Key Takeaways

- Strong demand from affluent, aging consumers and a focus on unique, premium experiences are driving higher fares, occupancy, and onboard spending growth.

- Fleet modernization, new luxury offerings, and expansion into emerging markets are boosting operational efficiency, margins, and attracting new customer bases.

- Heavy debt and ambitious expansion plans heighten margin pressure amidst overcapacity risks, shifting traveler preferences, and mounting sustainability-related costs.

Catalysts

About Norwegian Cruise Line Holdings- Operates as a cruise company in North America, Europe, the Asia-Pacific, and internationally.

- Norwegian Cruise Line Holdings is positioned to benefit from robust and sustained demand among older consumers and retirees, as the global population ages and wealth among retirees continues to rise. This tailwind supports record high occupancy and increasing average fares, driving revenue growth and supporting bullish long-term projections for top-line expansion.

- The company is capitalizing on a shift in consumer spending toward unique travel experiences and adventure-oriented vacations, which is translating into higher willingness to pay for premium cruises, upgrades, and enhanced onboard experiences, resulting in improved pricing power, greater onboard spend, and expanding net yields.

- Significant investments in next-generation, fuel-efficient ships and a disciplined fleet modernization program are enabling the company to reduce operating costs while delivering elevated guest experiences. This operational efficiency is driving margin expansion and supports higher long-term earnings growth.

- The strategic build-out of the luxury and premium cruise segments, as evidenced by the debut of vessels like Norwegian Aqua and Oceania’s Allura, is elevating average ticket prices while drawing new affluent customer segments. This enhances both revenue per passenger and overall profitability.

- Expansion into emerging markets and upgrades to exclusive destinations such as Great Stirrup Cay are unlocking untapped customer bases and enabling longer, more diverse itineraries. As NCLH broadens its market reach and increases deployment in high-growth regions, it is set to boost passenger volumes, capture premium pricing, and sustain elevated revenue growth in coming years.

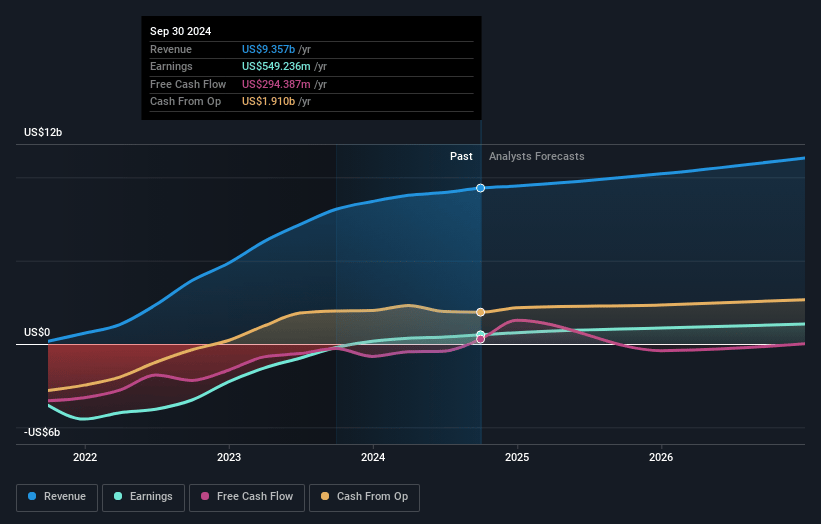

Norwegian Cruise Line Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Norwegian Cruise Line Holdings compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Norwegian Cruise Line Holdings's revenue will grow by 9.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 9.6% today to 12.0% in 3 years time.

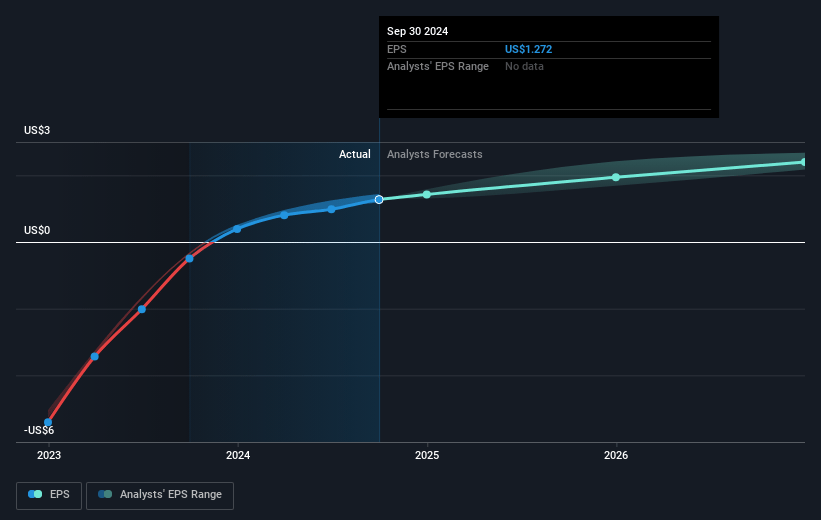

- The bullish analysts expect earnings to reach $1.5 billion (and earnings per share of $2.89) by about April 2028, up from $910.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 16.5x on those 2028 earnings, up from 8.1x today. This future PE is lower than the current PE for the US Hospitality industry at 22.4x.

- Analysts expect the number of shares outstanding to grow by 2.54% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.41%, as per the Simply Wall St company report.

Norwegian Cruise Line Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Norwegian Cruise Line Holdings continues to operate with a high level of debt, and although the company emphasizes deleveraging, the ongoing large capital expenditures for new ship orders and private island investments may keep net margins and earnings under pressure, particularly if market conditions soften.

- The cruise industry is facing increasing global regulation and consumer expectation regarding sustainability and emissions, and while Norwegian highlights incremental progress on biofuels and shore power, compliance with future, more ambitious decarbonization targets will likely require substantial investment, raising operating costs and impacting profitability.

- Shifting demographics, including an aging global population and younger travelers increasingly prioritizing eco-friendly and unique land-based experiences over traditional cruising, raise the risk of a gradual long-term decline in cruise demand, potentially reducing occupancy rates and revenue growth.

- The company’s strategy remains heavily reliant on premium and luxury segments, and management acknowledges some softness in the booking pace for these brands, which could leave Norwegian exposed to revenue declines and occupancy risk in economic downturns when discretionary travel spending weakens.

- Industry overcapacity remains an ongoing threat, as not only is Norwegian aggressively expanding its own fleet, but its competitors are as well, raising the risk of downward pricing pressure and reduced yields across the sector, which would directly impact revenue and operating margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Norwegian Cruise Line Holdings is $37.62, which represents two standard deviations above the consensus price target of $28.14. This valuation is based on what can be assumed as the expectations of Norwegian Cruise Line Holdings's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $38.0, and the most bearish reporting a price target of just $18.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $12.5 billion, earnings will come to $1.5 billion, and it would be trading on a PE ratio of 16.5x, assuming you use a discount rate of 11.4%.

- Given the current share price of $16.61, the bullish analyst price target of $37.62 is 55.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NYSE:NCLH. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.