Key Takeaways

- Leadership in global lottery and digital gaming enables expansion amid regulatory shifts and digital adoption, supporting steady long-term growth and recurring high-margin revenue streams.

- Ongoing innovation, long-term contracts, and structural cost reductions enhance operational efficiency, positioning the company for stronger earnings and improved cash flow.

- Narrowing focus on legacy lottery exposes IGT to regulatory, competitive, and technological risks, threatening revenue growth, margins, and market relevance as consumer preferences evolve.

Catalysts

About International Game Technology- Provides lottery solutions in the United States, Italy, rest of Europe, and internationally.

- IGT's exclusive focus on its global lottery business leverages its industry leadership, positioning the company to capitalize on the ongoing expansion and liberalization of gambling regulations, particularly in Europe and emerging markets—this significantly enlarges the total addressable market and supports sustained long-term revenue and earnings growth.

- The rapid growth of iLottery sales—up 28% year-over-year and representing broad-based momentum across multiple jurisdictions—demonstrates IGT's ability to benefit from increasing digital engagement in gaming. As digital and cashless transactions proliferate globally, the company’s robust iLottery platform and cloud integration should drive higher transaction volumes and recurring high-margin service revenue.

- Continuous investment in innovation, including proprietary technology such as Infinity print technology for instant tickets and state-of-the-art print facilities, enhances IGT’s ability to win new and extended contracts and up-sell to existing clients. This is expected to increase production volumes, improve operational efficiency, and drive both revenue growth and margin expansion over time.

- A strong track record of multi-year and decade-long contract wins and renewals—such as new 7

- to 10-year agreements in Colorado, Luxembourg, North Carolina, Mississippi, and Virginia—ensures long-term revenue visibility and supports high-margin recurring cash flows, which in turn should generate durable free cash flow and underpin improved net margins.

- Structural cost reduction initiatives, including the OPtiMa 3.0 program and business model simplification after divesting non-core assets, are poised to enhance earnings power by driving operational efficiencies, enabling further investment in technology, and supporting stronger net margins as the business benefits from scale and industry consolidation.

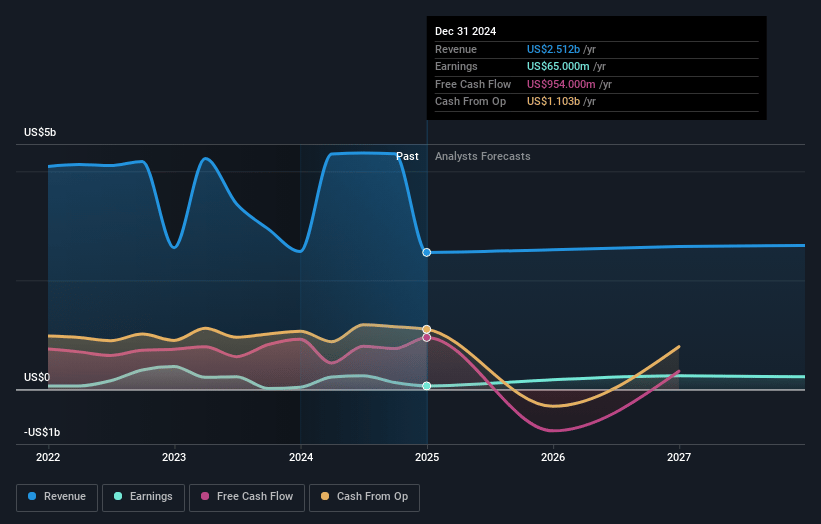

International Game Technology Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on International Game Technology compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming International Game Technology's revenue will grow by 2.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 2.6% today to 9.8% in 3 years time.

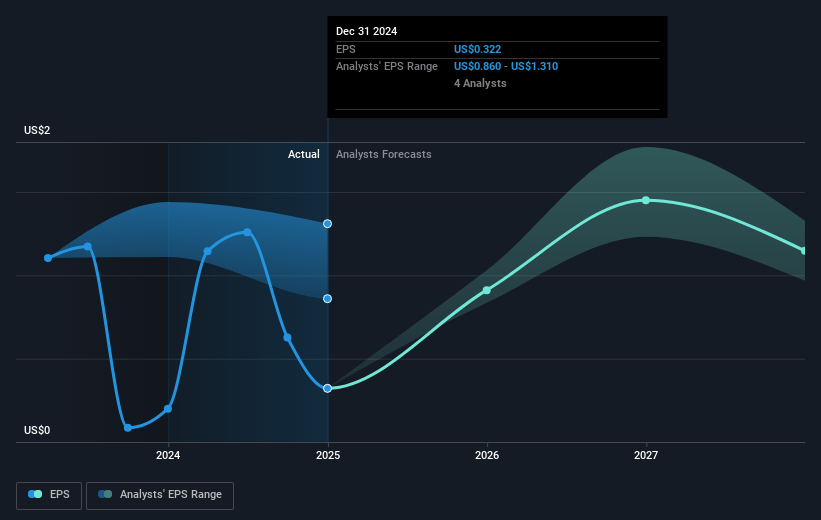

- The bullish analysts expect earnings to reach $265.7 million (and earnings per share of $1.3) by about April 2028, up from $65.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 33.9x on those 2028 earnings, down from 50.9x today. This future PE is greater than the current PE for the US Hospitality industry at 22.2x.

- Analysts expect the number of shares outstanding to grow by 1.02% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.01%, as per the Simply Wall St company report.

International Game Technology Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- IGT's narrowing focus on the legacy lottery business following the sale of its Gaming and Digital segment increases its exposure to changing consumer preferences and regulatory risks, which could result in long-term stagnating revenues and margin compression as demand for traditional lottery declines.

- Escalating regulatory scrutiny and tightening gambling laws globally—alongside growing anti-gambling sentiment and health initiatives—could further restrict market expansion and lead to reduced demand for IGT’s core products and services, dampening revenue growth and profitability.

- High upfront capital requirements for contract renewals, such as the EUR one billion license fee for the Italy Lotto, combined with elevated annual CapEx in the near term, may constrain IGT’s ability to invest flexibly in digital innovation and could pressure net margins and free cash flow.

- Increased competition from new digital entrants, advances in online and mobile gaming, and shifts toward blockchain-based alternatives threaten to erode IGT’s traditional hardware and point-of-sale revenues, potentially resulting in declining market share and long-term revenue headwinds.

- IGT’s reliance on long-term contracts and concentration in certain large jurisdictions exposes it to the risk of losing major bids or renewals, with potential negative implications for future revenues and earnings; consolidation among major lottery and gaming operators could also drive increased bargaining power on the customer side, pressuring supplier margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for International Game Technology is $30.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of International Game Technology's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $30.0, and the most bearish reporting a price target of just $18.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $2.7 billion, earnings will come to $265.7 million, and it would be trading on a PE ratio of 33.9x, assuming you use a discount rate of 13.0%.

- Given the current share price of $16.37, the bullish analyst price target of $30.0 is 45.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NYSE:IGT. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives