Key Takeaways

- Strategic enhancements in distribution and wealth management products are expected to drive significant revenue and earnings growth through enhanced fee-related earnings.

- Expanding origination capabilities and strong capital raising momentum aim to bolster revenue and net margins, leveraging diverse fund strategies.

- Reliance on forward-looking statements and expansion plans introduce risks that may affect earnings, while higher costs and acquisitions could pressure margins.

Catalysts

About Ares Management- Operates as an alternative asset manager in the United States, Europe, and Asia.

- Ares Management anticipates continued growth in Fee-Related Earnings (FRE) through enhancements in their distribution channels, particularly by expanding their wealth management products, forecasting a 65% increase in total management fees from wealth products in 2025. This will significantly impact revenue growth.

- The company expects to benefit from a dynamic transaction environment in 2025, driven by a combination of pent-up demand for PE exits, improving asset values, and potentially less regulation. This is expected to increase investment activity, impacting revenue positively.

- Ares has entered 2025 with a record $133 billion of dry powder and expects the deployment of $81 billion in AUM that is not yet fee-paying to yield approximately 30% embedded gross base management fee growth upon deployment. This catalyst likely impacts earnings growth and revenue.

- Strategic additions to Ares' origination capabilities, including 100 new investment professionals and the pending acquisition of GCP International, aim to foster growth in direct lending and secondary solutions. The company foresees these moves enhancing their ability to generate fees during active deployment environments, boosting revenue and net margins.

- The momentum in raising capital commitments has been strong, with a quarterly record in Q4 2024. The expectation of continued robust fundraising in 2025, despite fewer flagship funds, suggests a strategic advantage from diversified fund strategies. This continued inflow of capital supports future revenue growth and higher net income.

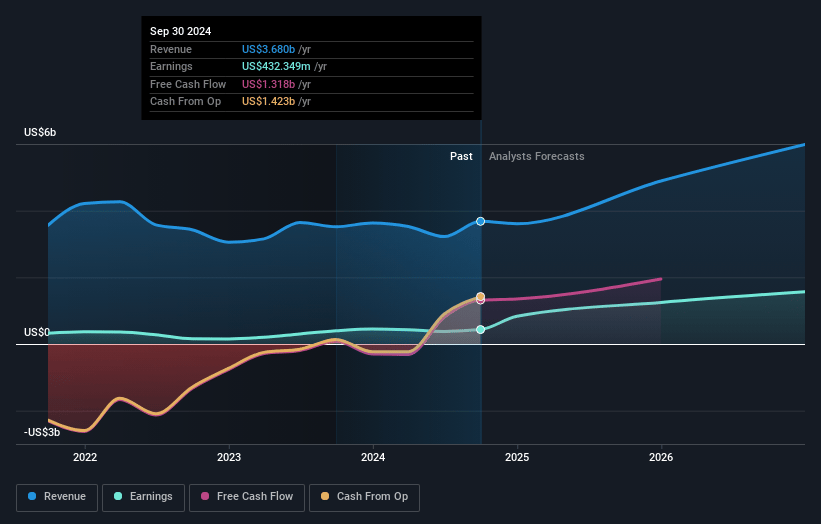

Ares Management Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Ares Management's revenue will grow by 22.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.6% today to 27.7% in 3 years time.

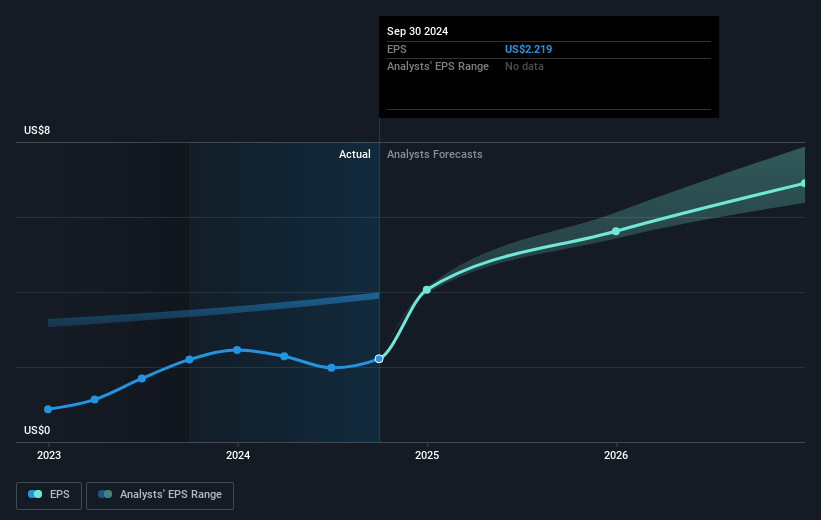

- Analysts expect earnings to reach $2.0 billion (and earnings per share of $7.75) by about April 2028, up from $410.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 39.2x on those 2028 earnings, down from 81.4x today. This future PE is greater than the current PE for the US Capital Markets industry at 24.5x.

- Analysts expect the number of shares outstanding to grow by 6.63% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.71%, as per the Simply Wall St company report.

Ares Management Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The reliance on forward-looking statements introduces risks and uncertainties, which could lead to actual results differing significantly from expectations, potentially affecting earnings projections.

- Increased G&A expenses and supplemental distribution fees in the wealth channel might weigh on the FRE margin, impacting net earnings.

- Competition and integration costs associated with the pending GCP acquisition may create additional financial pressures and affect net margins.

- Real estate and credit markets face potential headwinds; subdued transaction environments could delay revenue realization affecting overall revenue growth.

- Geographic and product expansion plans come with execution risks and uncertainties, which could also impact revenue and earnings negatively.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $157.0 for Ares Management based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $201.0, and the most bearish reporting a price target of just $125.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $7.1 billion, earnings will come to $2.0 billion, and it would be trading on a PE ratio of 39.2x, assuming you use a discount rate of 7.7%.

- Given the current share price of $152.79, the analyst price target of $157.0 is 2.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.