Key Takeaways

- The combination therapy approach and clinical advancements are set to drive increased revenue and expand market share in obesity and related treatments.

- Restructuring efforts and strategic plans, including a move to B2B2C models, aim to boost efficiency, margins, and earnings moving forward.

- Regulatory dependence and operational restructuring may hinder growth, with revenue impacted by external factors, requiring strategic adaptation to mitigate risks and bolster expansion efforts.

Catalysts

About Allurion Technologies- Focuses on ending obesity with a weight loss platform to treat people who are overweight.

- The combination therapy approach, pairing the Allurion Balloon with low-dose GLP-1s, is expected to become a new standard of care in obesity management. This synergy could drive increased procedure volumes and revenue growth by offering effective, metabolically healthy weight loss solutions.

- Advancements in clinical trials, such as better weight loss and adherence results when using a combo of Allurion Balloon with low-dose GLP-1s, could lead to influential shifts in type 2 diabetes, hypertension treatments, and market positioning, likely expanding revenue and market share.

- The restructuring efforts and a new commercial plan focusing on B2B2C sales models aim to increase efficiency and operating margins, which could enhance earnings in 2025 and beyond.

- The expected FDA approval for launching the Allurion Balloon in the U.S. market in 2026 could unlock a significant revenue stream, given the high prevalence of obesity and heightened market readiness.

- Plans for reducing operating expenses by approximately 50% in 2025, while maintaining sales expansion and increasing sales team sizes, are designed to better position the company for growth and attaining profitability, positively affecting net earnings and margins.

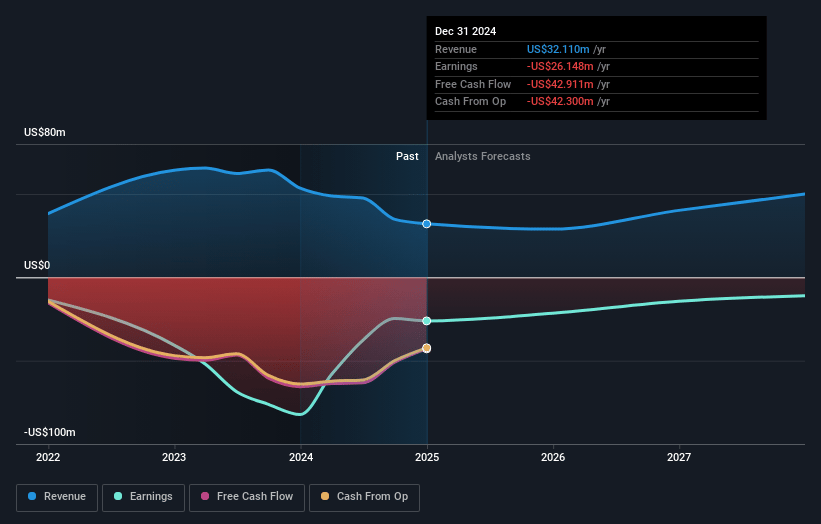

Allurion Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Allurion Technologies's revenue will grow by 15.9% annually over the next 3 years.

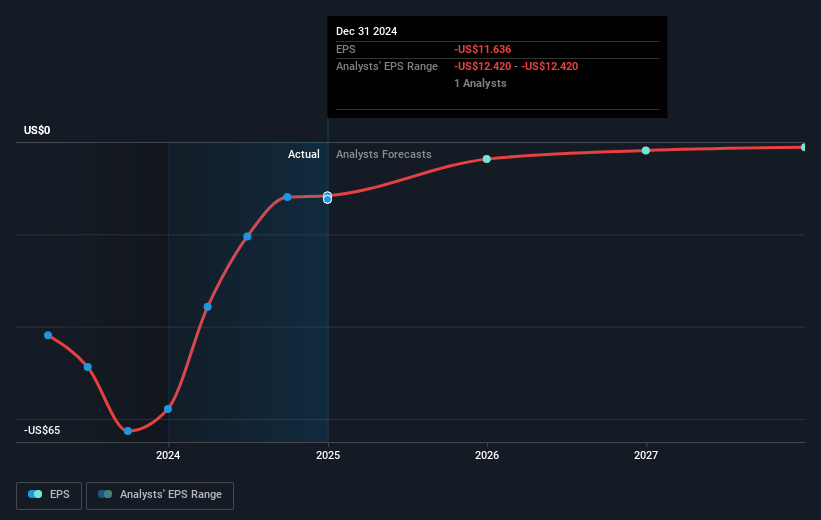

- Analysts are not forecasting that Allurion Technologies will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Allurion Technologies's profit margin will increase from -81.4% to the average US Consumer Services industry of 11.0% in 3 years.

- If Allurion Technologies's profit margin were to converge on the industry average, you could expect earnings to reach $5.5 million (and earnings per share of $0.79) by about May 2028, up from $-26.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.7x on those 2028 earnings, up from -0.5x today. This future PE is lower than the current PE for the US Consumer Services industry at 20.0x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.41%, as per the Simply Wall St company report.

Allurion Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The decrease in revenue from $8.2 million in Q4 2023 to $5.6 million in Q4 2024 due to the temporary suspension of sales in France and macroeconomic headwinds in some markets could continue to impact financial performance negatively. This suggests potential revenue stagnation or decline.

- Operating expenses, while reduced, indicate a focus on restructuring which may hinder short-term growth initiatives and put pressure on the company's ability to achieve its profitability goals promptly, impacting net margins and future earnings.

- The reliance on obtaining FDA approval for the Allurion Balloon as a key growth driver in the U.S. market introduces regulatory risk. Any delays or setbacks could significantly impact Allurion's anticipated revenue and market expansion plans.

- The transition to a B2B2C commercial model may have implementation risks, especially since it has only been piloted so far. Any challenges or delays in effectively executing this strategy could negatively impact revenue growth in 2025 and beyond.

- Temporary suspensions or regulatory issues, like those previously encountered in France, highlight the vulnerability to external regulatory environments which can cause fluctuations in revenues and incur additional compliance costs, affecting net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $10.625 for Allurion Technologies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $18.0, and the most bearish reporting a price target of just $2.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $49.9 million, earnings will come to $5.5 million, and it would be trading on a PE ratio of 18.7x, assuming you use a discount rate of 11.4%.

- Given the current share price of $2.38, the analyst price target of $10.62 is 77.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.