Narratives are currently in beta

Key Takeaways

- Integrating Black Knight technology enhances the mortgage segment, while global energy risk management tools and sustainability markets support further revenue growth.

- Strategic investments and recurring revenues from ICE Global Network expansion drive expense efficiency and predictable earnings growth over time.

- Revenue pressures from non-recurring items, CapEx plans, and mortgage declines challenge ICE, despite record growth in energy and interest rate markets.

Catalysts

About Intercontinental Exchange- Engages in the provision of market infrastructure, data services, and technology solutions for financial institutions, corporations, and government entities in the United States, the United Kingdom, the European Union, Singapore, India, Abu Dhabi, Israel, and Canada.

- The acquisition of Black Knight has been a significant move, and integrating its technology is creating a comprehensive life-of-loan offering that can streamline operations and potentially increase revenue in the mortgage technology segment as the mortgage origination market normalizes.

- Investments in data center infrastructure, originally planned for 2025, are expected to yield expense efficiencies beginning in 2026, which can improve net margins.

- The globalization of natural gas and increased demand for global energy risk management tools, driven by new supply routes and energy transitions, present opportunities for continued growth in transaction revenues.

- Record activity and growth in futures and options in environmental markets, such as European emissions allowances, bolster ICE’s position in sustainability markets, supporting revenue increases and expanded market presence.

- The strong performance and growth in recurring revenues through initiatives such as the ICE Global Network expansion and index business development should bolster earnings predictably over time, given the pricing power and operational efficiencies.

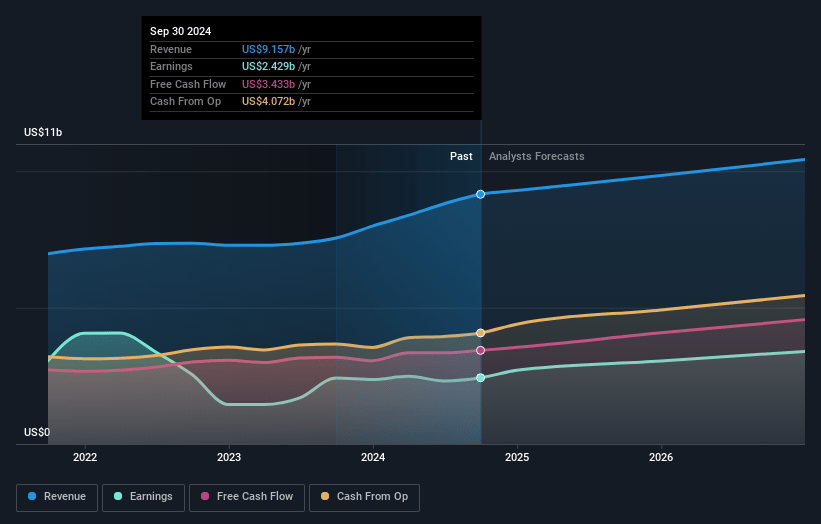

Intercontinental Exchange Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Intercontinental Exchange's revenue will grow by 5.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 26.5% today to 33.2% in 3 years time.

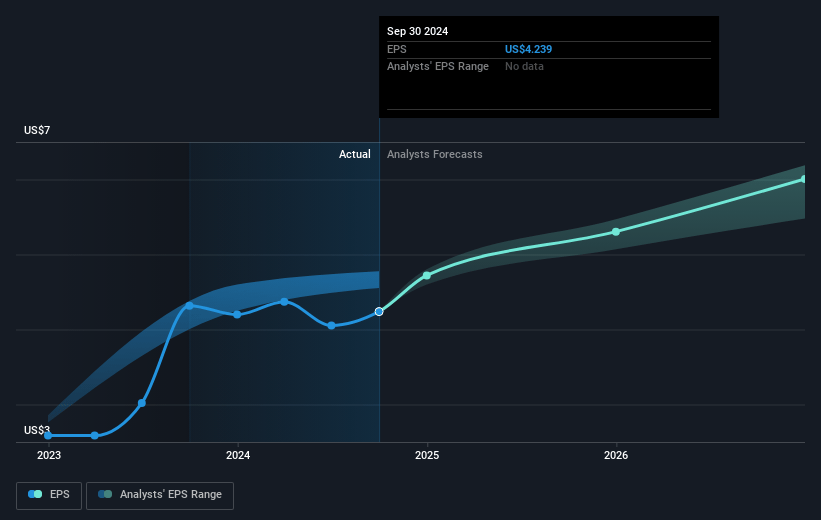

- Analysts expect earnings to reach $3.6 billion (and earnings per share of $6.44) by about November 2027, up from $2.4 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 34.4x on those 2027 earnings, down from 36.8x today. This future PE is greater than the current PE for the US Capital Markets industry at 24.2x.

- Analysts expect the number of shares outstanding to decline by 0.72% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.23%, as per the Simply Wall St company report.

Intercontinental Exchange Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intercontinental Exchange (ICE) indicated that they benefited from several non-recurring items in the third quarter, and they expect their OTC and other revenue to decrease by $15 million to $20 million in the fourth quarter, impacting revenue.

- ICE is planning significant capital expenditure (CapEx), estimated between $700 million and $740 million, mainly driven by data center investments that are expected to yield efficiencies only upon project completion in 2026, which could affect net margins in the near term.

- Mortgage Technology revenue, particularly recurring revenue, has seen a year-over-year decline, despite appearing to stabilize relative to prior quarters. This is impacted by the removal of retired loans and lower minimums on their Encompass platform, which could affect earnings if the mortgage origination market does not improve soon.

- Despite record revenue growth in its energy segment powered by strong performance in its oil, gas, and environmental markets, these figures are potentially buoyed by volatile trading environments and geopolitical issues, which may not be sustainable, impacting ICE's ability to maintain revenue growth.

- While a strong interest rate environment has supported growth in ICE's interest rate markets, future results could be influenced by changes in global central bank policies and macroeconomic conditions, which could affect revenue and margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $180.19 for Intercontinental Exchange based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $200.0, and the most bearish reporting a price target of just $148.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $10.9 billion, earnings will come to $3.6 billion, and it would be trading on a PE ratio of 34.4x, assuming you use a discount rate of 7.2%.

- Given the current share price of $155.84, the analyst's price target of $180.19 is 13.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives