Key Takeaways

- MarketAxess is leveraging high-tech platform solutions, like X-Pro and Pragma, to enhance trading efficiency and expand market capabilities, driving revenue growth.

- Expansion into portfolio trading, global pricing, and cross-asset offerings aims to boost market share, diversify revenue, and support long-term growth.

- MarketAxess faces challenges in maintaining growth due to competitive pressures, low volatility, and macroeconomic uncertainties affecting revenue streams and profitability.

Catalysts

About MarketAxess Holdings- Operates an electronic trading platform for institutional investor and broker-dealer firms worldwide.

- MarketAxess plans to roll out a full high-touch block trading solution in the U.S. credit market, which is expected to increase market share and drive revenue growth by addressing a large and underpenetrated segment with high value trades.

- The company is enhancing its client and dealer solutions with the launch of new technology platforms such as X-Pro, Pragma for client algos, and automation tools. These advancements are anticipated to improve trading efficiency and expand capabilities, positively impacting revenue and earnings.

- MarketAxess is focusing on expanding its portfolio trading and dealer-initiated channels with new features and solutions. The introduction of global benchmark pricing and enhanced dealer systems could lead to market share gains and increased commission revenue.

- The growing adoption of the company's rates trading solutions, including algorithms for large block orders and client algos being migrated to Pragma technology, is expected to drive trading ADV growth and subsequently boost revenue.

- With the integration of RFQ-hub and emphasis on cross-asset class trading, MarketAxess aims to broaden its product offerings to encompass fixed income ETFs and derivatives, potentially leading to revenue diversification and long-term growth.

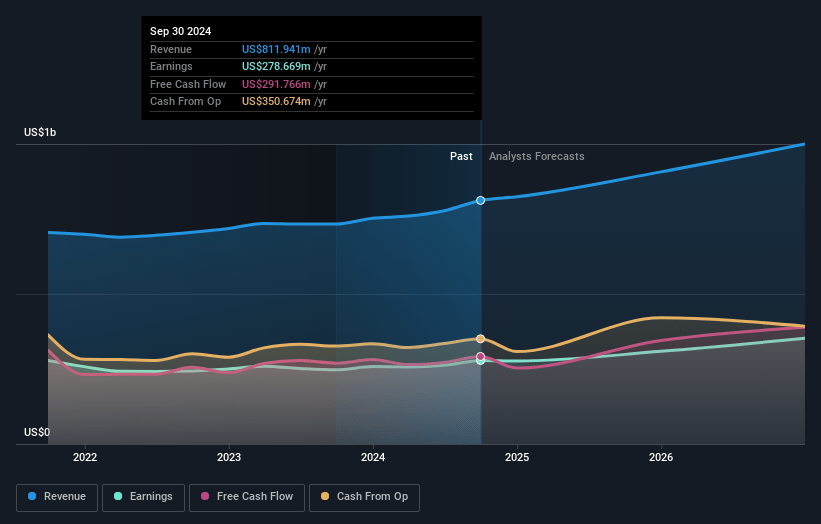

MarketAxess Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming MarketAxess Holdings's revenue will grow by 8.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 33.6% today to 35.1% in 3 years time.

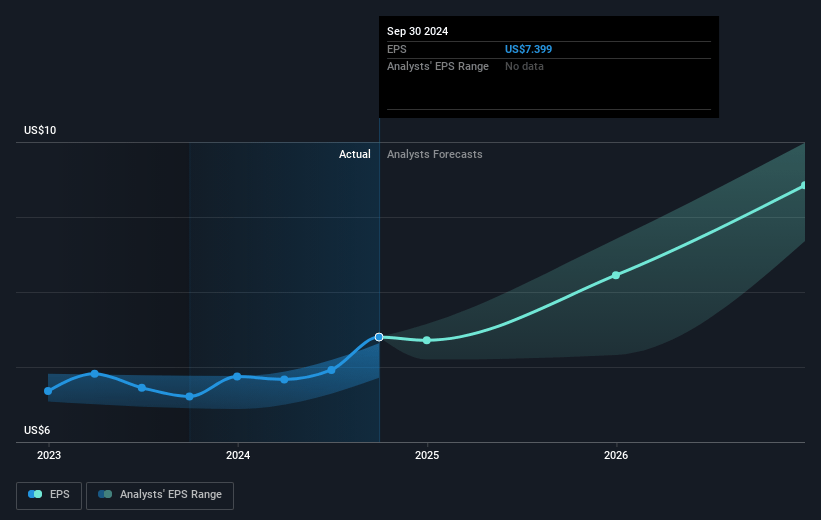

- Analysts expect earnings to reach $365.9 million (and earnings per share of $9.88) by about March 2028, up from $274.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 29.1x on those 2028 earnings, down from 29.9x today. This future PE is greater than the current PE for the US Capital Markets industry at 23.2x.

- Analysts expect the number of shares outstanding to decline by 0.54% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.1%, as per the Simply Wall St company report.

MarketAxess Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Concerns about MarketAxess' U.S. high-grade market share and disappointing performance in January highlight challenges in maintaining growth, potentially impacting future revenues and market share.

- The competitive landscape, with increased competition in portfolio trading and low electronification in block trading, poses risks to MarketAxess' ability to capture market share and maintain fee margins.

- Low volatility and tight spreads in the fixed income market could hinder the profitability of MarketAxess' trading solutions, affecting fee capture and earnings.

- High levels of capital intensity required for portfolio trading by dealers may impact MarketAxess’ growth potential in this area, potentially affecting revenue from its portfolio trading channel.

- Uncertainty in macroeconomic conditions, such as changes in interest rate policies and their impact on trading behavior and durations, could lead to variability in MarketAxess' commission revenues and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $234.167 for MarketAxess Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $305.0, and the most bearish reporting a price target of just $189.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.0 billion, earnings will come to $365.9 million, and it would be trading on a PE ratio of 29.1x, assuming you use a discount rate of 7.1%.

- Given the current share price of $217.36, the analyst price target of $234.17 is 7.2% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.