Key Takeaways

- Favorable market dynamics and a retreat by traditional lenders provide Greystone with expansion opportunities in affordable housing and new funding relationships.

- Enhanced access to ESG capital and a focus on inflation-protected, fixed-rate assets improve financial flexibility, earnings stability, and resilience against economic shifts.

- Exposure to interest rate volatility, rising costs, policy shifts, weak property sales, and geographic concentration increases risk to income stability and long-term profitability.

Catalysts

About Greystone Housing Impact Investors- Acquires, holds, sells, and deals in a portfolio of mortgage revenue bonds (MRBs) that are issued to provide construction and permanent financing for multifamily, student, and senior citizen housing; skilled nursing properties; and commercial properties in the United States.

- The ongoing shortage of affordable housing, combined with increasing urbanization and demographic changes in the U.S., continues to drive demand for Greystone’s core investment products, supporting sustained growth in assets under management and future revenue streams.

- The increased focus on impact and ESG investing is opening access to new, lower-cost capital sources for Greystone, which can translate to improved net margins and greater financial flexibility over the long run.

- The pullback by commercial banks in affordable housing construction lending creates a significant opportunity for Greystone (especially via the BlackRock JV) to deploy capital into new lending opportunities and expand relationships with developers, underpinning forward growth in net interest income and overall earnings.

- Current elevated liquidity, replenished by property sales and new preferred unit issuances, positions Greystone to comfortably fund existing and future commitments, enabling them to capitalize on market dislocations for accretive investments that should drive net income and book value over time.

- With a focus on long-term, predominantly fixed-rate assets that have embedded inflation protection in rental streams, Greystone is well-positioned to maintain and potentially grow net interest margins and earnings despite economic volatility or shifts in the broader interest rate environment.

Greystone Housing Impact Investors Future Earnings and Revenue Growth

Assumptions

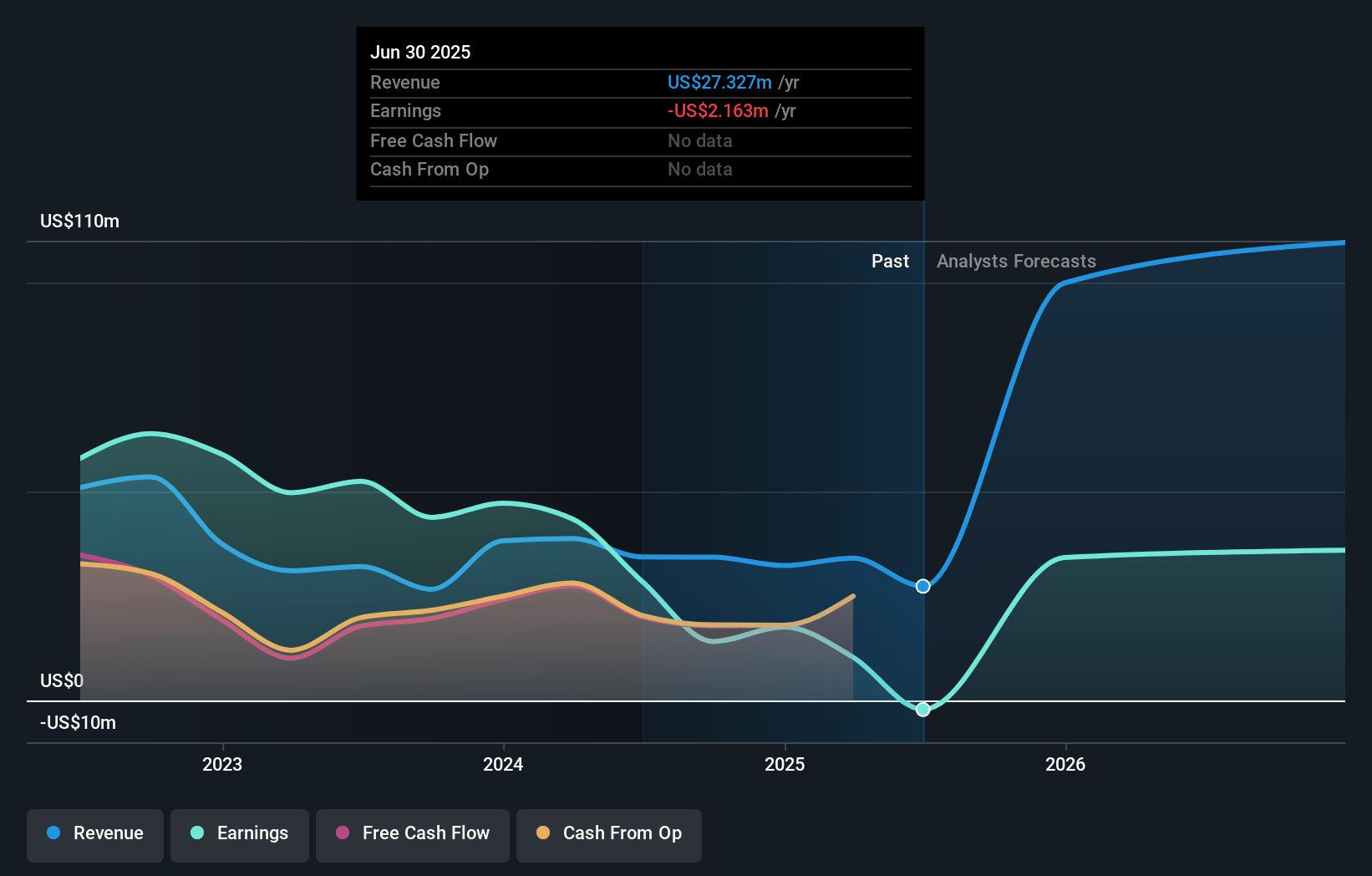

How have these above catalysts been quantified?- Analysts are assuming Greystone Housing Impact Investors's revenue will grow by 91.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 30.4% today to 31.0% in 3 years time.

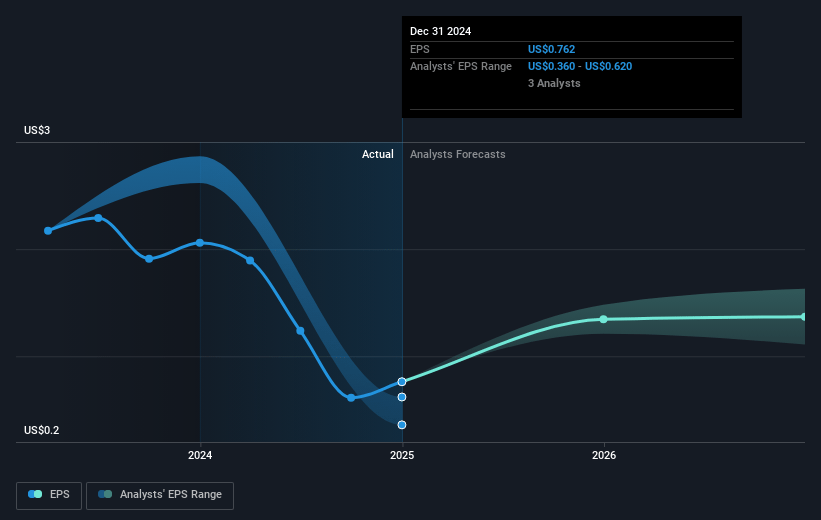

- Analysts expect earnings to reach $73.6 million (and earnings per share of $3.11) by about May 2028, up from $10.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 6.4x on those 2028 earnings, down from 25.8x today. This future PE is lower than the current PE for the US Diversified Financial industry at 15.5x.

- Analysts expect the number of shares outstanding to decline by 0.5% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.41%, as per the Simply Wall St company report.

Greystone Housing Impact Investors Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rising interest rates and municipal bond market volatility can directly reduce the fair value of Greystone’s mortgage revenue bond portfolio, as evidenced by significant unrealized losses in Q1 2025 and pressure on book value, ultimately impacting reported GAAP net income and potentially compressing net margins.

- Increased insurance and operating costs, as seen with a 3.5x jump in property insurance costs for a key asset, can erode profitability on property sales and reduce gain-on-sale income and returns from joint venture equity investments, thereby putting pressure on earnings and distributable cash flow.

- Muted gains on asset sales versus historical performance, driven by elevated cap rates and a multifamily market that “hasn’t turned the corner,” signal a persistent headwind for generating outsized transaction-based profits, which could dampen revenue growth and overall net income.

- Ongoing reliance on government programs like Section 8 introduces legislative and policy risk; proposed changes (e.g., shifting funding from federal to state management or potential reduction in certain HUD allocations) could diminish rental subsidies or funding stability, threatening a critical revenue stream if realized.

- Geographic concentration in markets such as Colorado, California, Texas, and South Carolina exposes Greystone to localized economic downturns, regulatory changes, or natural disasters, which could elevate volatility in rental income, impair asset values, and create earnings variability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $14.833 for Greystone Housing Impact Investors based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $237.4 million, earnings will come to $73.6 million, and it would be trading on a PE ratio of 6.4x, assuming you use a discount rate of 11.4%.

- Given the current share price of $11.4, the analyst price target of $14.83 is 23.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.