Key Takeaways

- Strategic investments in marketing and new programs, including HVACR and nursing, are boosting enrollment and future revenue growth.

- Partnerships, like Tesla training, enhance program attractiveness, driving enrollment and revenue, while expanding operating capacity boosts geographic reach and earnings growth.

- Regulatory changes and increased competition, alongside operational challenges, may pressure net margins and impact Universal Technical Institute's revenue and market share.

Catalysts

About Universal Technical Institute- Provides transportation, skilled trades, and healthcare education programs in the United States.

- Universal Technical Institute's (UTI) growth and diversification strategy, including higher investments in marketing and admissions, is expected to continue delivering strong new student start performance, particularly within their Concorde division. This strategic investment is likely to positively impact revenue growth.

- The expansion of UTI's program offerings, including HVACR and launching 10 new cash-pay short course programs across Concorde campuses by 2025, as well as new nursing program initiatives, are set to heighten demand, thereby boosting future revenues.

- Partnerships with industry leaders, such as the recently announced Tesla training collaboration, are anticipated to enhance the attractiveness and relevance of UTI's offerings. These partnerships could increase enrollment and subsequently revenue, while also expanding net margins through premium program offerings.

- UTI's plan to open new campuses, such as a greenfield campus in Atlanta and a co-branded campus with Heartland Dental, further supports revenue growth by increasing operational capacity and expanding geographic reach.

- The ongoing North Star strategic plan emphasizes consistent program and campus expansion, with expectations of subsequent revenue growth and adjusted EBITDA margin improvement to nearly 20% by fiscal 2029. These expansions are geared towards significantly increasing earnings capacity.

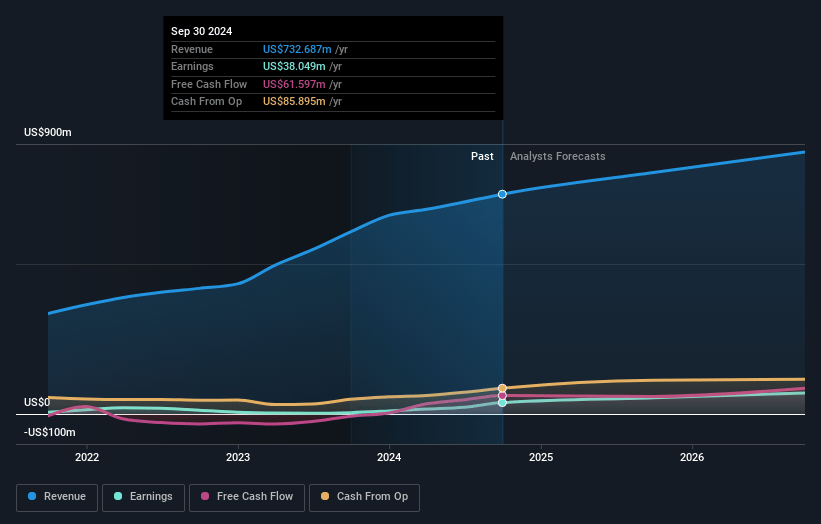

Universal Technical Institute Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Universal Technical Institute's revenue will grow by 8.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 7.1% today to 7.0% in 3 years time.

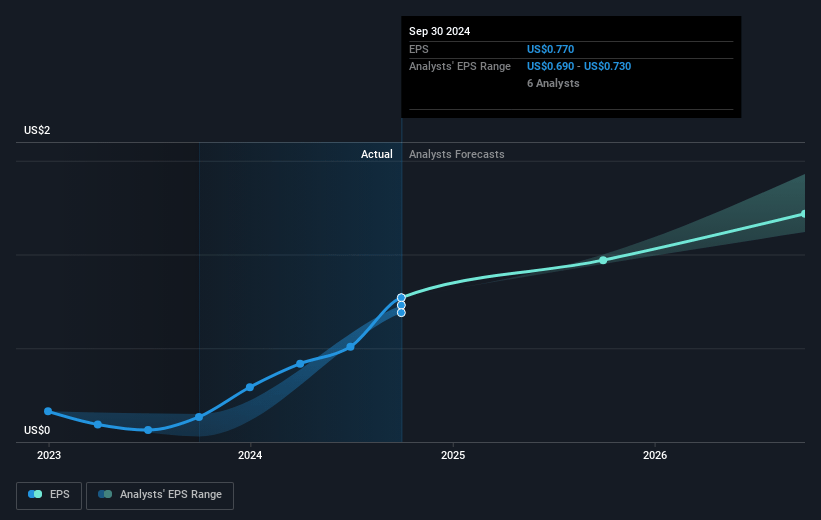

- Analysts expect earnings to reach $68.0 million (and earnings per share of $1.16) by about March 2028, up from $53.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 33.9x on those 2028 earnings, up from 26.6x today. This future PE is greater than the current PE for the US Consumer Services industry at 18.5x.

- Analysts expect the number of shares outstanding to grow by 1.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.04%, as per the Simply Wall St company report.

Universal Technical Institute Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Potential shifts in regulation, particularly if not favorable to the outcomes-based comparison that benefits UTI, could lead to increased operational costs or impact program offerings, affecting both revenue and net margins.

- The temporary increase in revenue from deferred student starts due to FAFSA delays may not be sustainable, which could create variability in revenue growth forecasts.

- Increased strategic initiative investments, particularly as they relate to new campus expansions and program launches, may result in higher than expected operational expenses, pressuring net margins and earnings.

- Increased competition in the education sector, especially for skilled trades and healthcare programs, could potentially limit UTI's ability to maintain its market share, impacting future revenues.

- Operational challenges, such as those highlighted by campus consolidations, could lead to inefficiencies or unexpected costs that might negatively affect net margins and financial stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $33.6 for Universal Technical Institute based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $971.7 million, earnings will come to $68.0 million, and it would be trading on a PE ratio of 33.9x, assuming you use a discount rate of 7.0%.

- Given the current share price of $26.32, the analyst price target of $33.6 is 21.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.