Key Takeaways

- Strategic acquisitions and partnerships in tech and finance drive revenue growth, diversify offerings, and improve client retention.

- Rapid international expansion and automation investments enhance market shifts, boosting revenue momentum and operational efficiency.

- Tradeweb's growth aspirations face challenges from high costs, acquisition risks, complex international expansion, and heavy reliance on favorable economic conditions for trading.

Catalysts

About Tradeweb Markets- Tradeweb Markets Inc., together with its subsidiaries, builds and operates electronic marketplaces worldwide.

- Tradeweb Markets is enhancing its product offerings and client relationships through strategic acquisitions such as Yieldbroker and r8fin and moving into new areas like corporate treasury with ICD. This diversification is likely to drive increased revenues and robust free cash flow as these new segments mature and integrate.

- The company's international business, particularly in Asia Pacific, is growing rapidly with a 20% yearly increase in international revenues since 2016. Expanding its global footprint can significantly boost revenue growth as Tradeweb further taps into these emerging markets.

- The integration with BlackRock's Aladdin and strategic partnerships with Goldman Sachs’s Digital Assets Platform and Tokyo Stock Exchange signal Tradeweb's focus on innovation and technology. These initiatives are designed to improve market share and client retention, leading to enhanced revenue and earnings growth.

- Tradeweb's focus on electronification and automation in its core markets, such as U.S. Treasuries and global swaps, positions it well to capitalize on market shifts. These initiatives are expected to maintain Tradeweb’s revenue momentum and expand its net margins through operational efficiencies and increased transaction volumes.

- Continuous investment in technology, with over $780 million spent in the last nine years, allows Tradeweb to lead in electronic markets. As these investments mature, adjusted EBITDA margins, which recently saw an increase of 91 basis points, are expected to expand further, driving improved earnings performance.

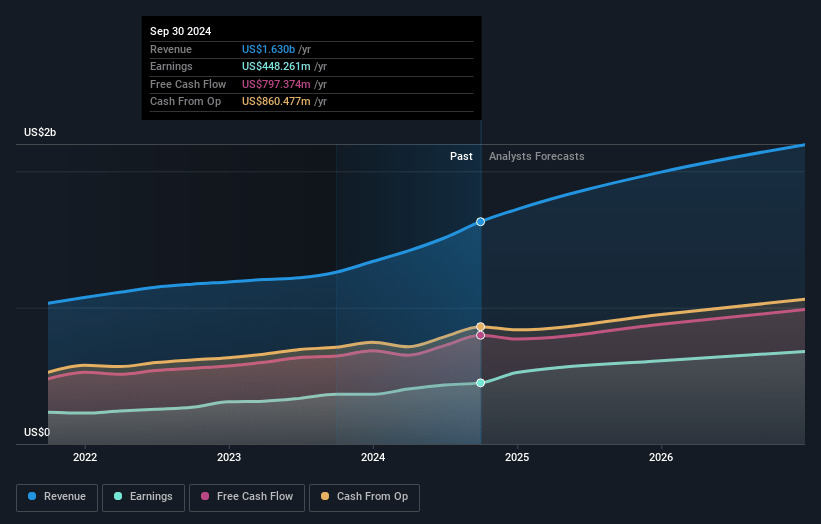

Tradeweb Markets Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Tradeweb Markets compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

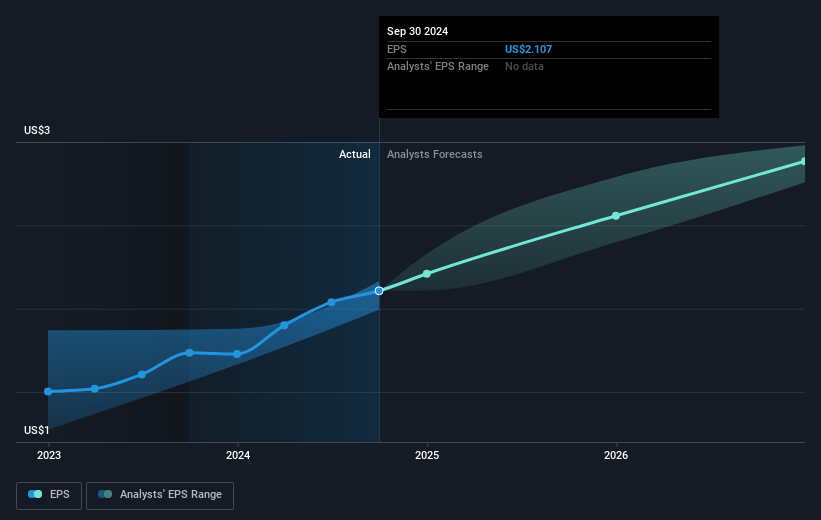

- The bullish analysts are assuming Tradeweb Markets's revenue will grow by 16.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 29.1% today to 32.8% in 3 years time.

- The bullish analysts expect earnings to reach $892.0 million (and earnings per share of $3.54) by about April 2028, up from $501.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 63.2x on those 2028 earnings, up from 56.5x today. This future PE is greater than the current PE for the US Capital Markets industry at 23.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.06%, as per the Simply Wall St company report.

Tradeweb Markets Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Tradeweb’s significant investment in technology, with costs growing at an average of 15% since 2016, might not immediately translate into commensurate revenue growth, potentially affecting net margins and earnings.

- The integration of recent acquisitions such as ICD and Yieldbroker carries execution risks that could disrupt operations or fail to realize anticipated synergies, impacting overall revenue growth and operating margins.

- Tradeweb’s international business, particularly in emerging markets, demonstrates promising growth; however, the complexity of regulatory approvals and market entry strategies in these regions may present hurdles that could temper revenue prospects.

- The increase in expenses due to the expansion of their geographic footprint and new headquarters, including a significant rise in occupancy expenses by up to 55% in the latter half of 2025, might affect net margins if revenue growth does not sufficiently offset these costs.

- Reliance on a favorable macroeconomic environment for continued growth in trading activity, especially given the volatility in interest rate markets, means any negative macro-induced changes could adversely affect transaction volumes, and subsequently, revenues.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Tradeweb Markets is $194.83, which represents two standard deviations above the consensus price target of $149.53. This valuation is based on what can be assumed as the expectations of Tradeweb Markets's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $208.0, and the most bearish reporting a price target of just $107.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $2.7 billion, earnings will come to $892.0 million, and it would be trading on a PE ratio of 63.2x, assuming you use a discount rate of 7.1%.

- Given the current share price of $132.7, the bullish analyst price target of $194.83 is 31.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NasdaqGS:TW. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives