Narratives are currently in beta

Key Takeaways

- Menu innovations and value offerings aim to increase sales and market share among price-sensitive consumers.

- Strategic digital investments and operational efficiencies focus on sustaining growth and enhancing net margins.

- Rising costs, competition, and consumer trends could hurt McDonald's brand, revenues, margins, and growth in both domestic and international markets.

Catalysts

About McDonald's- Operates and franchises restaurants under the McDonald’s brand in the United States and internationally.

- McDonald's focus on enhancing its value offerings, such as the $5 Meal Deal and branded value platforms like McSmart and Saver, is aimed at driving traffic and gaining market share, particularly among price-sensitive consumers. This is likely to positively impact revenue by increasing guest counts and sales.

- The introduction of new menu innovations such as the Chicken Big Mac and expansion of the McCrispy chicken sandwich across more markets is expected to drive menu excitement and increase average check size, ultimately boosting earnings.

- Efforts to improve operational efficiencies through initiatives like Ready on Arrival (ROA) technology are expected to reduce wait times and enhance customer satisfaction, potentially improving net margins.

- The expansion of McDonald's global loyalty program, with a target of 250 million active users by 2027, aims to increase customer visit frequency and spending, positively impacting revenue growth.

- Continued investment in strategic transformations and digital initiatives, along with disciplined cost control, is intended to sustain long-term growth and efficiency, potentially supporting improved net margins and earnings.

McDonald's Future Earnings and Revenue Growth

Assumptions

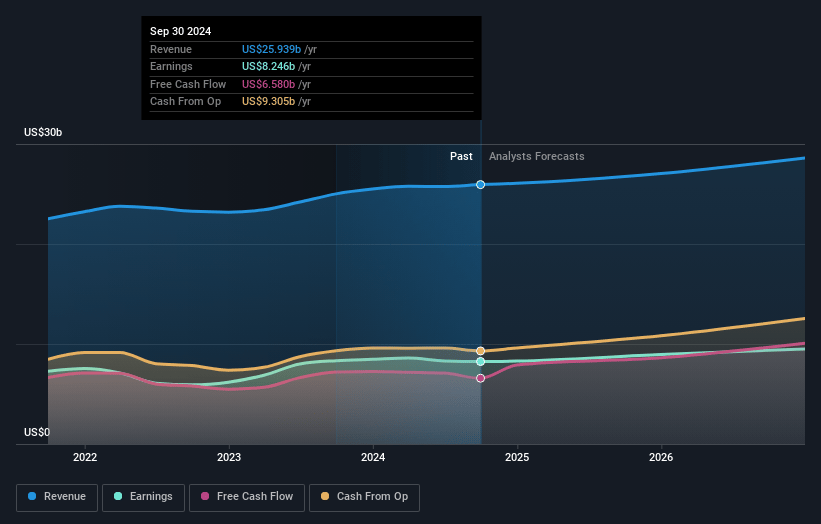

How have these above catalysts been quantified?- Analysts are assuming McDonald's's revenue will grow by 4.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 31.8% today to 33.5% in 3 years time.

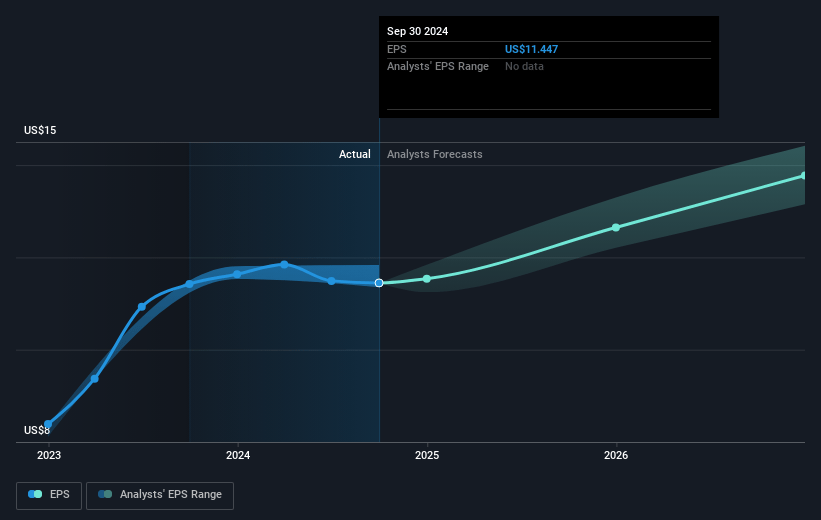

- Analysts expect earnings to reach $9.9 billion (and earnings per share of $14.57) by about November 2027, up from $8.2 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 27.7x on those 2027 earnings, up from 25.4x today. This future PE is greater than the current PE for the US Hospitality industry at 24.4x.

- Analysts expect the number of shares outstanding to decline by 1.65% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.88%, as per the Simply Wall St company report.

McDonald's Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The recent E.coli cases linked to slivered onions could damage McDonald's brand reputation and customer trust, potentially affecting future revenues and market share.

- The QSR industry slowdown, with pressured industry traffic and a trend of low-income consumers eating at home more often, could negatively impact McDonald's revenue growth and guest counts.

- Increased competition in value offerings from competitors has shrunk McDonald's value leadership gap, which may pressure pricing power and impact net margins.

- Economic challenges in international markets, with some markets seeing deteriorating consumer sentiment and contracting QSR industry, could impact international revenue growth and overall earnings.

- Rising costs, including mid-single-digit wage pressure and low single-digit commodity increases, could squeeze operating margins, especially if pricing actions are limited due to consumer resistance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $321.51 for McDonald's based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $360.0, and the most bearish reporting a price target of just $280.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $29.6 billion, earnings will come to $9.9 billion, and it would be trading on a PE ratio of 27.7x, assuming you use a discount rate of 7.9%.

- Given the current share price of $292.63, the analyst's price target of $321.51 is 9.0% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives