Last Update 23 Apr 25

Key Takeaways

- Expansion into new club locations and focus on nightclubs is expected to drive revenue and earnings through market maturity and strategic acquisitions.

- Capital allocation and asset divestment strategies aim to enhance shareholder value and operational efficiency, boosting free cash flow and optimizing margins.

- Challenges with underperforming segments, rising expenses, acquisition uncertainties, and financial risks could strain revenue growth, cash flow, and net income.

Catalysts

About RCI Hospitality Holdings- Through its subsidiaries, engages in the hospitality and related businesses in the United States.

- The planned development and opening of new locations, such as clubs in El Paso, Lubbock, Rowlett, Central City, and Baby Dolls Fort Worth, are expected to provide significant revenue contributions as these establishments open and mature in their markets. This expansion is likely to drive future revenue growth.

- The ongoing focus on the core Nightclubs business with an emphasis on increasing same-store sales and strategic acquisitions is expected to lead to overall revenue and earnings growth by enhancing profitability and expanding the business footprint.

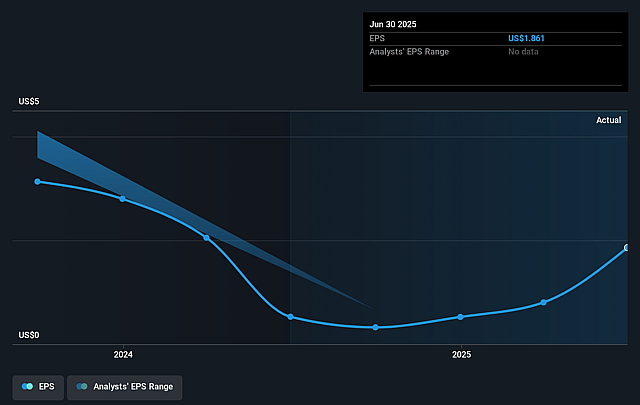

- The capital allocation strategy, which emphasizes share buybacks and dividends, aims to grow free cash flow per share by 10% to 15% annually. This strategy is likely to improve earnings per share (EPS) and overall shareholder value, particularly if executed during periods of undervaluation.

- The divestment of non-income-producing assets estimated between $23 million and $28 million provides an opportunity to release capital, which can be reinvested in higher-yielding acquisitions or returned to shareholders, potentially increasing future free cash flow and net income.

- The strategic acquisition of the Flight Club in Detroit, alongside efforts to streamline underperforming Bombshells locations, is expected to optimize operational efficiency and margins, which could positively impact EBITDA and net margins over time.

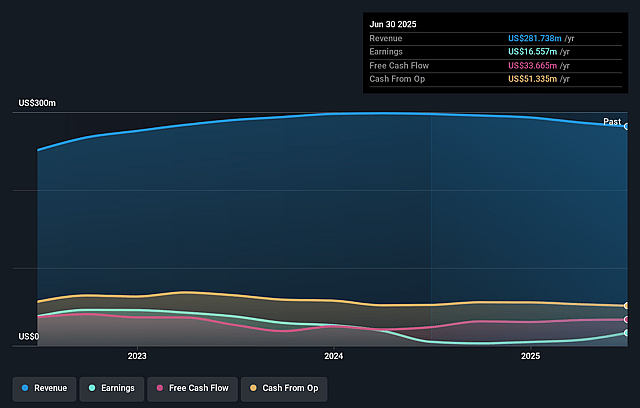

RCI Hospitality Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming RCI Hospitality Holdings's revenue will grow by 5.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.6% today to 39.2% in 3 years time.

- Analysts expect earnings to reach $136.2 million (and earnings per share of $16.43) by about April 2028, up from $4.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 6.6x on those 2028 earnings, down from 72.6x today. This future PE is lower than the current PE for the US Hospitality industry at 22.4x.

- Analysts expect the number of shares outstanding to decline by 4.91% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.59%, as per the Simply Wall St company report.

RCI Hospitality Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The closure and sale of underperforming Bombshells locations highlight potential challenges in that segment, affecting overall revenue and indicating difficulties in achieving same-store sales growth targets.

- Increased corporate expenses due to setting up a self-insurance reserve reflect rising operational costs, which could strain net margins and dampen earnings growth.

- The Detroit club acquisition's uncertain EBITDA improvement potential amid adverse weather conditions suggests potential volatility in expected revenue and profit contributions from new acquisitions.

- The reliance on aggressive capital allocation, including significant share buybacks and debt repayments, might strain cash flow if revenue targets are not met, impacting free cash flow and earnings per share growth.

- The potential lawsuits and liabilities associated with the closure of certain Bombshells locations pose financial risks that may negatively impact net income if regulatory outcomes are unfavorable.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $98.0 for RCI Hospitality Holdings based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $347.7 million, earnings will come to $136.2 million, and it would be trading on a PE ratio of 6.6x, assuming you use a discount rate of 9.6%.

- Given the current share price of $39.37, the analyst price target of $98.0 is 59.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on RCI Hospitality Holdings?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.