Key Takeaways

- Expansion of fundamental quant strategies and new product launches are set to boost revenue and diversify Federated Hermes' investment offerings.

- Optimization in private markets and strategic buybacks are expected to enhance revenues, investment returns, and shareholder value.

- Net redemptions and decreased market share pose challenges to revenue growth, while FX impacts and thematic funds misalignment create additional earnings variability.

Catalysts

About Federated Hermes- A publicly owned investment manager.

- The expansion of MDT fundamental quant strategies, which topped $13 billion in assets by year-end (up 70% from the previous year), is expected to contribute to increased revenue due to higher net sales from these high-growth strategies.

- The launch of new products, such as four active ETFs and a new collective fund, is anticipated to boost future earnings by diversifying the product lineup and attracting new investments.

- The optimization and expansion in the private markets segment, including efforts in European Direct Lending and growth in private equity and real estate funds, are projected to enhance revenues and investment returns.

- Record high money market assets and a favorable outlook on short-term interest rates suggest potential revenue growth from money market strategies as they provide attractive yields in a higher rate environment.

- Strategic buybacks are expected to drive earnings per share (EPS) growth and reflect management's confidence in the undervaluation of the company's stock, thus potentially improving shareholder value.

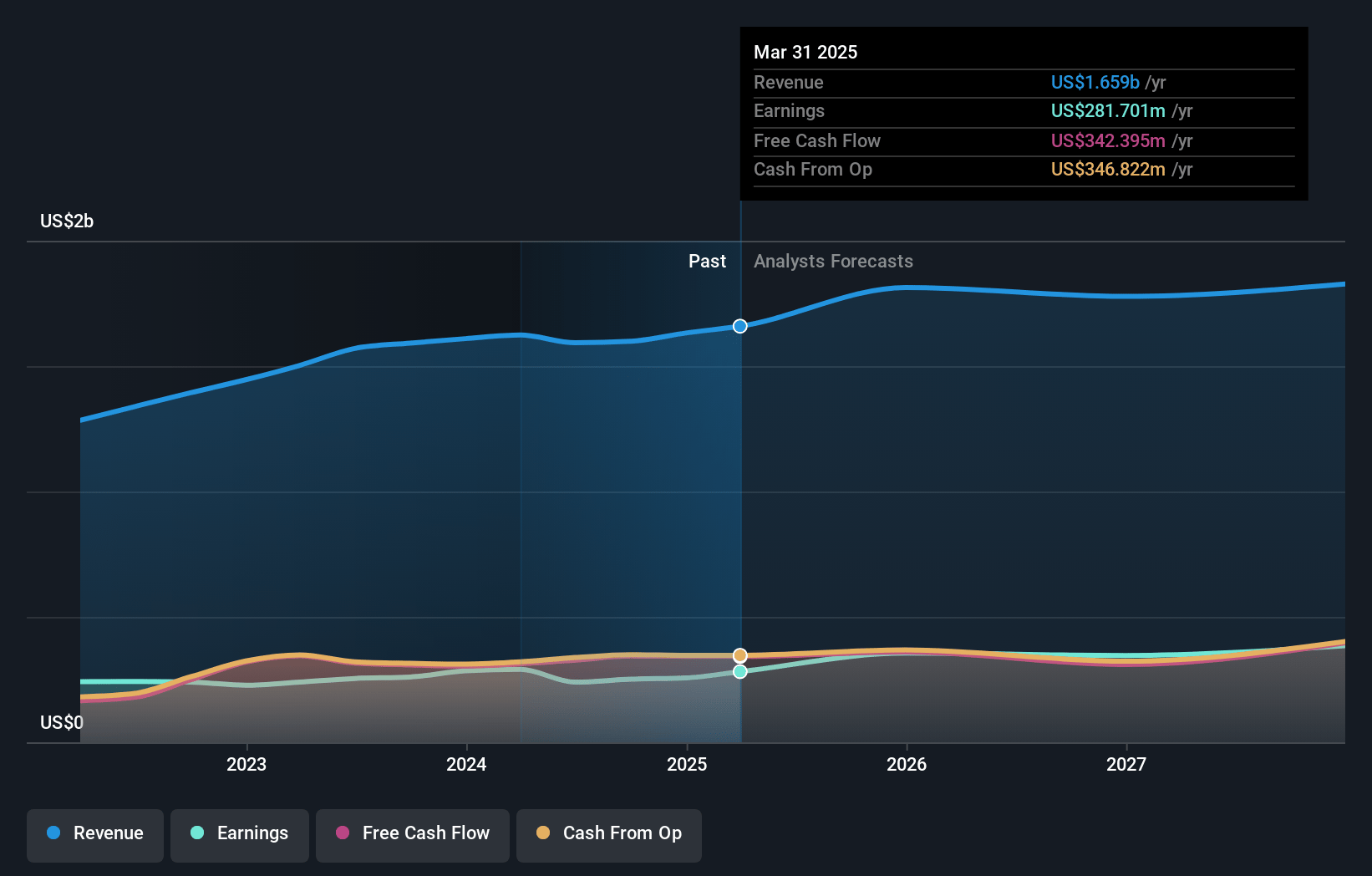

Federated Hermes Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Federated Hermes's revenue will grow by 5.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 15.7% today to 20.5% in 3 years time.

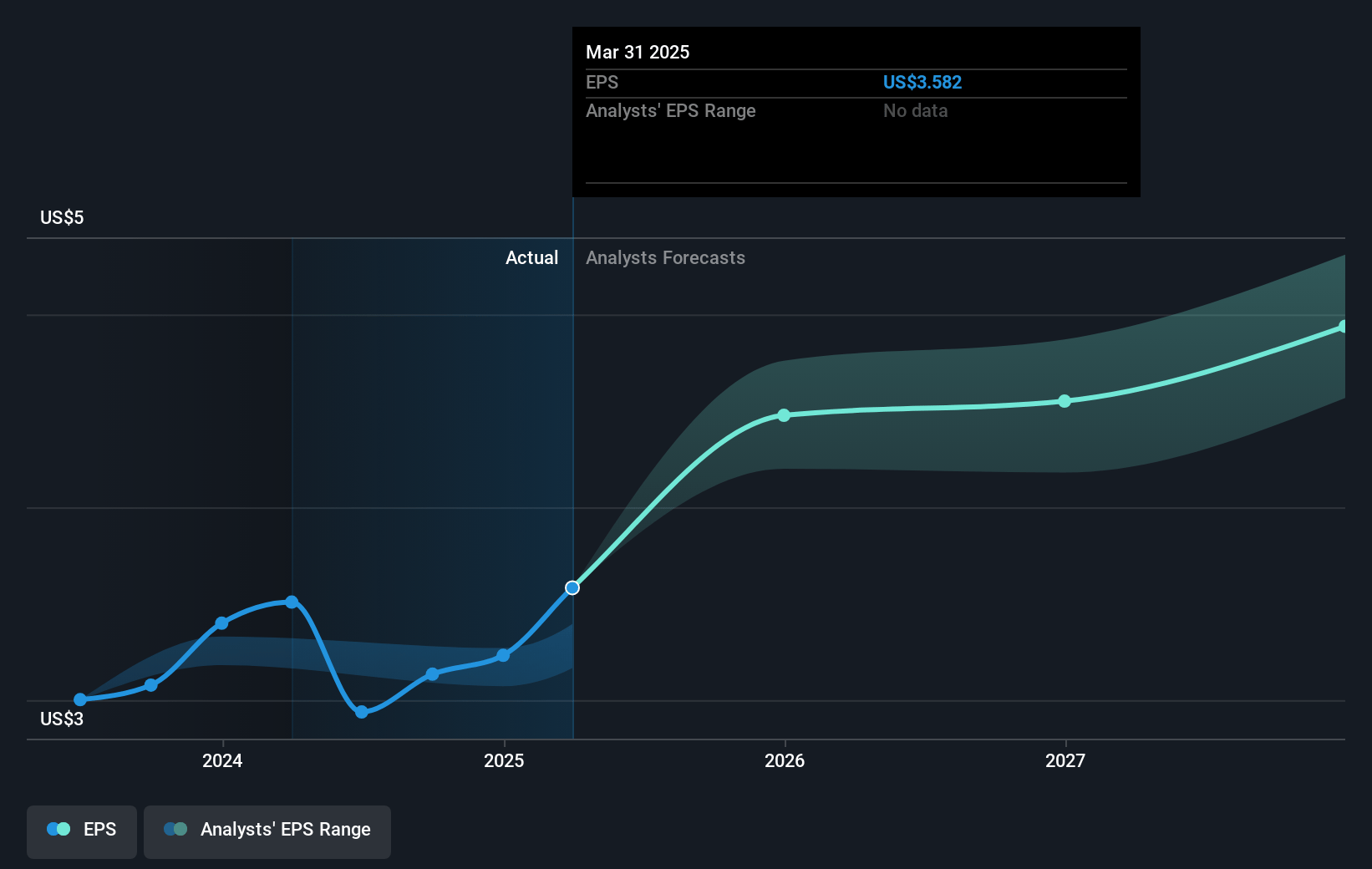

- Analysts expect earnings to reach $389.0 million (and earnings per share of $4.78) by about March 2028, up from $256.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.1x on those 2028 earnings, down from 11.7x today. This future PE is lower than the current PE for the US Capital Markets industry at 21.0x.

- Analysts expect the number of shares outstanding to decline by 3.24% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.46%, as per the Simply Wall St company report.

Federated Hermes Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Net redemptions in both equities and fixed income, including $2.5 billion in equities and $950 million in fixed income, indicate potential challenges in maintaining or growing revenue streams.

- Decreased market share in money market mutual funds, down slightly from 7.32% to 7.22%, may impact future growth in revenue from the money market sector.

- FX impacts, notably a $13.8 million increase in FX-related expenses due to the weakening of the pound versus the dollar, introduce variability that could affect net margins and costs.

- Construction of thematic and ESG funds may not align with broader market sentiment, potentially limiting demand and affecting future earnings from these types of investment products.

- Institutional money, while viewed optimistically with inflow projections, remains on a short leash, introducing an element of unpredictability to expected future earnings and revenues from institutional mandates.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $40.75 for Federated Hermes based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.9 billion, earnings will come to $389.0 million, and it would be trading on a PE ratio of 9.1x, assuming you use a discount rate of 7.5%.

- Given the current share price of $38.73, the analyst price target of $40.75 is 5.0% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives