Narratives are currently in beta

Key Takeaways

- Anticipated rate cuts by the Federal Reserve are expected to enhance financing activity, boosting Seven Hills Realty Trust's revenue growth.

- Strategic opportunities and a stable, diversified loan portfolio position Seven Hills to capitalize on increased transaction volumes and future revenue growth.

- Heavy reliance on the office sector and floating rate loans amid tight credit spreads and rising CECL reserves pose risks to Seven Hills Realty Trust's revenue stability and earnings.

Catalysts

About Seven Hills Realty Trust- A real estate investment trust, focuses on originating and investing in first mortgage loans secured by middle market and transitional commercial real estate in the United States.

- Seven Hills Realty Trust anticipates that the Federal Reserve’s lowering of interest rates will catalyze increased financing activity, which should positively impact their revenue growth as borrowing becomes more attractive.

- The company is witnessing an increased pipeline of potential financings, growing from $700 million to over $1 billion, suggesting a boost in future loan originations and subsequent revenue growth.

- Seven Hills sees opportunities in a competitive market due to tightening credit spreads and aims to capitalize on increased transaction volumes, which may enhance earnings through higher yield deals.

- The diversification and stability of Seven Hills' loan portfolio, characterized by no defaulting or nonaccrual loans, support a stable and potentially expanding revenue base as they maintain a vigilant approach toward underwriting and risk management.

- The presence of ample liquidity and available capital positions Seven Hills to originate accretive loans, which supports future revenue growth and the potential for increased distributable earnings as they navigate an easing interest rate environment.

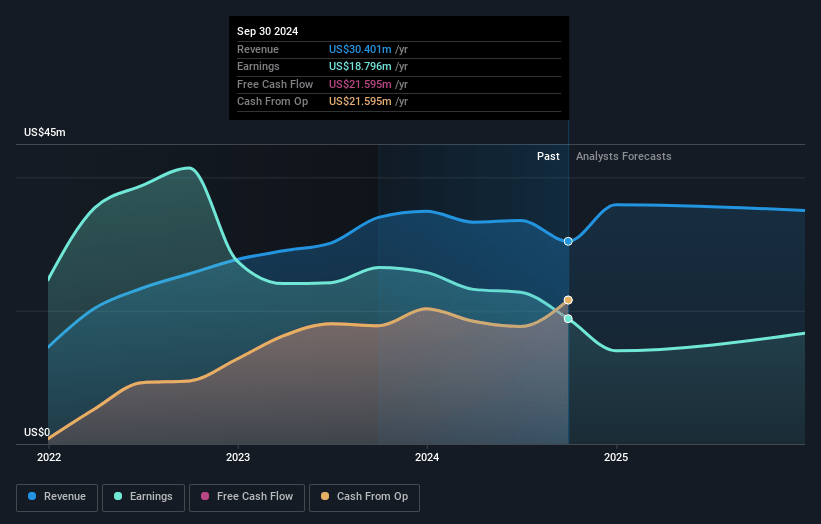

Seven Hills Realty Trust Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Seven Hills Realty Trust's revenue will grow by 10.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 61.8% today to 36.2% in 3 years time.

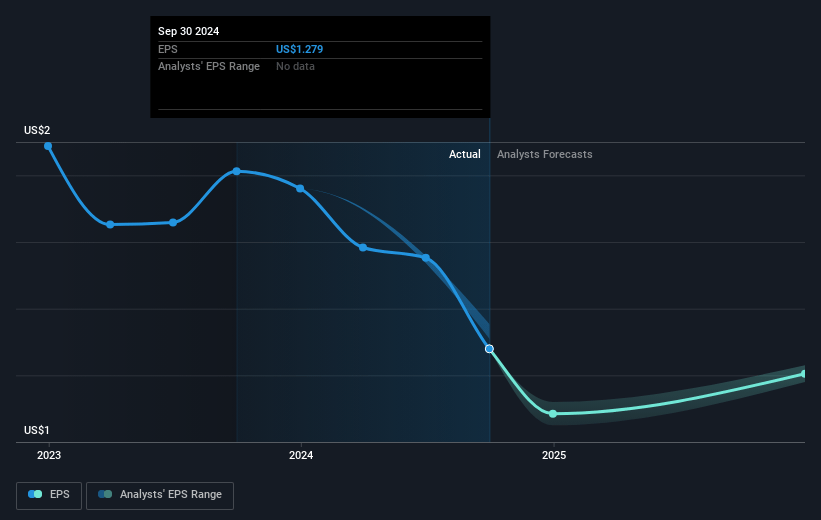

- Analysts expect earnings to reach $15.0 million (and earnings per share of $1.16) by about November 2027, down from $18.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.2x on those 2027 earnings, up from 10.2x today. This future PE is greater than the current PE for the US Mortgage REITs industry at 11.0x.

- Analysts expect the number of shares outstanding to decline by 4.52% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.32%, as per the Simply Wall St company report.

Seven Hills Realty Trust Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company has a significant exposure to the office sector, which remains risky and could lead to challenges in maintaining stable revenue from this segment.

- An increase in competition among lenders has led to tightening credit spreads, which might affect the company’s ability to earn higher yields on new loans, potentially impacting net margins.

- Rising CECL reserves, influenced by unfavorable commercial real estate pricing forecasts, indicate potential risks in asset valuation that might affect overall earnings.

- The reliance on floating rate loans poses a risk in a volatile interest rate environment, potentially impacting interest income if market conditions change unexpectedly.

- Current liquidity levels might be strained if further loan payoffs occur faster than anticipated, potentially affecting the company's ability to generate earnings in the short term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $14.83 for Seven Hills Realty Trust based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $41.5 million, earnings will come to $15.0 million, and it would be trading on a PE ratio of 14.2x, assuming you use a discount rate of 6.3%.

- Given the current share price of $12.88, the analyst's price target of $14.83 is 13.2% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives