Key Takeaways

- Aggressive expansion in lower-tier cities and digital ecosystem investments fuel revenue growth, enhance customer engagement, and boost operational efficiency.

- Innovation in menu offerings and improved supply chain efficiency support market share gains, higher profitability, and resilience against increasing competition.

- Escalating costs, intensifying competition, and shifting consumer preferences may constrain sales growth, compress margins, and challenge Yum China's ability to sustain long-term earnings expansion.

Catalysts

About Yum China Holdings- Owns, operates, and franchises restaurants in the People’s Republic of China.

- Continued aggressive expansion into lower-tier Chinese cities and new store formats (including KCOFFEE Cafes and Pizza Hut WOW), combined with healthy new store payback periods, supports ongoing top-line revenue growth and market share gains by tapping into rising urbanization and a broadening middle class.

- Deepening digital ecosystem investments (e.g., Super App, Mini programs, AI-driven end-to-end digitization, frontline innovation fund) enhance customer engagement, drive higher frequency of transactions, and improve operational efficiencies-positively impacting both revenues and net margins.

- Rapid growth of the delivery business, with delivery now 45% of total sales and all brands available on major platforms, expands the addressable market and supports sustainable same-store sales growth, mitigating competition by leveraging scale and cross-channel synergies.

- Ongoing innovation in menu offerings (e.g., KFC product launches, Pizza Hut's new pizzas, value-driven "All-You-Can-Eat" campaigns, and branded collaborations) enables Yum China to capture evolving consumer preferences for branded, safe, and experiential dining, driving incremental transactions and pricing power.

- Supply chain improvements, store automation, and lower CapEx per store (alongside a growing franchise store mix) drive down cost ratios and G&A expense, enabling sustainable margin expansion and higher operating profits even in the face of labor cost pressures.

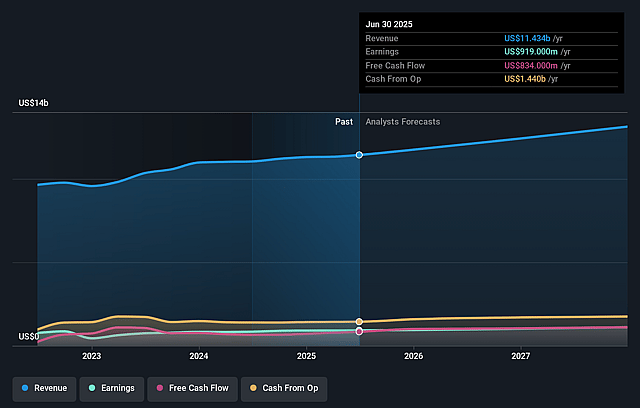

Yum China Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Yum China Holdings's revenue will grow by 7.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.0% today to 8.7% in 3 years time.

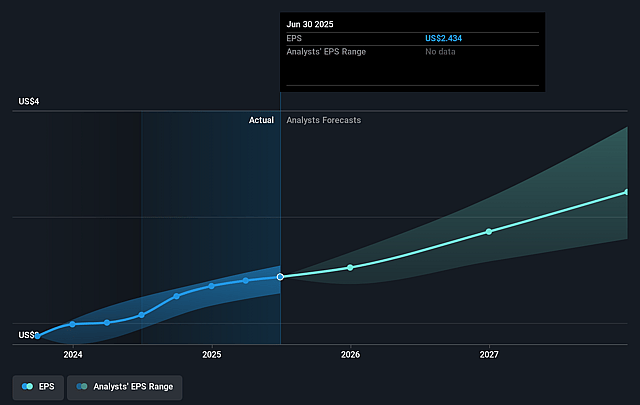

- Analysts expect earnings to reach $1.2 billion (and earnings per share of $3.49) by about August 2028, up from $919.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $1.3 billion in earnings, and the most bearish expecting $1.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.9x on those 2028 earnings, up from 17.8x today. This future PE is lower than the current PE for the US Hospitality industry at 23.1x.

- Analysts expect the number of shares outstanding to decline by 2.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.48%, as per the Simply Wall St company report.

Yum China Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying competition and aggressive discounting on delivery platforms, especially from digital-native and local Chinese QSR brands, could erode market share and limit Yum China's pricing power, resulting in downward pressure on same-store sales growth and net margins.

- The ongoing shift to a higher delivery mix, while expanding sales reach, is structurally increasing rider costs as a percentage of sales, which may compress restaurant margins and limit operating profit growth if labor cost inflation persists.

- Mix shift toward smaller-ticket orders (e.g., beverages, breakfast), and aggressive expansion into lower-tier cities with inherently lower ticket averages, may dilute average check size and restrain top-line revenue growth, even if transaction volumes increase.

- Reduced tailwind from commodity price declines, coupled with rising labor and delivery costs, may result in margin headwinds and create challenges in maintaining value-for-money offerings, limiting potential earnings expansion.

- Reliance on Western core brands (KFC, Pizza Hut) and slower testing or scaling of innovative formats (like Pizza Hut WOW) exposes the company to shifting consumer preferences towards healthier, more local, or niche QSR options, increasing the risk of stagnating same-store sales and impacting long-term revenue and profit stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $58.734 for Yum China Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $76.0, and the most bearish reporting a price target of just $53.1.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $14.0 billion, earnings will come to $1.2 billion, and it would be trading on a PE ratio of 21.9x, assuming you use a discount rate of 9.5%.

- Given the current share price of $44.51, the analyst price target of $58.73 is 24.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.