Narratives are currently in beta

Key Takeaways

- Growth in Corporate Finance and restructuring activity anticipate revenue and earnings improvements, driven by an active M&A market and elevated leverage conditions.

- Strategic acquisitions enhance capabilities and expand sector presence, boosting revenue potential and efficiency, with a balanced capital allocation strategy supporting EPS growth.

- Sustained high interest rates and geopolitical volatility could negatively impact revenue growth and profitability, compounded by M&A delays and inconsistent restructuring revenues.

Catalysts

About Houlihan Lokey- An investment banking company, provides merger and acquisition (M&A), capital market, financial restructuring, and financial and valuation advisory services in the United States and internationally.

- Houlihan Lokey anticipates continued revenue growth in Corporate Finance due to improvements in M&A markets and an increasing number of companies going to market, despite recognizing longer transaction timelines. This could boost revenue and potentially improve earnings.

- The company's Financial Restructuring segment, which remains strong due to elevated leverage and interest rates, is expected to sustain elevated activity well into fiscal 2026, positively impacting revenue and earnings.

- The acquisition of Prytania Solutions enhances Houlihan Lokey's Financial and Valuation Advisory group by expanding its tech-enabled valuation capabilities, particularly in structured products. This could lead to increased revenue and potentially higher net margins due to efficiencies.

- The acquisition of Waller Helms expands Houlihan Lokey’s footprint in the insurance and wealth management sectors, areas of high private equity activity, which could lead to synergies and increased revenue opportunities.

- Houlihan Lokey retains flexibility in capital allocation, prioritizing dividends and acquisitions, while maintaining a stable share count. This balanced approach supports sustained shareholder returns and potential growth in earnings per share (EPS).

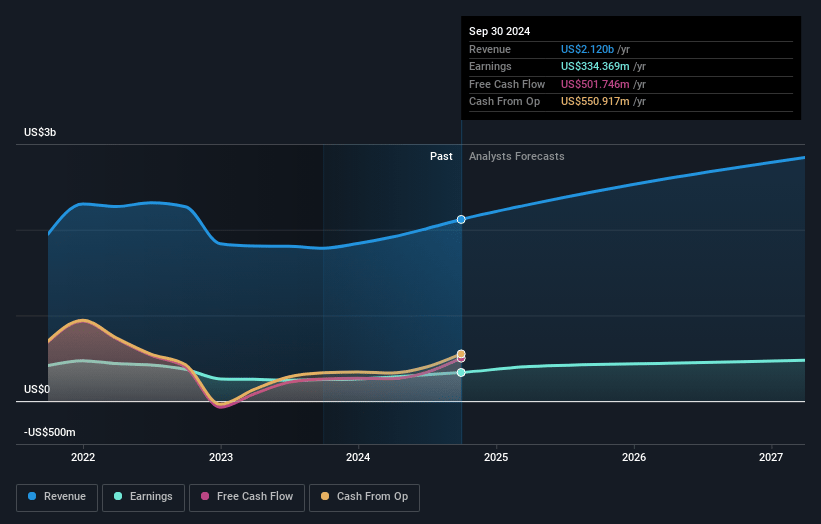

Houlihan Lokey Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Houlihan Lokey's revenue will grow by 12.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 15.8% today to 17.0% in 3 years time.

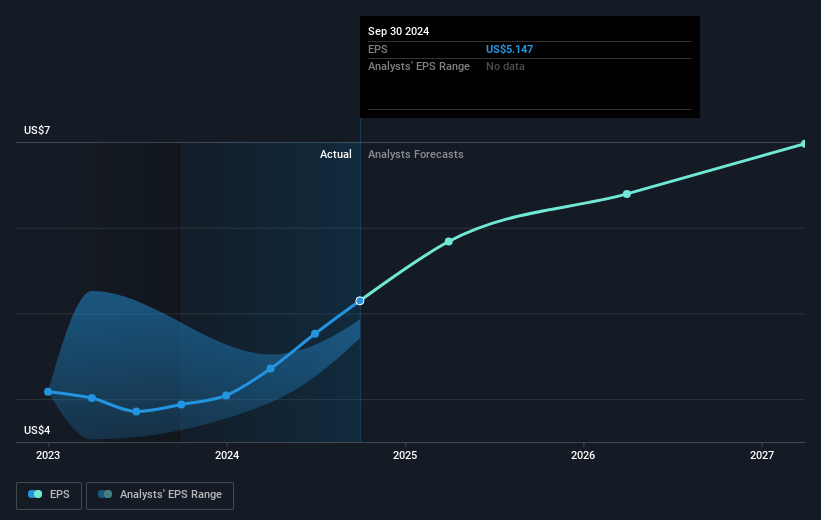

- Analysts expect earnings to reach $516.5 million (and earnings per share of $6.98) by about November 2027, up from $334.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 29.5x on those 2027 earnings, down from 38.5x today. This future PE is greater than the current PE for the US Capital Markets industry at 23.6x.

- Analysts expect the number of shares outstanding to grow by 2.12% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.79%, as per the Simply Wall St company report.

Houlihan Lokey Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Interest rates, although lower than their recent peaks, remain high and could negatively impact clients' financial performances and Houlihan Lokey's revenue growth.

- Ongoing geopolitical volatility, including conflicts in the Middle East and Ukraine, adds uncertainty and complexity to the business environment, potentially affecting revenue and profitability.

- Longer timelines for closing M&A transactions reflect slower recovery than previous cycles, which might lead to delays in realizing revenue growth in Corporate Finance.

- Fluctuations in the restructuring market, described as lumpy quarter-to-quarter, can result in inconsistent revenue flow and potential volatility in earnings.

- An increase in the effective tax rate due to heightened state and foreign taxes may impact net margins and overall profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $168.86 for Houlihan Lokey based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $206.0, and the most bearish reporting a price target of just $129.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $3.0 billion, earnings will come to $516.5 million, and it would be trading on a PE ratio of 29.5x, assuming you use a discount rate of 6.8%.

- Given the current share price of $185.01, the analyst's price target of $168.86 is 9.6% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives