Key Takeaways

- Strategic international expansion, digital adoption, and local integrations are broadening Remitly’s market reach while reducing regional dependency.

- Product innovation, automation, and operating efficiencies are boosting customer retention, profitability, and scalability amidst rising regulatory demands.

- Rising competition, persistent customer acquisition costs, regulatory and macroeconomic uncertainty, declining transaction profitability, and emerging technologies pose significant risks to future growth and margins.

Catalysts

About Remitly Global- Engages in the provision of digital financial services in the United States, Canada, and internationally.

- Remitly’s rapid expansion into new international corridors and direct integrations with local payment partners (e.g., Orange Money, Plin, MACH, Vodafone Cash) is materially increasing its addressable market and geographic diversification, which should accelerate future revenue growth and reduce dependency on any single region.

- Continued product innovation—such as frictionless experiences for high-value senders, targeted offerings for micro-businesses, and the integration of conversational AI (WhatsApp Send)—is driving increased customer engagement, higher transaction values, and improved retention, which is expected to positively impact both revenues and net margins over time.

- The shift from cash-based to digital remittances, aided by expanding smartphone and internet penetration in emerging markets, is accelerating adoption of Remitly’s digital-first platform and enabling ongoing market share gains from legacy providers, supporting sustained revenue growth.

- Advanced automation and AI-powered risk/compliance systems are allowing Remitly to safely serve higher-value transactions, efficiently onboard business users, and maintain lower transaction loss rates, preserving/enhancing net margins as regulatory scrutiny and AML/KYC requirements intensify globally.

- Operating leverage is becoming increasingly evident as marketing spend per active user declines and efficiencies in customer support, technology, and G&A are realized; this suggests ongoing scalability and expanding EBITDA margins as Remitly benefits from both scale and rising word-of-mouth acquisition.

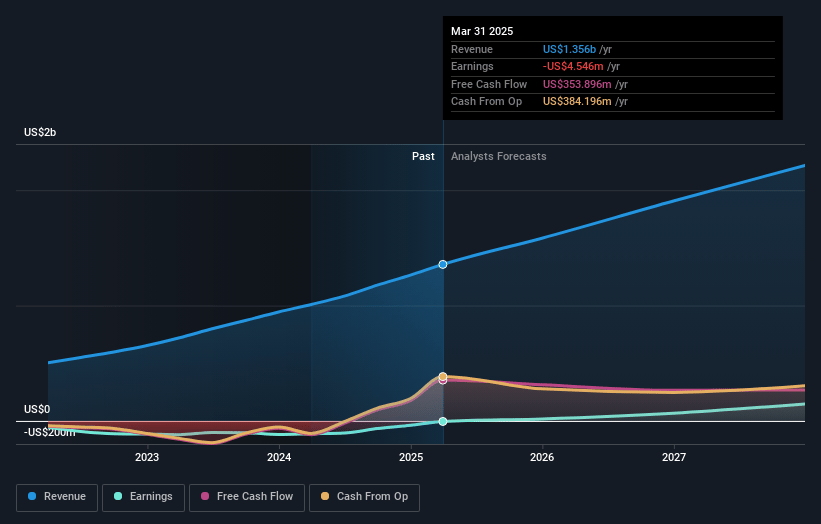

Remitly Global Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Remitly Global's revenue will grow by 19.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from -0.3% today to 5.2% in 3 years time.

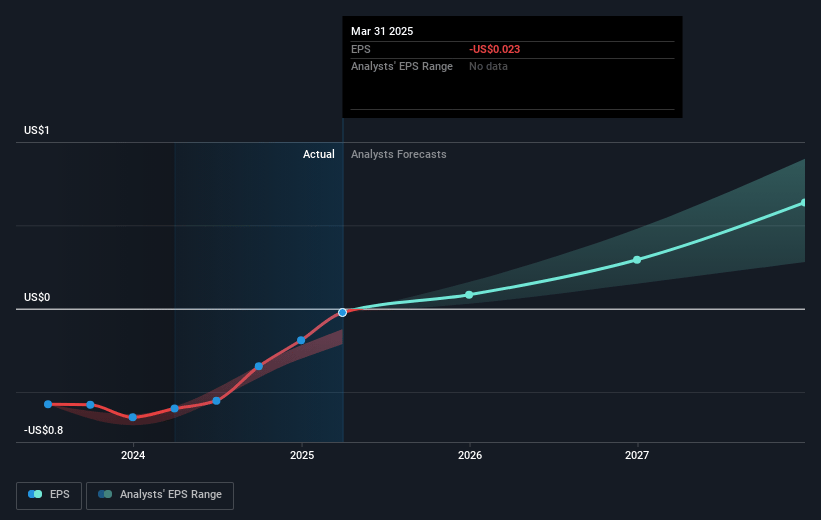

- Analysts expect earnings to reach $122.2 million (and earnings per share of $0.41) by about July 2028, up from $-4.5 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $147.1 million in earnings, and the most bearish expecting $67.2 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 66.4x on those 2028 earnings, up from -783.0x today. This future PE is greater than the current PE for the US Diversified Financial industry at 15.9x.

- Analysts expect the number of shares outstanding to grow by 4.47% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.04%, as per the Simply Wall St company report.

Remitly Global Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Increasing competition from both traditional and digital-first remittance providers could force Remitly to lower its pricing and reduce net revenue margins—while current gains are driven by product and marketing efficiencies, these might be eroded if larger, well-capitalized tech or fintech firms aggressively pursue market share.

- Sustained high marketing spend—while marketing per active customer has declined, continued investment and rising competitive pressures may result in persistently high customer acquisition costs, potentially impacting earnings and profitability over the long term.

- Exposure to macroeconomic, regulatory, and geopolitical risks—management cautions that their outlook assumes no material changes in these areas; should restrictive immigration policies, heightened regulatory scrutiny, or adverse geopolitical conditions arise, these could limit Remitly’s addressable market and increase compliance costs, directly affecting revenue and net margins.

- Declining gross take rates as high-dollar senders and low-fee transaction segments grow (with send volume consistently outpacing revenue growth)—the company expects this trend to continue, which could pressure top-line growth even as transaction volumes rise.

- The looming threat of industry disruption by alternative technologies, such as government-backed real-time payment rails or mainstream adoption of blockchain/crypto-based remittance solutions, which may diminish Remitly’s technological advantages and compress both revenue and margins if customers shift to lower-cost alternatives.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $28.516 for Remitly Global based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $32.0, and the most bearish reporting a price target of just $25.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.3 billion, earnings will come to $122.2 million, and it would be trading on a PE ratio of 66.4x, assuming you use a discount rate of 7.0%.

- Given the current share price of $17.46, the analyst price target of $28.52 is 38.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.