Narratives are currently in beta

Key Takeaways

- Strategic partnerships and collaboration in the U.S. retirement market create significant revenue growth opportunities for Equitable Holdings.

- Expansion in assets under management and distribution capabilities indicates strong potential for future earnings and improved net margins.

- Increasing competition, interest rate fluctuations, and equity market sensitivity may pressure Equitable Holdings' market share, pricing, and earnings stability.

Catalysts

About Equitable Holdings- Together with its consolidated subsidiaries, operates as a diversified financial services company worldwide.

- Equitable Holdings' strategic partnership with JPMorgan Asset Management for a new smart retirement, lifetime income offering and collaboration with BlackRock and AllianceBernstein for in-plan annuities create a significant growth opportunity in the U.S. retirement market, potentially increasing revenue streams from retirement solutions.

- The continued strong demand for Equitable's Individual Retirement offerings, alongside positive net inflows and a focus on secure income solutions, indicate potential for future growth in revenue and improved net margins.

- Equitable Holdings' substantial growth in firm-wide assets under management, exceeding $1 trillion, along with positive net flows across retirement, asset management, and wealth management segments, are strong indicators of future revenue enhancement and margin growth.

- AllianceBernstein's successful real estate relocation, potentially leading to a 100 to 150 basis points margin expansion, and anticipated increase in adjusted operating margins by 2025 suggest an acceleration in earnings growth.

- The focus on expanding Equitable's distribution capabilities, as highlighted by strong adviser recruiting and improving productivity, is likely to drive future earnings and improve net margins.

