Narratives are currently in beta

Key Takeaways

- Strategic acquisitions and expansion plans are likely to drive future revenue growth and improve margins through operational improvements.

- Enhanced food and beverage offerings and data-driven operations are expected to increase customer spending and control costs, boosting net margins.

- The company's aggressive acquisition strategy and increased financial leverage pose risks to earnings stability and flexibility amid economic and environmental challenges.

Catalysts

About Bowlero- Operates location-based entertainment business under the AMF, Bowlero, and Lucky Strike brand names.

- Strategic acquisitions such as Raging Waves and Boomers are expected to drive future revenue growth and EBITDA expansion through operational improvements and capital deployment. These initiatives are likely to enhance earnings as the company intends to leverage its procurement and labor models.

- New build and expansion plans, including new Lucky Strike locations, are projected to contribute significantly to future revenue by increasing the company's market presence and capitalizing on attractive demographics. This expansion can drive revenue growth and potential margin improvements as the new locations mature.

- Increased focus on the food and beverage segment, with improved menus and mobile ordering, is expected to enhance revenue and net margins through higher per capita spend across Bowlero’s locations by increasing customer spend beyond the core bowling activities.

- The implementation of data-driven decision-making and the hiring of a Chief Procurement Officer are anticipated to increase operational efficiencies and control costs, which could positively impact net margins and support EBITDA growth moving forward.

- Bowlero’s continued strategy to capitalize on M&A opportunities to acquire undervalued assets at attractive multiples is expected to contribute to revenue growth, margin expansion, and ultimately earnings growth as the company integrates its operational best practices and enhances asset performance.

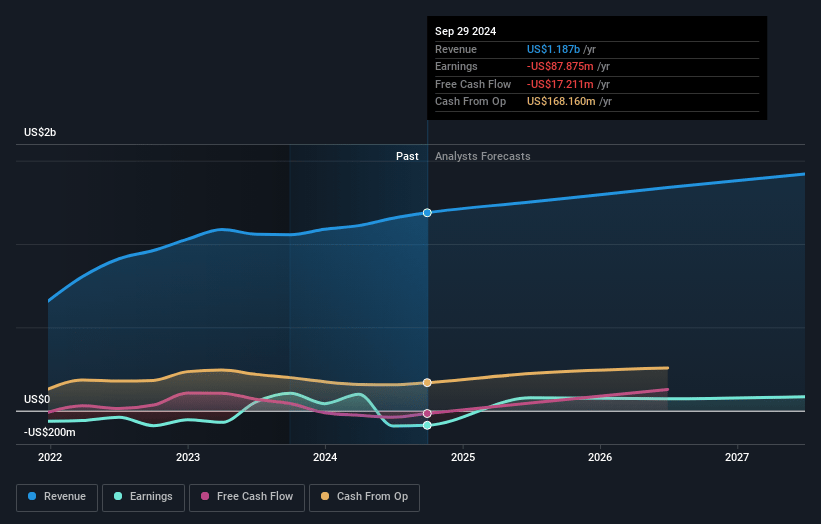

Bowlero Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Bowlero's revenue will grow by 6.8% annually over the next 3 years.

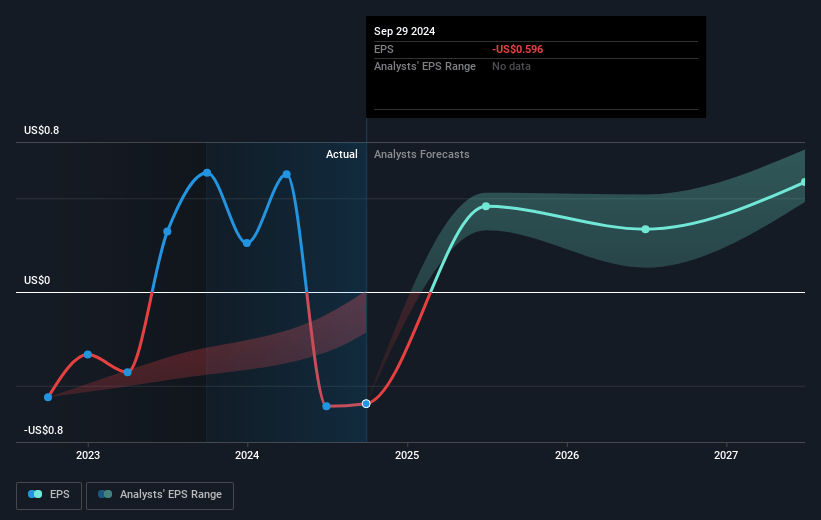

- Analysts assume that profit margins will increase from -7.4% today to 6.3% in 3 years time.

- Analysts expect earnings to reach $91.5 million (and earnings per share of $0.61) by about November 2027, up from $-87.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 38.8x on those 2027 earnings, up from -19.2x today. This future PE is greater than the current PE for the US Hospitality industry at 24.4x.

- Analysts expect the number of shares outstanding to grow by 0.83% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.86%, as per the Simply Wall St company report.

Bowlero Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's reliance on acquisitions for growth, such as Raging Waves and Boomers, carries execution risks. Mismanagement of these acquisitions or failure to realize expected synergies could negatively impact net margins and earnings.

- The seasonal nature of certain acquisitions, like water parks, introduces potential volatility in revenue and EBITDA, particularly in off-season periods, which may affect overall earnings stability.

- Increased net debt to $1.1 billion raises concerns about financial leverage, potentially impacting net margins and limiting future capital allocation flexibility, including investments or buybacks.

- Adverse weather events significantly affect same-store sales and comps, as seen in the impact of hurricanes, posing risks to consistent revenue generation and profitability.

- Pressure from inflation, especially in food costs, remains a headwind. Inability to manage or mitigate these costs could squeeze margins, affecting net earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $17.35 for Bowlero based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $29.0, and the most bearish reporting a price target of just $12.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $1.4 billion, earnings will come to $91.5 million, and it would be trading on a PE ratio of 38.8x, assuming you use a discount rate of 10.9%.

- Given the current share price of $11.48, the analyst's price target of $17.35 is 33.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives