Narratives are currently in beta

Key Takeaways

- Strategic investments in electronic payments and value-added services aim to drive revenue growth and enhance net margins through increased transaction volumes and high-margin offerings.

- Expansion through strategic acquisitions and global partnerships focuses on market penetration, particularly in underpenetrated regions, bolstering revenue and market positioning.

- Heavy reliance on consumer spending and international markets, alongside regulatory and competitive pressures, poses risks to Mastercard's revenue and margin growth.

Catalysts

About Mastercard- A technology company, provides transaction processing and other payment-related products and services in the United States and internationally.

- Mastercard is investing in the secular shift to electronic payments and new payment flows, which could drive long-term revenue growth through increased transaction volumes and market penetration.

- Expansion in value-added services such as cybersecurity, fraud prevention, and data analytics aims to enhance net margins by offering differentiated high-margin services to clients.

- Strategic acquisitions like Recorded Future and Minna Technologies are set to enhance Mastercard's capability in threat intelligence and subscription management, potentially boosting future earnings through cross-sell opportunities and expanded addressable markets.

- Mastercard's continued growth in commercial payments and partnerships, such as with Citi and new ventures in Latin America, could lead to substantial revenue gains by capturing larger volumes of B2B and cross-border transactions.

- The company's focus on gaining market share and expanding acceptance globally, particularly in underpenetrated regions such as Africa and Latin America, and its entrance into the Chinese domestic market could positively impact revenue growth and market positioning in coming years.

Mastercard Future Earnings and Revenue Growth

Assumptions

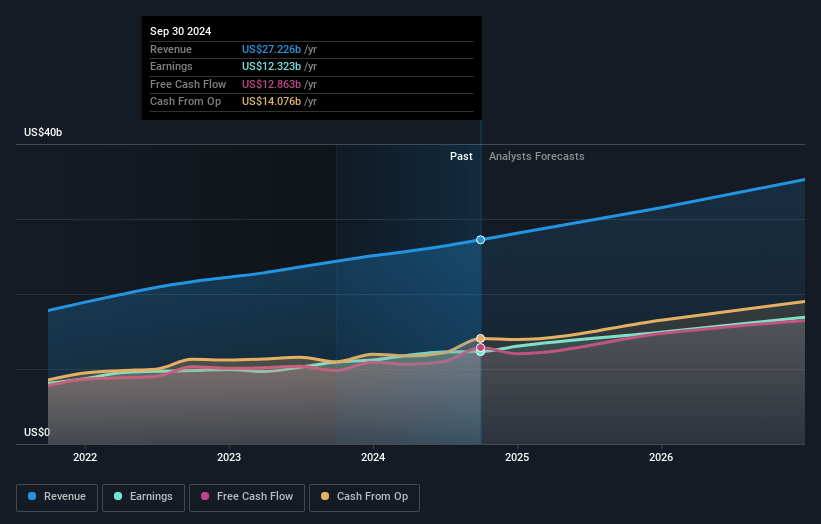

How have these above catalysts been quantified?- Analysts are assuming Mastercard's revenue will grow by 11.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 45.3% today to 46.9% in 3 years time.

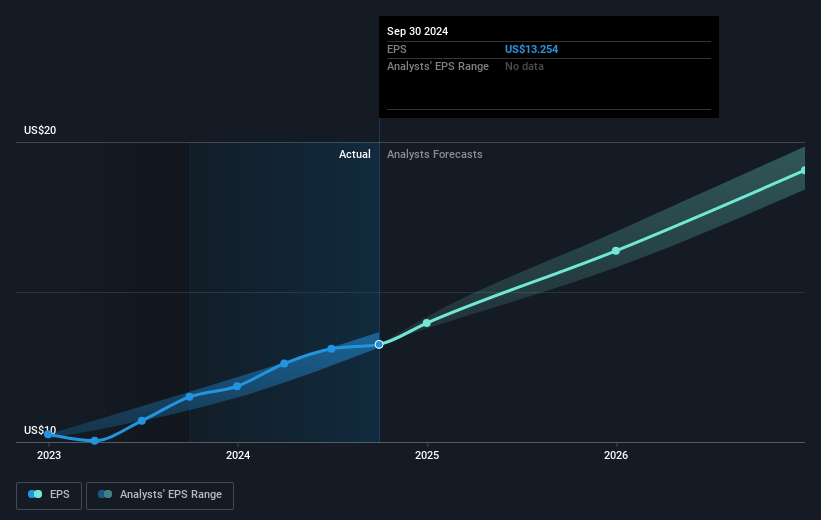

- Analysts expect earnings to reach $17.8 billion (and earnings per share of $20.73) by about November 2027, up from $12.3 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 32.1x on those 2027 earnings, down from 38.9x today. This future PE is greater than the current PE for the US Diversified Financial industry at 17.4x.

- Analysts expect the number of shares outstanding to decline by 2.19% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.73%, as per the Simply Wall St company report.

Mastercard Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The growth projections rely heavily on continued consumer spending strength, which may be adversely affected if macroeconomic conditions deteriorate, such as an economic downturn or rising unemployment, impacting future revenue.

- Competitive pressures and increasing rebates and incentives to retain and win market share could compress net margins, as Mastercard competes with other payment networks and new financial technologies for key portfolios and market share.

- Regulatory risks, particularly potential changes in global tax rules like the Pillar 2 global minimum tax rules, could increase the company’s effective tax rate, reducing net earnings.

- Dependence on international markets like China for growth presents execution risks and potential challenges due to differences in regulatory environments, economic conditions, and distinct consumer behavior which might impact targeted revenue increases.

- The ability to sustain high growth in value-added services, particularly in cybersecurity and intelligence products, could face competition and technological disruptions, affecting anticipated revenue streams and overall financial performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $547.7 for Mastercard based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $605.0, and the most bearish reporting a price target of just $464.23.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $38.0 billion, earnings will come to $17.8 billion, and it would be trading on a PE ratio of 32.1x, assuming you use a discount rate of 6.7%.

- Given the current share price of $521.88, the analyst's price target of $547.7 is 4.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives