Last Update07 May 25Fair value Decreased 12%

AnalystHighTarget has decreased revenue growth from 23.7% to 19.2%.

Read more...Key Takeaways

- Expansion into new financial products, international markets, and institutional offerings is diversifying revenue streams and broadening the customer base.

- Growing adoption of subscription and advanced trading services is creating recurring high-margin revenues and supporting sustained profit growth.

- Expansion into new financial products and markets increases regulatory, competitive, and operational risks, potentially hurting profitability, user growth, and long-term revenue stability.

Catalysts

About Robinhood Markets- Operates financial services platform in the United States.

- Robinhood is rapidly diversifying its platform by introducing new asset classes and products—such as futures, prediction markets, advisory services, and banking—all designed to capture rising user engagement from a new generation of digitally native investors, which is expected to significantly expand both transaction revenues and revenue per user in the coming years.

- The adoption of Robinhood Gold subscriptions is accelerating, with over 3.3 million subscribers and a high attach rate among new customers; as Gold becomes central to more of the customer experience, this model is likely to unlock recurring high-margin revenue streams, supporting growth in both overall revenue and operating margins.

- The company’s ongoing international expansion (notably the U.K. launch and upcoming Asia entry) together with acquisitions like Bitstamp and TradePMR is set to open vast new markets, giving Robinhood access to a global user base and new institutional clients, which will diversify revenues and dampen cyclicality while raising the company’s long-term earnings floor.

- Growth in active trading volume—fueled by ongoing improvements to the trading platform and the addition of sophisticated tools for more advanced users—positions Robinhood to benefit disproportionately from the secular trend of increased retail and younger generation participation in markets, which will lift trading volumes, assets under custody, and ultimately fee-based and net interest income.

- Investments in technological innovation, including proprietary trading infrastructure, AI-powered trading assistants (such as Cortex), and improved order routing, are expected to drive both user engagement and operational efficiencies, leading to higher incremental margins and robust long-term EPS growth.

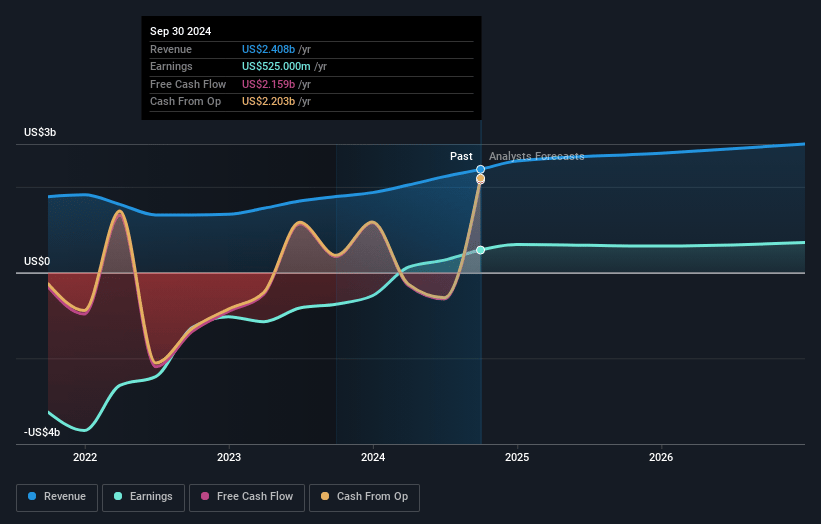

Robinhood Markets Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Robinhood Markets compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Robinhood Markets's revenue will grow by 19.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 48.8% today to 38.6% in 3 years time.

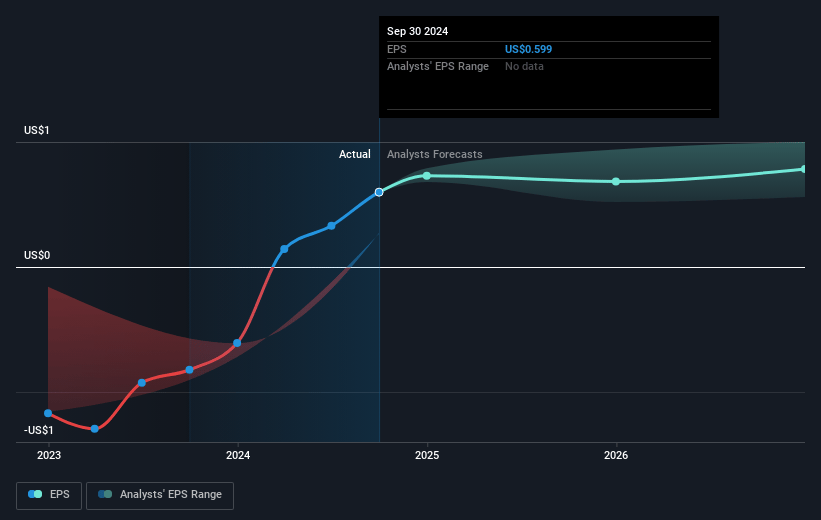

- The bullish analysts expect earnings to reach $2.1 billion (and earnings per share of $2.36) by about May 2028, up from $1.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 46.0x on those 2028 earnings, up from 27.0x today. This future PE is greater than the current PE for the US Capital Markets industry at 25.0x.

- Analysts expect the number of shares outstanding to grow by 0.41% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.64%, as per the Simply Wall St company report.

Robinhood Markets Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Robinhood is increasingly expanding into highly regulated areas such as futures, advisory products, credit cards, and global crypto, which exposes the company to greater regulatory scrutiny and potential compliance costs that could compress net margins or restrict revenue growth over time.

- As Robinhood attempts to diversify its business lines beyond retail trading, it faces intense competition from full-service brokerages, emerging decentralized finance platforms, and established global players, which could drive margin compression and slow user growth, eventually reducing both revenues and earnings.

- The company continues to rely on active traders and promotional strategies to drive engagement and net deposit growth, leaving it exposed to prolonged bear markets or declining retail trading volumes, which could lead to significant volatility in revenues and less predictable earnings in the long run.

- Ongoing industry trends towards zero-commission trading and broad fee reductions, alongside Robinhood’s need to offer incentives and rewards for asset transfers and Gold subscriptions, may erode overall profitability and put pressure on operating margins.

- The company’s rapid rollout of new products—such as Robinhood Legend, prediction markets, and expansion into global markets—may stretch operational resources, introduce execution risk, and increase susceptibility to technology outages or brand reputation incidents, potentially impacting customer trust, acquisition costs, and future revenue consistency.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Robinhood Markets is $87.92, which represents two standard deviations above the consensus price target of $59.29. This valuation is based on what can be assumed as the expectations of Robinhood Markets's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $105.0, and the most bearish reporting a price target of just $40.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $5.5 billion, earnings will come to $2.1 billion, and it would be trading on a PE ratio of 46.0x, assuming you use a discount rate of 7.6%.

- Given the current share price of $48.69, the bullish analyst price target of $87.92 is 44.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.