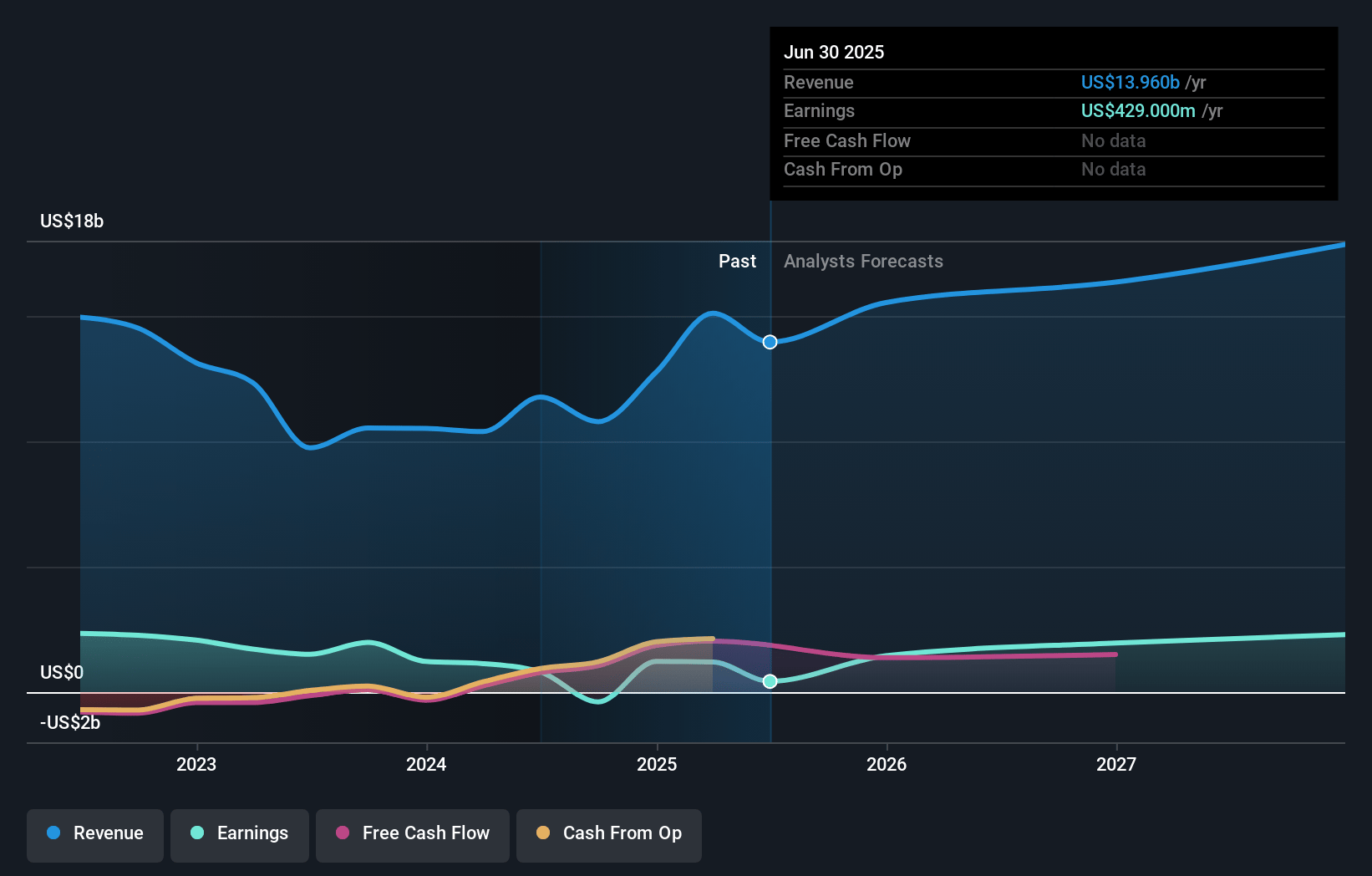

Equitable Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Equitable Holdings's revenue will grow by 19.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from -3.4% today to 12.8% in 3 years time.

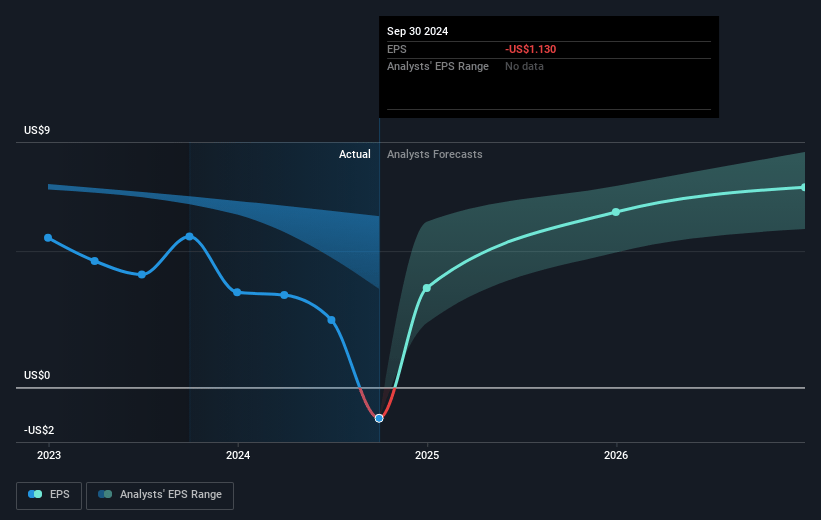

- Analysts expect earnings to reach $2.3 billion (and earnings per share of $8.62) by about November 2027, up from $-370.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 7.5x on those 2027 earnings, up from -39.5x today. This future PE is lower than the current PE for the US Diversified Financial industry at 18.5x.

- Analysts expect the number of shares outstanding to decline by 4.88% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.47%, as per the Simply Wall St company report.

Equitable Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Competition in the U.S. retirement market is increasing, with new entrants like Corebridge and Apollo, which may exert pressure on Equitable Holdings' market share and pricing, potentially impacting revenue and net margins.

- Interest rate fluctuations pose a risk. Lower long-term rates might make certain retirement products less appealing, affecting sales and consequently revenue and net income.

- Equitable Holdings is heavily reliant on income from fee-based earnings, which are sensitive to equity market performance. A decline in market returns could negatively impact fee income, thereby affecting overall earnings.

- The company experienced some quarterly noise in its net interest margin due to factors such as market value adjustment gains on early surrenders. Continued volatility in these areas could impact net margins.

- The assumption updates and macroeconomic factors such as equity market movements could cause variability in earnings as these factors are closely tied to financial performance, impacting net income.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $52.1 for Equitable Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $61.0, and the most bearish reporting a price target of just $45.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $18.2 billion, earnings will come to $2.3 billion, and it would be trading on a PE ratio of 7.5x, assuming you use a discount rate of 7.5%.

- Given the current share price of $46.6, the analyst's price target of $52.1 is 10.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives