Key Takeaways

- Favorable demographic trends and industry shifts toward non-bank lending position Ellington for growth in loan origination and diversified revenue streams.

- Proprietary technology and strategic asset acquisitions drive operational efficiency, scalable growth, and improved earnings resilience.

- Rising credit risks, increased competition, and structural financing vulnerabilities threaten Ellington's margins, profitability, and ability to sustain earnings in a shifting regulatory and housing market environment.

Catalysts

About Ellington Financial- Through its subsidiary, Ellington Financial Operating Partnership LLC, acquires and manages mortgage-related, consumer-related, corporate-related, and other financial assets in the United States.

- Increasing rates of homeownership and the aging U.S. population are driving greater demand for both traditional and reverse mortgage products; Ellington's success with Longbridge and the launch of its HELOC for Seniors program position the company to benefit from these demographic trends, supporting sustained growth in loan origination volumes and revenue.

- The ongoing shift of mortgage origination and credit provision away from regulated banks toward non-bank lenders, alongside potential GSE (Fannie/Freddie) footprint reduction, is enlarging Ellington's addressable market in non-QM and private-label loans, with new product segments offering opportunities to deploy capital at attractive yields-potentially boosting net interest income and ROE.

- Proprietary technology, such as Ellington's automated non-QM loan origination portal, is streamlining loan acquisition and underwriting, enabling scalable growth and operational efficiency gains that are likely to support margin expansion and higher net earnings over time.

- Active portfolio rotation, opportunistic acquisitions of distressed or nonperforming assets, and frequent securitizations at attractive levels allow Ellington to originate or acquire high-yield loans during market dislocations, which supports book value growth and enhanced total return.

- Strategic equity investments in originator platforms create a recurring pipeline of high-quality assets and allow Ellington to share in the profitability of originators, while enhancing vertical integration and widening its footprint-contributing to diversified earnings streams and greater earnings resilience.

Ellington Financial Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Ellington Financial's revenue will grow by 23.4% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 36.2% today to 34.2% in 3 years time.

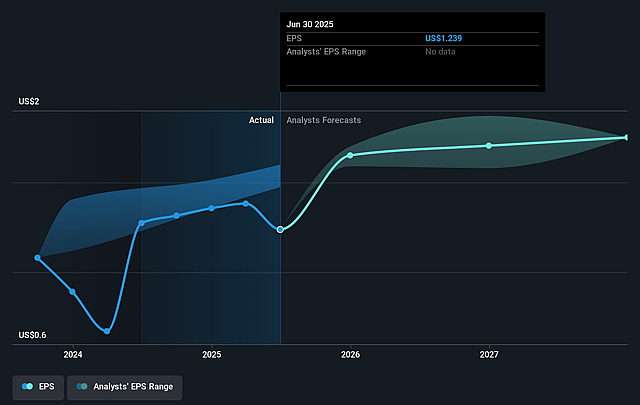

- Analysts expect earnings to reach $200.8 million (and earnings per share of $1.75) by about September 2028, up from $113.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.6x on those 2028 earnings, down from 12.1x today. This future PE is lower than the current PE for the US Mortgage REITs industry at 14.3x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.14%, as per the Simply Wall St company report.

Ellington Financial Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent home price weakness and broad-based affordability challenges, compounded by rising taxes and insurance costs, may result in subdued or even negative home price appreciation (HPA); this raises the risk of higher delinquencies and loan losses, potentially leading to lower revenues and net earnings.

- Elevated non-QM loan delinquencies-now above early product years and reflecting more normalized (not extraordinary) credit trends-could signal higher future credit losses and earnings volatility, pressuring profitability and book value per share.

- Increasing competition from larger non-bank mortgage originators, especially if agency loan volumes rebound, could weaken Ellington's access to high-quality loan flow, narrowing origination margins and reducing net interest income over time.

- Structural reliance on favorable securitization markets and short-term repurchase (repo) financing increases vulnerability to changes in liability conditions; in an environment of wider agency MBS spreads or funding shocks, higher funding costs would compress net interest margins and reduce long-term earnings.

- Technological and regulatory shifts-such as further FinTech disintermediation in mortgage origination/servicing, or more stringent lending and securitization regulations-may erode Ellington's competitive advantages and increase compliance costs, negatively affecting operational scalability, margins, and overall profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $14.531 for Ellington Financial based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $16.0, and the most bearish reporting a price target of just $13.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $587.8 million, earnings will come to $200.8 million, and it would be trading on a PE ratio of 11.6x, assuming you use a discount rate of 9.1%.

- Given the current share price of $13.66, the analyst price target of $14.53 is 6.0% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.