Narratives are currently in beta

Key Takeaways

- Tradeweb's market share growth in U.S. Treasuries and expansion into emerging markets enhances revenue streams and geographic diversification.

- Strategic acquisitions and technology enhancements are expected to improve service offerings, revenue stability, and net margins.

- Rising competition and market dynamics pose challenges to Tradeweb's revenue and earnings growth, potentially impacting its ability to maintain margins.

Catalysts

About Tradeweb Markets- Tradeweb Markets Inc., together with its subsidiaries, builds and operates electronic marketplaces worldwide.

- Tradeweb's increasing market share in U.S. Treasuries, supported by automation and innovative trading protocols, is expected to drive future revenue growth by capturing more trading volume.

- The expansion into emerging markets, with new client successes in Latin America and the Middle East, opens additional revenue streams and enhances geographic diversification.

- Growth in multi-asset class trading, with substantial revenue contributions from areas outside the core rates business, is anticipated to bolster overall earnings and profitability.

- Continual integration of strategic acquisitions like ICD and YieldBroker aims to enhance service offerings and create new revenue opportunities, contributing positively to net margins.

- The focus on enhancing technology and client relationships supports long-term growth in market data and service offerings, potentially improving revenue stability and net margins over time.

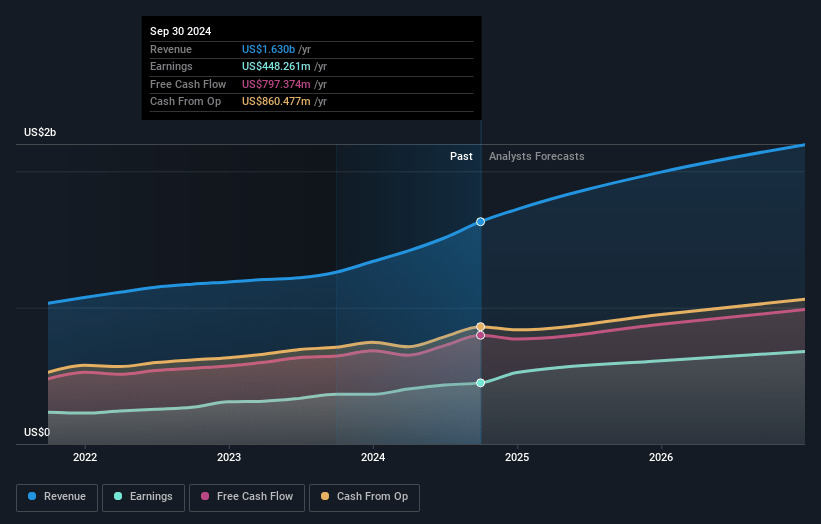

Tradeweb Markets Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Tradeweb Markets's revenue will grow by 11.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 27.5% today to 37.0% in 3 years time.

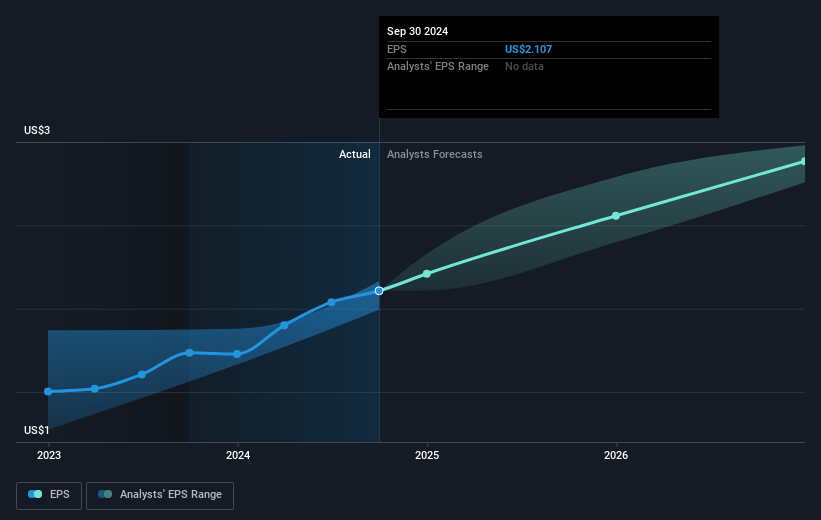

- Analysts expect earnings to reach $833.7 million (and earnings per share of $3.26) by about November 2027, up from $448.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 53.0x on those 2027 earnings, down from 60.6x today. This future PE is greater than the current PE for the US Capital Markets industry at 24.2x.

- Analysts expect the number of shares outstanding to grow by 2.73% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.72%, as per the Simply Wall St company report.

Tradeweb Markets Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- With industry participants offering certain credit trades for free, the pressure on portfolio trading pricing could impact revenue growth if Tradeweb cannot maintain its competitive edge. [Revenue]

- While expanding into emerging markets shows potential, only 30% of the swaps market is currently electronified. If the pace of electronification does not meet expectations, swaps revenue growth could be inhibited. [Revenue]

- Rising competition from platforms like MarketAxess, including partnerships with ICE, could threaten Tradeweb's market share gains in the credit market, impacting future revenues. [Revenue]

- The company is investing substantially in expenses such as technology, professional fees, and new hires. If market conditions decline, sustaining margin growth could prove challenging. [Net Margins]

- Uncertainty around the global macroeconomic environment and fluctuating interest rates may introduce volatility in trading volumes and client activity, thus impacting future earnings. [Earnings]

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $142.0 for Tradeweb Markets based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $158.0, and the most bearish reporting a price target of just $100.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $2.3 billion, earnings will come to $833.7 million, and it would be trading on a PE ratio of 53.0x, assuming you use a discount rate of 6.7%.

- Given the current share price of $127.37, the analyst's price target of $142.0 is 10.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives