Last Update 12 Dec 25

DFIN: AI Adoption And Share Repurchases Will Drive Strong Future Returns

Narrative Update on Donnelley Financial Solutions

Analysts have modestly raised their price target on Donnelley Financial Solutions to approximately $64.33 per share, reflecting fine tuned assumptions around the discount rate, long term revenue growth, profit margins, and future earnings multiples that collectively support a slightly higher implied valuation.

What's in the News

- Donnelley Financial Solutions launched Active Intelligence, a suite of AI capabilities embedded across its software platform to boost efficiency, accuracy, and insight for clients navigating complex regulatory and compliance workflows (Key Developments)

- Select ActiveDisclosure clients are receiving early access to AI enhanced tools that compare draft SEC filings against prior company and peer filings, with the goal of reducing risk and speeding preparation of 10 Qs, 10 Ks, proxy statements, and IPO documents (Key Developments)

- The company introduced an AI Client Advisory Panel to give clients an early view of upcoming AI features and direct input into future product development priorities (Key Developments)

- DFIN issued fourth quarter 2025 guidance, projecting total net sales in the range of 150 million dollars to 160 million dollars, reflecting expectations for steady revenue performance (Key Developments)

- From July 1 to September 30, 2025, DFIN repurchased 659,367 shares, or about 2.4 percent of shares, for 35.47 million dollars, completing the buyback program announced on May 19, 2025 (Key Developments)

Valuation Changes

- Fair Value Estimate remained unchanged at approximately $64.33 per share, indicating no net impact from the updated assumptions.

- The Discount Rate rose slightly from about 8.41 percent to roughly 8.48 percent, modestly increasing the required return applied in the valuation model.

- Revenue Growth was effectively unchanged at around 3.16 percent, reflecting consistent expectations for top line expansion.

- Net Profit Margin was effectively unchanged at roughly 22.18 percent, signaling stable assumptions about long term profitability.

- The Future P/E rose slightly from about 9.41x to approximately 9.43x, implying a marginally higher multiple applied to forward earnings.

Key Takeaways

- Secular digitalization and rising regulatory complexity are boosting recurring revenue from software solutions, driving margin expansion and improving cash flow resilience.

- Strength in capital markets activity and ongoing automation investments enhance profitability and position the company to benefit from deal rebounds and operational efficiencies.

- Persistent print decline, sluggish transactions, slowing software growth, and competitive SaaS pressures threaten revenue, margins, and the success of transformation investments.

Catalysts

About Donnelley Financial Solutions- Provides innovative software and technology-enabled financial regulatory and compliance solutions in the United States, Asia, Europe, Canada, and internationally.

- The ongoing global increase in regulatory complexity-like the recent Tailored Shareholder Reports (TSR) regulation and persistent, evolving ESG and financial disclosure demands-is driving continued adoption of compliance software (e.g., Arc Suite and ActiveDisclosure), expected to boost recurring revenue and expand margins as compliance shifts from print to software-based solutions.

- The secular shift towards digitalization in capital markets and regulatory functions is accelerating migration from print to secure, cloud-based platforms, evidenced by notable growth in DFIN's software mix and sustained growth in recurring software products, supporting higher long-term net margins and more resilient cash flow.

- Upticks in capital markets activity (M&A, IPOs, cross-border deals) and DFIN's established leadership in servicing complex, high-value transactions position the company to capitalize on any rebound in deal activity, providing a forward-looking tailwind for top-line revenue growth.

- Strategic investments in automation and digital transformation are expected to drive further operating leverage and cost efficiencies, enhancing profitability and helping protect or expand EBITDA and free cash flow as more services migrate to scalable software platforms.

- Share repurchase activity and prudent capital allocation, supported by robust free cash flow and a strong balance sheet, can provide additional upside to earnings per share, making the current valuation more attractive if operational improvement and secular growth trends persist.

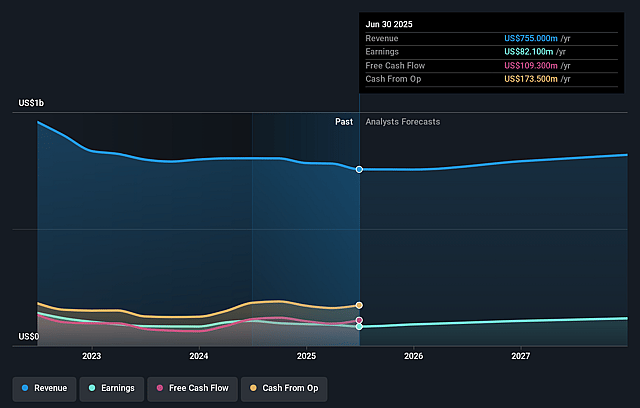

Donnelley Financial Solutions Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Donnelley Financial Solutions's revenue will grow by 3.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.9% today to 15.4% in 3 years time.

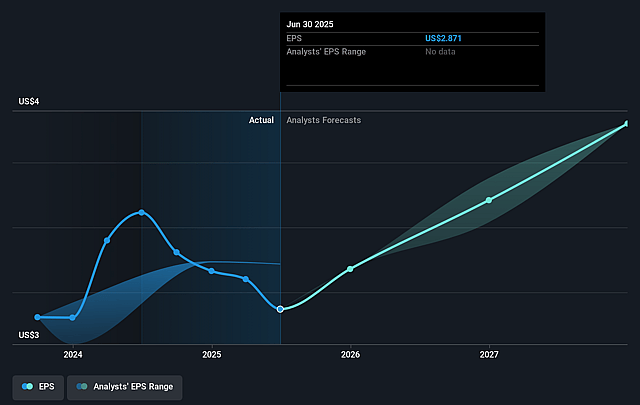

- Analysts expect earnings to reach $127.7 million (and earnings per share of $4.3) by about September 2028, up from $82.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.2x on those 2028 earnings, down from 18.7x today. This future PE is lower than the current PE for the US Capital Markets industry at 26.7x.

- Analysts expect the number of shares outstanding to decline by 4.72% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.38%, as per the Simply Wall St company report.

Donnelley Financial Solutions Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Accelerating structural decline in print and distribution revenue, driven by regulations like Tailored Shareholder Reports that significantly reduce the size and scope of printed materials, is not expected to stabilize and will put long-term pressure on overall top-line revenue growth.

- Capital markets transactional activity remains at historically low levels, and management acknowledges limited visibility and persistent volatility in the environment (e.g., IPO and M&A deal volumes), meaning any prolonged sluggishness or secular reduction in deals could result in lower transactional revenues and more volatile earnings.

- Normalization of growth in key software products such as Arc Suite, which benefited from regulatory-driven tailwinds (e.g., TSR regulation) that are now annualizing, could lead to decelerating software sales growth, impacting the scalability assumptions and margin expansion in future periods.

- The company's transformation relies heavily on continued migration of clients from traditional compliance and communications services to software offerings; if clients are slow to adopt, or competitors with more integrated/cloud-native SaaS platforms gain share, DFIN may see weaker-than-expected software revenue and margin improvement, impacting overall financial performance.

- Ongoing investments in transformation and technology, while necessary to remain competitive, could compress operating margins and constrain free cash flow if not matched by sufficient revenue growth or if secular headwinds (e.g., commoditization, cost-cutting by clients, and SaaS competition) reduce pricing power and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $70.667 for Donnelley Financial Solutions based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $830.2 million, earnings will come to $127.7 million, and it would be trading on a PE ratio of 16.2x, assuming you use a discount rate of 8.4%.

- Given the current share price of $55.73, the analyst price target of $70.67 is 21.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Donnelley Financial Solutions?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.