Key Takeaways

- Strategic realignment and focus on high-growth areas aim to optimize revenue growth and enhance operating efficiencies for better margins and earnings.

- Exiting non-core markets and consolidating under the Genius brand is expected to improve efficiency and boost revenue through cross-selling opportunities.

- Operational and integration challenges, foreign exchange headwinds, and reliance on asset disposals and modernizing POS systems may impact Global Payments' near-term growth and efficiency.

Catalysts

About Global Payments- Provides payment technology and software solutions for card, check, and digital-based payments in the Americas, Europe, and the Asia-Pacific.

- Global Payments has launched a broad transformation agenda, which includes a realignment of the operating model and business structure. This is expected to optimize revenue growth opportunities and enhance operating efficiencies, leading to improved operating margins and better earnings over time.

- The company is focusing its investments on high-growth areas such as the merchant segment, where it has seen approximately 25% annual recurring revenue growth with new customers. This focus is projected to bolster revenue growth in the retail and restaurant verticals.

- Global Payments is consolidating its products and platforms under the Genius brand, which is anticipated to increase revenue through cross-selling and upselling opportunities within its unified POS solutions.

- The strategic move to exit non-core and subscale markets and divest certain assets is expected to improve operating efficiency, focusing resources on areas with higher growth potential, potentially leading to margin expansion.

- The technology modernization program, including cloud capabilities, aims to make the Issuer Solutions business more scalable and attractive to new customers, thus potentially increasing accounts on file and driving higher long-term growth and earnings.

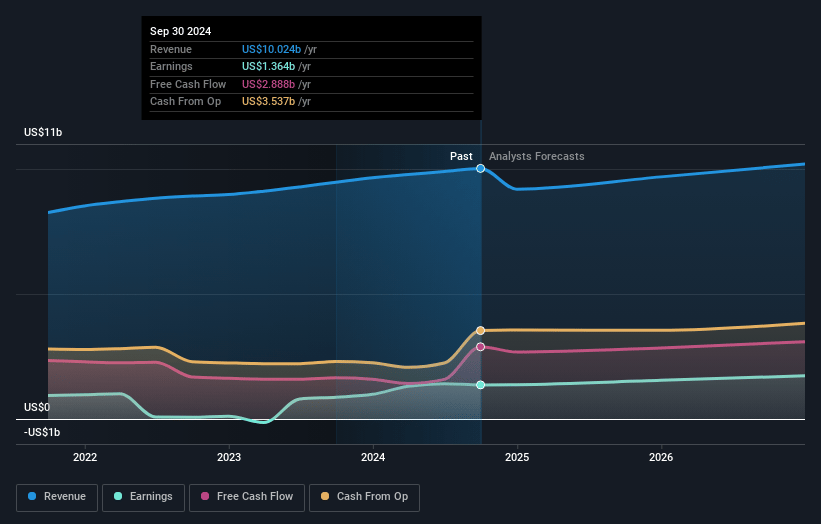

Global Payments Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Global Payments compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Global Payments's revenue will decrease by 0.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 15.5% today to 15.0% in 3 years time.

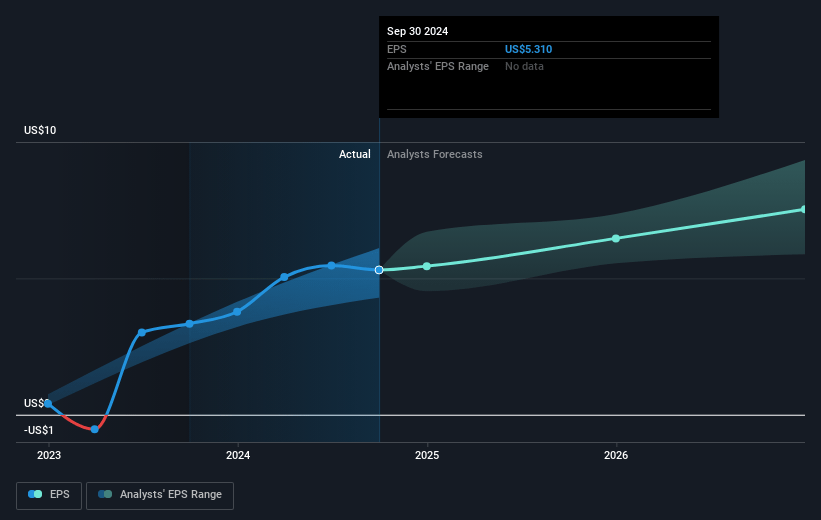

- The bearish analysts expect earnings to reach $1.5 billion (and earnings per share of $7.12) by about April 2028, down from $1.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 18.6x on those 2028 earnings, up from 13.2x today. This future PE is greater than the current PE for the US Diversified Financial industry at 14.5x.

- Analysts expect the number of shares outstanding to decline by 2.99% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.49%, as per the Simply Wall St company report.

Global Payments Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Global Payments is experiencing a significant transformation, but the extensive changes could cause disruptions in operations and integration phases, potentially affecting revenue stability and growth in the near term.

- The company is managing foreign exchange headwinds, which may continue to negatively impact adjusted net revenue and earnings per share if exchange rates remain unfavorable.

- The reliance on disposing of subscale or non-core assets to streamline operations might not yield timely or enough financial benefit, potentially impacting revenue and operating efficiency.

- There are execution risks associated with modernizing and consolidating POS systems under the Genius brand, which could delay anticipated growth in revenue and net margins if the rollout faces setbacks.

- Potential economic uncertainties and conservative capital expenditures might hinder investment in growth initiatives, limiting opportunities to expand revenue and operating income.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Global Payments is $99.07, which represents one standard deviation below the consensus price target of $124.23. This valuation is based on what can be assumed as the expectations of Global Payments's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $194.0, and the most bearish reporting a price target of just $85.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $10.1 billion, earnings will come to $1.5 billion, and it would be trading on a PE ratio of 18.6x, assuming you use a discount rate of 8.5%.

- Given the current share price of $84.12, the bearish analyst price target of $99.07 is 15.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystLowTarget holds no position in NYSE:GPN. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.