Key Takeaways

- Strategic tech partnerships and AI-driven offerings position Sabre as a leading travel aggregator, enhancing efficiency and supporting higher-margin, recurring SaaS revenue streams.

- Divestment of non-core assets and debt reduction boost financial health, enabling reinvestment in product innovation and supporting durable, diversified earnings growth.

- Heavy reliance on core B2B segments, weak transaction volumes, and high leverage expose Sabre to significant risks if travel demand or contract execution falters.

Catalysts

About Sabre- Operates as a software and technology company for travel industry in the United States, Europe, Asia-Pacific, and internationally.

- Sabre is set to benefit from accelerating implementation of large, multi-year agency contracts and consolidation of new multisource content, which should drive significant transaction volume growth in air and hotel bookings throughout 2025 and into 2026—positively impacting revenue and overall market share.

- The company's strategic technology partnership with Google and continued investments in AI-powered, cloud-native offerings (e.g., SabreMosaic) position it to capture demand from travel providers seeking efficiency and next-gen retailing solutions, supporting higher-margin SaaS revenue and long-term earnings expansion.

- The successful sale of Hospitality Solutions and the subsequent rapid paydown of debt meaningfully improves Sabre’s credit profile, reduces net leverage by nearly a full turn, cuts annual interest expense by $55–65 million, and enhances free cash flow—enabling reinvestment in product innovation and margin accretive initiatives.

- Growing complexity and fragmentation across travel distribution channels, paired with Sabre’s leadership in NDC and low-cost carrier integrations, reinforces Sabre's role as an essential aggregator, supporting both revenue durability and incremental high-growth B2B booking streams.

- Strong momentum in Sabre’s fast-growing digital payments business and hotel B2B distribution—which posted 30% and 7% year-on-year bookings growth, respectively—are unlocking new recurring revenue streams and diversifying the earnings base, with positive effects on net margins and free cash flow.

Sabre Future Earnings and Revenue Growth

Assumptions

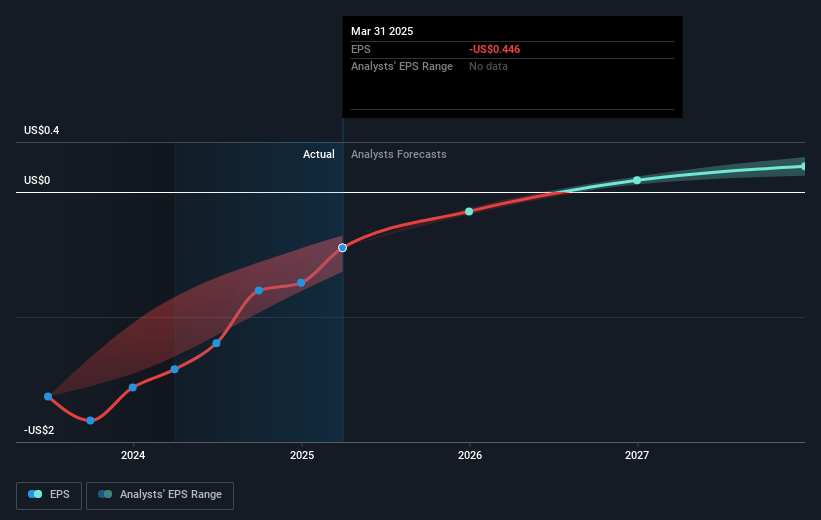

How have these above catalysts been quantified?- Analysts are assuming Sabre's revenue will grow by 3.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from -5.7% today to 2.8% in 3 years time.

- Analysts expect earnings to reach $92.9 million (and earnings per share of $0.35) by about July 2028, up from $-171.9 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $173.7 million in earnings, and the most bearish expecting $26 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 27.5x on those 2028 earnings, up from -7.0x today. This future PE is greater than the current PE for the US Hospitality industry at 23.7x.

- Analysts expect the number of shares outstanding to grow by 0.55% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.6%, as per the Simply Wall St company report.

Sabre Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The sale of Sabre’s Hospitality Solutions business, while reducing debt, also removes approximately $70 million in annual adjusted EBITDA contribution, meaning the company is now more reliant on its airline and hotel B2B distribution segments for growth; any prolonged weakness in air travel or failure to grow these segments could negatively impact future revenue and earnings.

- Broader GDS (Global Distribution System) industry growth is expected to decline by 1–2% for 2025, with Sabre’s bookings also down 3% year-on-year in Q1; this secular softness in core transaction volume, if sustained beyond management expectations, would directly pressure Sabre’s top-line growth and profitability.

- The company is highly dependent on signed (but not yet fully implemented) large agency contracts to drive anticipated double-digit bookings growth in the back half of 2025; any implementation delays, client churn, or failure to execute on these deals would materially impact revenue, margin expansion, and investor confidence.

- Increasing airline capacity constraints, airline traffic softness, and significant pullbacks in government and military travel (down 30% year-over-year in Q1) highlight the risk that macro or sector-specific downturns can more deeply impact Sabre’s transactional revenue model than expected.

- While deleveraging, Sabre will still end 2025 with a high net-debt-to-EBITDA ratio of approximately 5.4x, leaving the company financially vulnerable if interest rates rise, refinancing becomes more difficult, or revenue underperforms—the ongoing high leverage continues to pose a risk to margins and future free cash flow.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $4.662 for Sabre based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $7.0, and the most bearish reporting a price target of just $3.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.3 billion, earnings will come to $92.9 million, and it would be trading on a PE ratio of 27.5x, assuming you use a discount rate of 11.6%.

- Given the current share price of $3.09, the analyst price target of $4.66 is 33.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.