Narratives are currently in beta

Key Takeaways

- Improving demand and renovations in key regions are set to enhance Playa's revenue and earnings through better pricing and occupancy rates.

- Asset sales and share repurchases are aimed at streamlining operations and boosting shareholder value and EPS.

- External disruptions such as hurricanes, travel advisories, and currency volatility pose significant risks to Playa's profitability and future EBITDA growth.

Catalysts

About Playa Hotels & Resorts- Owns, develops, and operates resorts in prime beachfront locations in Mexico and the Caribbean.

- Improving demand in regions such as the Pacific Coast and Jamaica, alongside a strong holiday season, is expected to positively impact Playa's future revenue growth as these markets recover from disruptions.

- The completion of renovations in the Pacific Coast and the planned upgrade of Zilara Cancun by early 2025 are anticipated to bolster future earnings, providing a catalyst for improved pricing and occupancy rates in these high-margin properties.

- Foreign exchange tailwinds, particularly the favorable Mexican peso exchange rate, are projected to positively impact cash flows and reported earnings, boosting EBITDA margins.

- The strategic sale of non-core assets is expected to streamline operations and allow for reinvestment into higher ROI projects, potentially enhancing net margins and overall financial health.

- Significant share repurchases, having already bought back 29% of float since late 2022, are expected to enhance shareholder value and boost earnings per share (EPS) in the longer term.

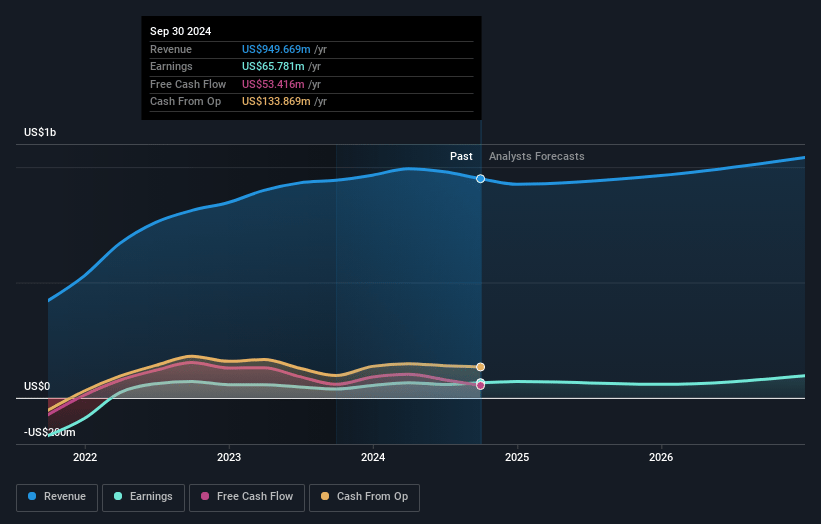

Playa Hotels & Resorts Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Playa Hotels & Resorts's revenue will grow by 3.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.9% today to 8.8% in 3 years time.

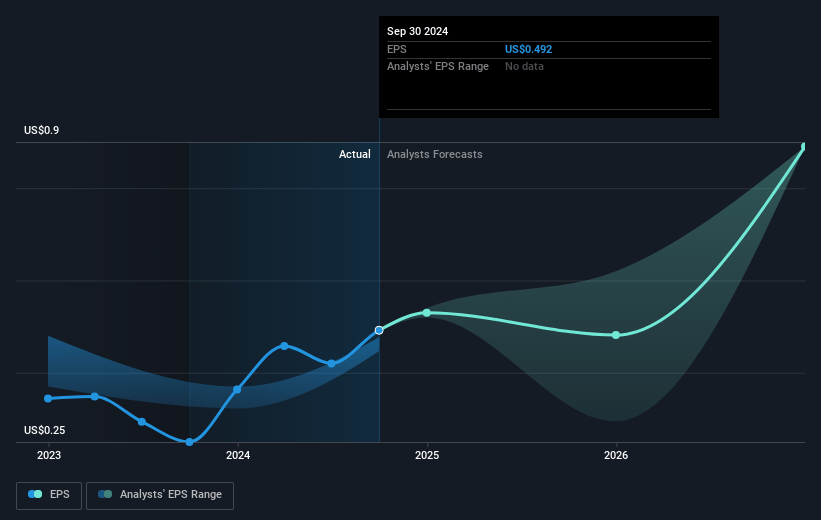

- Analysts expect earnings to reach $93.7 million (and earnings per share of $0.93) by about November 2027, up from $65.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.4x on those 2027 earnings, down from 18.0x today. This future PE is lower than the current PE for the US Hospitality industry at 24.3x.

- Analysts expect the number of shares outstanding to decline by 5.99% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.43%, as per the Simply Wall St company report.

Playa Hotels & Resorts Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The impact of Hurricane Barrel on bookings and renovations led to a 36% decline in underlying owned resort EBITDA growth for the total portfolio in the third quarter, which could continue to affect revenue and net margins if similar disruptions occur in the future.

- Construction disruption in the Pacific Coast and a U.S. State Department Travel Advisory on the Jamaican segment have led to negative EBITDA impacts, potentially influencing future earnings adversely if such issues are not resolved.

- Rebuilding ADR (average daily rate) amidst lower occupancy, particularly in Jamaica, comes at the expense of margins, which could impact overall profitability and earnings if ADRs cannot be increased effectively.

- Exposure to foreign exchange fluctuations, particularly the U.S. dollar-Mexican peso conversion rate, poses a risk to EBITDA and net margins, making financial performance sensitive to currency volatility despite hedging efforts.

- Rising operating costs, including labor and inflation, and the tapering benefits from process improvements, suggest potential headwinds for sustaining net margins and profitability unless offset by revenue growth or additional efficiencies.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $11.0 for Playa Hotels & Resorts based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $14.0, and the most bearish reporting a price target of just $8.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $1.1 billion, earnings will come to $93.7 million, and it would be trading on a PE ratio of 15.4x, assuming you use a discount rate of 9.4%.

- Given the current share price of $9.75, the analyst's price target of $11.0 is 11.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives