Key Takeaways

- Expanding electronic trading and new product launches are driving robust revenue growth, market share gains, and operating leverage across multiple bond market segments.

- Growing data solutions, international presence, and automation support high-margin service revenues, geographic diversification, and sustained trading volume and earnings growth.

- Rising competitive, regulatory, and technological pressures threaten MarketAxess's revenue growth, margin expansion, and market share due to limited diversification and escalating operating costs.

Catalysts

About MarketAxess Holdings- Operates an electronic trading platform for institutional investor and broker-dealer firms in the United States, the United Kingdom, and internationally.

- The global shift from manual, voice-based bond trading to electronic platforms is accelerating, with MarketAxess positioned to capture outsized share as more asset classes (such as blocks, portfolio trades, munis, and emerging market debt) move online, potentially driving robust revenue and market share growth over the medium and long term.

- Expanding adoption of data-driven investment strategies—including systematic, algorithmic, and quantitative trading—boosts demand for the company’s proprietary data and analytics solutions, supporting high-margin, recurring service revenue streams and enhancing overall net margins.

- Major product rollouts in 2025—in particular, high-touch block trading solutions in U.S. investment grade and high yield, a global benchmark portfolio trading suite, and the new dealer-initiated protocols—are expected to unlock access to large, previously under-electronified segments of the bond market, acting as near-term catalysts for revenue acceleration and operating leverage.

- The company’s continued expansion into international markets (notably Europe and Asia-Pacific), the growing rates platform, and the integration of cross-asset capabilities via acquisitions such as RFQ-hub create new revenue streams and extend the addressable market, bolstering long-term topline growth and geographic diversification.

- Increasing automation, higher levels of buy

- and sell-side network effects, and the ongoing rise in global fixed-income issuance all underpin sustained growth in trading volumes on the platform, which should enable earnings growth and support consistently strong free cash flow for reinvestment and buybacks.

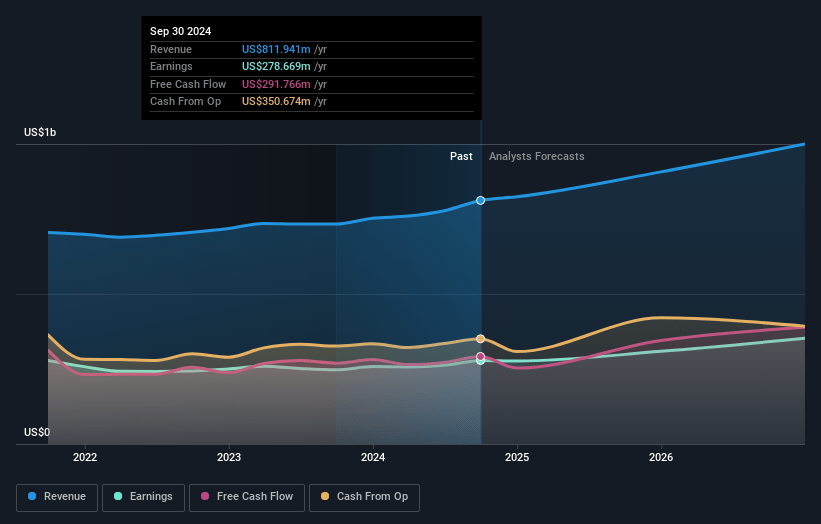

MarketAxess Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on MarketAxess Holdings compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming MarketAxess Holdings's revenue will grow by 11.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 33.6% today to 35.7% in 3 years time.

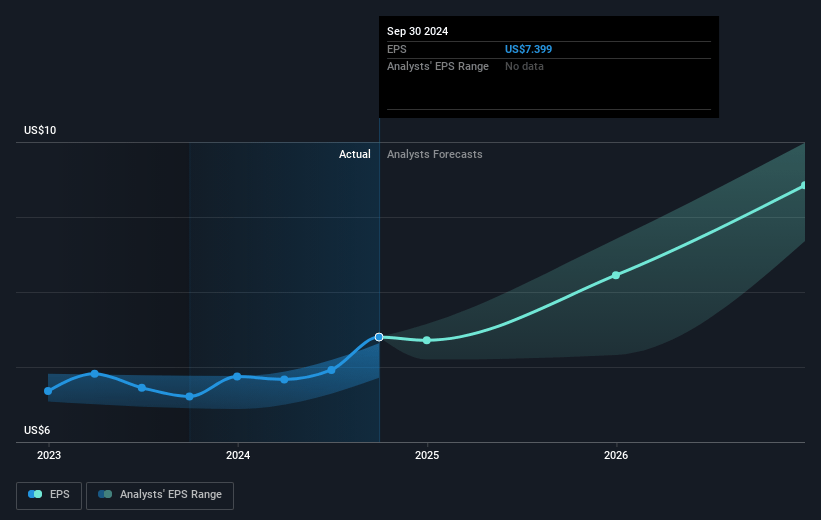

- The bullish analysts expect earnings to reach $400.2 million (and earnings per share of $10.66) by about April 2028, up from $274.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 33.0x on those 2028 earnings, up from 30.6x today. This future PE is greater than the current PE for the US Capital Markets industry at 23.1x.

- Analysts expect the number of shares outstanding to decline by 0.54% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.04%, as per the Simply Wall St company report.

MarketAxess Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The rise of decentralized finance and blockchain-based solutions presents a threat to MarketAxess’s core trading platform, as clients may ultimately bypass electronic venues like MarketAxess, leading to long-term pressure on trading volumes and a potential decline in transaction-driven revenues.

- Intensified regulatory scrutiny and evolving financial regulation such as Basel III/IV and MiFID III could drive higher compliance costs and limit trading flexibility, reducing the company’s ability to grow its addressable market and constraining operating margin expansion over time.

- Growing competition from both established financial institutions and nimble fintech entrants—particularly in algorithmic and all-to-all bond trading—could erode MarketAxess’s historic pricing power, resulting in compressed net margins and increased risk of market share loss in critical areas such as U.S. high-grade and high-yield credit.

- The company’s slow pace of product or geographic diversification beyond its core U.S. investment-grade credit market leaves it vulnerable to revenue concentration risk; any stagnation or market share losses in this segment, as mentioned in the call regarding disappointing U.S. high-grade and high-yield market share, could stall overall earnings growth and increase volatility in future profitability.

- Persistent increases in technology and infrastructure expenditures required for platform security, feature parity, and integration (including ongoing investments in block trading, automation, and global expansion) may outpace future revenue growth, putting sustained pressure on MarketAxess’s operating expenses and net income in coming years.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for MarketAxess Holdings is $291.32, which represents two standard deviations above the consensus price target of $232.75. This valuation is based on what can be assumed as the expectations of MarketAxess Holdings's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $295.0, and the most bearish reporting a price target of just $185.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.1 billion, earnings will come to $400.2 million, and it would be trading on a PE ratio of 33.0x, assuming you use a discount rate of 7.0%.

- Given the current share price of $222.41, the bullish analyst price target of $291.32 is 23.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NasdaqGS:MKTX. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives