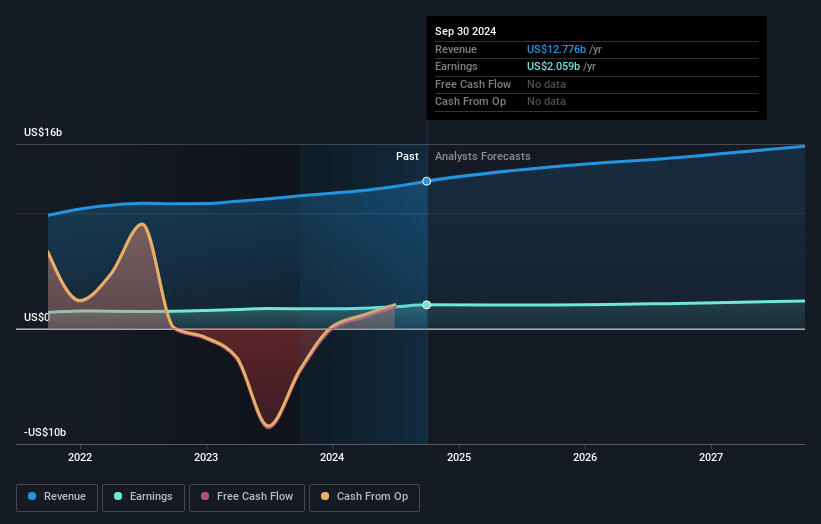

Raymond James Financial Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Raymond James Financial's revenue will grow by 7.4% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 16.1% today to 15.1% in 3 years time.

- Analysts expect earnings to reach $2.4 billion (and earnings per share of $11.84) by about November 2027, up from $2.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.1x on those 2027 earnings, down from 15.9x today. This future PE is lower than the current PE for the US Capital Markets industry at 24.2x.

- Analysts expect the number of shares outstanding to decline by 0.23% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.05%, as per the Simply Wall St company report.

Raymond James Financial Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Natural disasters, such as hurricanes impacting key regions where the company is headquartered, could result in operational disruptions or increased expenses related to business continuity and disaster recovery, potentially affecting net margins.

- The statement highlights potential material differences between forward-looking statements and actual results, suggesting uncertainties in achieving projected financial outcomes, which may impact future earnings.

- Ongoing integration challenges with recently acquired businesses, particularly in the UK, could affect the company's ability to capitalize fully on synergies and anticipated growth, impacting future revenue growth.

- Interest rate fluctuations, such as recent declines, affect the company's net interest income and the overall economic environment, influencing clients' investment behaviors and thus could constrain revenue growth.

- Competitive financial advisor recruitment and retention contribute to operations but high costs related to these efforts could pressurize net margins if growth does not match expenditure in this area.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $146.07 for Raymond James Financial based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $15.8 billion, earnings will come to $2.4 billion, and it would be trading on a PE ratio of 15.1x, assuming you use a discount rate of 7.1%.

- Given the current share price of $160.64, the analyst's price target of $146.07 is 10.0% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives