Key Takeaways

- Expansion into infrastructure, climate investments, and innovative fund offerings positions TPG for sustained growth in fee-based revenue and long-term earnings stability.

- Integration of acquisitions and cross-platform strategies drives operating leverage, supporting upside in margins and potentially exceeding current market expectations.

- Rising regulatory scrutiny, market competition, and leadership risks threaten TPG’s fee structures, investment flexibility, and long-term profitability.

Catalysts

About TPG- Operates as an alternative asset manager in the United States and internationally.

- TPG is positioned to capture accelerating capital inflows as institutional and high-net-worth investors continue shifting allocations toward private markets, demonstrated by its record $30 billion raised in 2024 and a robust pipeline for 2025. This trend, fueled by global wealth growth and the search for higher returns in a persistently yield-starved environment, is likely to drive substantial increases in fee-earning assets under management and recurring management fee revenue.

- The company’s strategic expansion into infrastructure and climate-related investments—highlighted by launches such as the Rise Climate Transition Infrastructure Fund and large-scale partnerships (like the $20 billion data center power initiative with Google)—enables TPG to access fast-growing, high-demand sectors. This increases both the magnitude and duration of fee streams, while providing a long runway for earnings and management fee growth tied to secular demand for digitalization and energy transition solutions.

- TPG’s integrated platform and successful acquisition of Angelo Gordon are beginning to yield significant revenue synergies, especially through cross-platform credit offerings and increased penetration with large pools of institutional capital. As these synergies are unlocked, TPG should achieve greater operating leverage, resulting in improved fee-related earnings margins and accelerated EBITDA growth.

- The commitment to product innovation and global diversification—including the build-out of next-generation funds (such as GP-led secondaries, hybrid solutions, and Asian growth strategies) and the roll-out of perpetual capital vehicles targeting the private wealth channel—will progressively reduce AUM and earnings volatility. This underpins more stable growth in both management and performance fees, and supports meaningful upside in long-term net earnings.

- TPG’s ambition and publicly stated plan to double AUM to $500 billion within several years, underpinned by both organic innovation and select inorganic expansion, suggest that current earnings and valuation models may underappreciate the scale of future revenue and margin expansion. As TPG realizes the full economic benefit from deploying its current $58 billion in dry powder and activates large new funds, operating leverage is expected to drive fee-related earnings and margins to levels that could exceed current market expectations, justifying the most bullish projections for TPG stock.

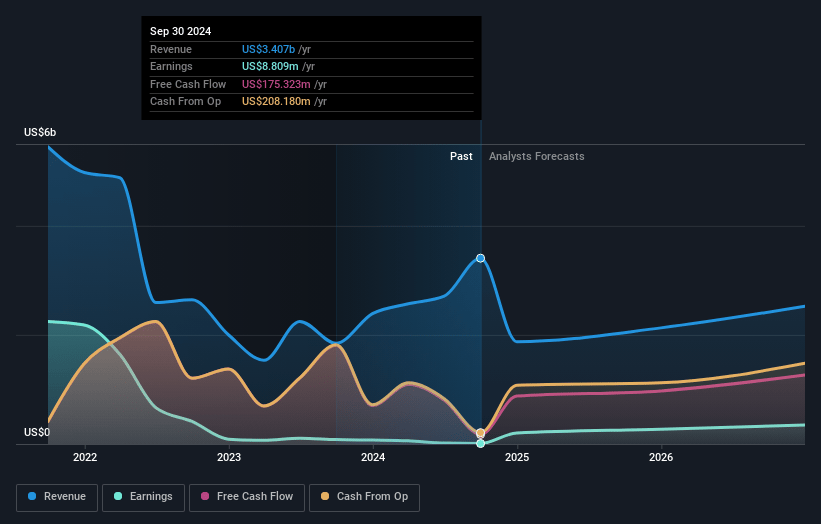

TPG Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on TPG compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming TPG's revenue will decrease by 7.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -0.0% today to 15.2% in 3 years time.

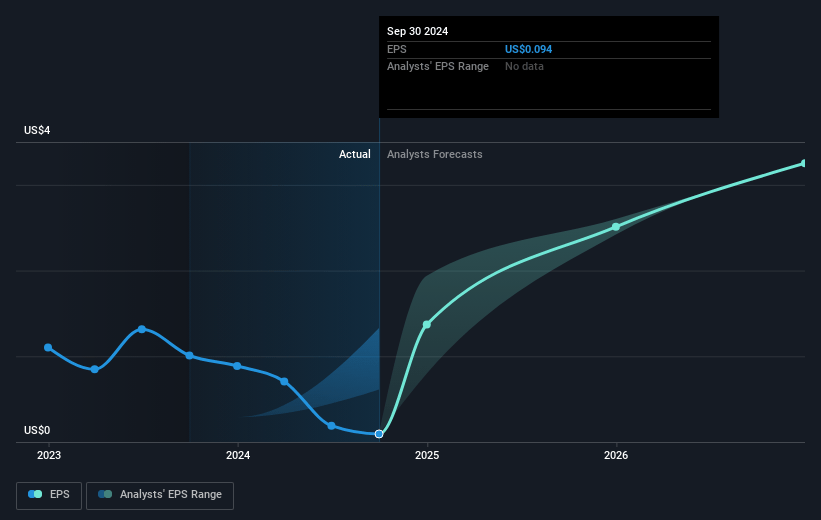

- The bullish analysts expect earnings to reach $426.9 million (and earnings per share of $3.48) by about April 2028, up from $-307.0 thousand today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 93.1x on those 2028 earnings, up from -16031.1x today. This future PE is greater than the current PE for the US Capital Markets industry at 23.1x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.26%, as per the Simply Wall St company report.

TPG Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Increasing regulatory scrutiny and growing anti-ESG sentiment could raise compliance costs, slow fundraising, and limit investment flexibility, which may dampen both revenue growth and future net earnings.

- Persistent high interest rates or a structurally higher cost of capital could lead to depressed asset valuations and weaker deal activity, reducing future performance fees and pressuring overall net margins.

- Heightened industry competition and the proliferation of lower-cost, passive, or semi-liquid alternatives may erode traditional fee structures and compress margins, impacting both management fee income and profitability over the long term.

- Succession risk and heavy reliance on key senior leaders—highlighted by the recent passing of TPG's co-founder—could undermine investment discipline and brand value, leading to inconsistent revenue growth and fluctuating earnings.

- Overexposure to specific sectors, such as climate infrastructure or highly cyclical investments in Asia, leaves TPG vulnerable to adverse regulatory or market shifts, potentially resulting in higher portfolio volatility and weaker net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for TPG is $71.24, which represents two standard deviations above the consensus price target of $53.92. This valuation is based on what can be assumed as the expectations of TPG's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $72.0, and the most bearish reporting a price target of just $42.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $2.8 billion, earnings will come to $426.9 million, and it would be trading on a PE ratio of 93.1x, assuming you use a discount rate of 7.3%.

- Given the current share price of $43.28, the bullish analyst price target of $71.24 is 39.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NasdaqGS:TPG. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.