Narratives are currently in beta

Key Takeaways

- Expansion efforts in Macao and Singapore are expected to boost revenue and earnings through project completions and enhanced gaming capacity.

- A strong capital return program indicates a commitment to increasing EPS and shareholder value as financial performance improves.

- Economic uncertainties and renovations could suppress earnings, while regulatory changes and investments may strain financial resources and alter strategic priorities.

Catalysts

About Las Vegas Sands- Develops, owns, and operates integrated resorts in Macao and Singapore.

- The continued growth in the Macao market, particularly in mass gaming revenue, along with confidence in the Chinese economy's future growth, positions Las Vegas Sands to increase its revenue and market share in gross gaming revenues over time.

- The completion of The Londoner project in Macao by 2025, including the introduction of additional suites and casino features, is expected to boost EBITDA growth and expand margins as disruption decreases and visitor numbers increase.

- The ongoing investment and upcoming completion of upgrades at Marina Bay Sands in Singapore, including refurbishment and adding services, are anticipated to drive higher revenue and EBITDA by enhancing the appeal for high-value tourism and events.

- The company's substantial investment in new facilities at Marina Bay Sands, as part of the IR2 project, indicates significant anticipated revenue growth and expanded gaming capacity that could further increase earnings.

- The company's capital return program, including stock repurchases and increased dividends, suggests a focus on increasing earnings per share (EPS) and delivering greater shareholder value as financial performance improves.

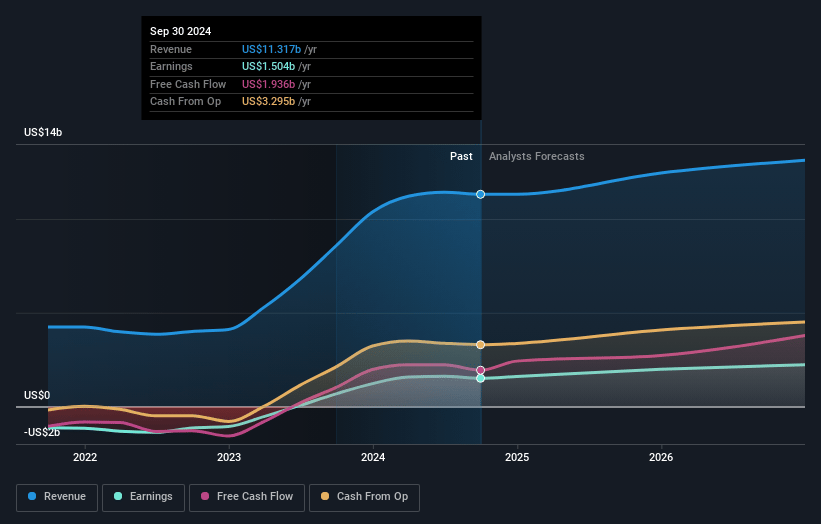

Las Vegas Sands Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Las Vegas Sands's revenue will grow by 6.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 13.3% today to 18.6% in 3 years time.

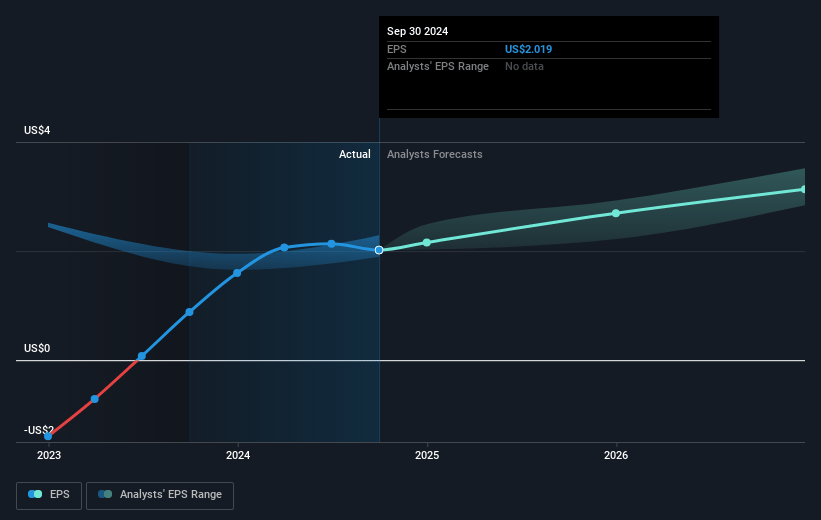

- Analysts expect earnings to reach $2.5 billion (and earnings per share of $3.65) by about November 2027, up from $1.5 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.3x on those 2027 earnings, down from 23.9x today. This future PE is lower than the current PE for the US Hospitality industry at 24.4x.

- Analysts expect the number of shares outstanding to decline by 1.7% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.27%, as per the Simply Wall St company report.

Las Vegas Sands Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The Chinese economy faces uncertainties, and despite resilience in Macao, a significant economic downturn could negatively impact consumer spending, impacting revenue growth projections.

- Disruptions due to ongoing renovations at key properties like the Londoner and Marina Bay Sands are currently affecting margins and might continue to suppress earnings if timelines extend or consumer responses are tepid post-renovation.

- The Macao gaming market, while showing growth, is still experiencing slower recovery in the base mass gaming segment, which could delay achieving full revenue potential and optimal EBITDA margins.

- The increased scope and investment required for projects like Marina Bay Sands IR2 and other capital projects may strain financial resources and impact return on investment, especially if market conditions change or projected revenue growth does not materialize.

- Competition and potential regulatory changes in international markets, such as potential online gambling expansion, could affect future revenue streams and necessitate strategic shifts that might not align with current investment plans.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $58.44 for Las Vegas Sands based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $65.0, and the most bearish reporting a price target of just $50.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $13.5 billion, earnings will come to $2.5 billion, and it would be trading on a PE ratio of 20.3x, assuming you use a discount rate of 8.3%.

- Given the current share price of $49.53, the analyst's price target of $58.44 is 15.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives