Narratives are currently in beta

Key Takeaways

- Strong liquidity and improved credit ratings position Ladder Capital for growth, lowering costs and boosting margins as market conditions recover.

- Strategic shifts towards loan originations and middle-market lending could enhance earnings and expand the loan portfolio advantageously.

- Ladder faces risks from loan payoffs, short loan maturities, market uncertainties, potential asset impairments, and reliance on achieving investment-grade status for growth.

Catalysts

About Ladder Capital- Operates as an internally-managed real estate investment trust in the United States.

- Ladder Capital's strong liquidity position, including $1.9 billion in total liquidity and a high percentage of unencumbered assets, positions the company to capitalize on new investment opportunities as the market recovers, likely boosting future revenue and earnings.

- The recent upgrade in Ladder's corporate credit rating and positive outlook from major ratings agencies set the stage for potential investment-grade status, which would lower the cost of capital and improve net margins and earnings.

- The company's strategic shift from securities to loan originations as market conditions stabilize signals an uptick in lending activity, which could enhance interest income and drive distributable earnings growth.

- Ladder's focus on acquiring AAA securities and executing strategic shifts in capital allocation, such as reallocating from T-bills to higher-yielding assets, should result in higher distributable earnings and potentially improved net margins.

- A strong credit culture, coupled with the underexplored opportunity in middle-market lending due to reduced bank and competitor activity, provides Ladder with a distinct advantage in growing its loan portfolio, which could increase revenue and return on equity.

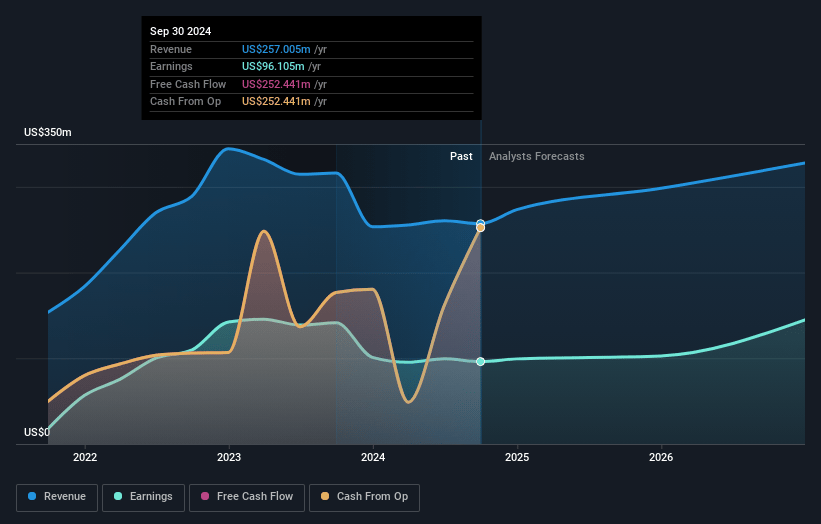

Ladder Capital Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Ladder Capital's revenue will grow by 11.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 37.4% today to 42.5% in 3 years time.

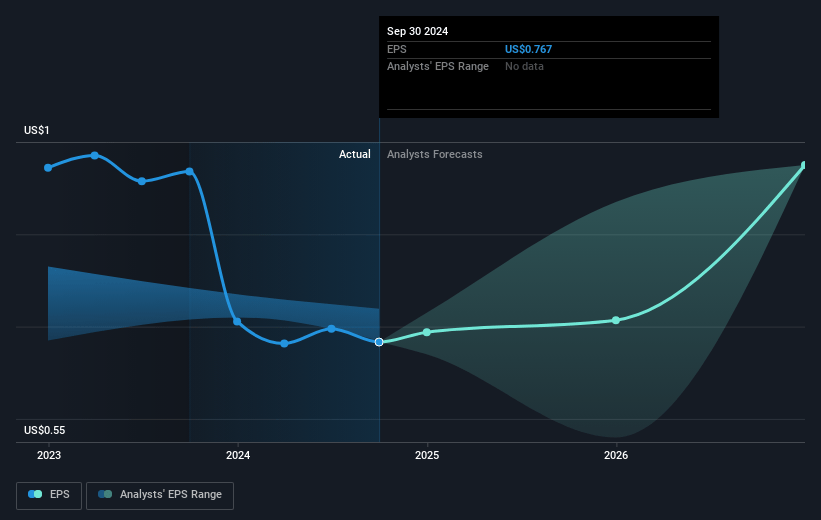

- Analysts expect earnings to reach $150.2 million (and earnings per share of $1.19) by about November 2027, up from $96.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.6x on those 2027 earnings, down from 15.5x today. This future PE is greater than the current PE for the US Mortgage REITs industry at 11.0x.

- Analysts expect the number of shares outstanding to decline by 0.35% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.65%, as per the Simply Wall St company report.

Ladder Capital Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The recent increase in loan payoffs, including $492 million in the third quarter, could indicate challenges in retaining loan revenues, potentially leading to a temporary dip in earnings as high-yielding loans are paid off.

- Ladder's existing loan portfolio's weighted average extended maturity is just over 1 year, which places pressure on backfilling with new originations to maintain revenue and earnings levels.

- Despite increased transaction levels, significant market uncertainties remain, with valuations and buyer motivations still realigning post-pandemic, potentially causing volatility in Ladder's ability to grow or stabilize net margins.

- The potential for future asset impairments is highlighted by a $5 million loan balance write-off this quarter, suggesting ongoing risks to asset values and potential impacts on net earnings if commercial real estate markets fluctuate further.

- Ladder's reliance on achieving investment-grade status to enhance its market position and attract investors carries execution risk; failure to secure this status could limit growth in revenue and increase financing costs.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $13.36 for Ladder Capital based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $353.5 million, earnings will come to $150.2 million, and it would be trading on a PE ratio of 13.6x, assuming you use a discount rate of 6.7%.

- Given the current share price of $11.66, the analyst's price target of $13.36 is 12.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives