Key Takeaways

- Emphasis on back-to-basics strategy and revamped marketing initiatives is poised to boost revenue and enhance customer satisfaction and engagement.

- Innovative games, strategic store developments, and financial optimizations are expected to drive growth and increase shareholder value.

- Leadership transitions and past operational missteps could impact revenue, profitability, and investor confidence, amid economic uncertainties and execution challenges.

Catalysts

About Dave & Buster's Entertainment- Owns and operates entertainment and dining venues for adults and families in North America.

- The leadership's commitment to returning to a back to basics strategy, focusing on proven business models and operations that previously made the company successful, is expected to drive revenue growth and improve net margins through increased customer satisfaction and operational efficiencies.

- Changes in marketing strategies, particularly the reintroduction of TV advertising and successful promotions like the Eat & Play Combo, aim to strengthen brand awareness and customer engagement, supporting revenue growth and potentially boosting earnings through increased foot traffic and sales.

- The introduction of new and innovative games, including The Human Crane and other premium arcade offerings, is anticipated to draw more customers and enhance the entertainment experience, driving revenue growth and same-store sales increases.

- A more measured and strategically prioritized approach to store remodels and new store development, with a focus on high ROI locations and effective capital allocation, is expected to support revenue growth while maintaining disciplined capital expenditures and contributing to free cash flow generation.

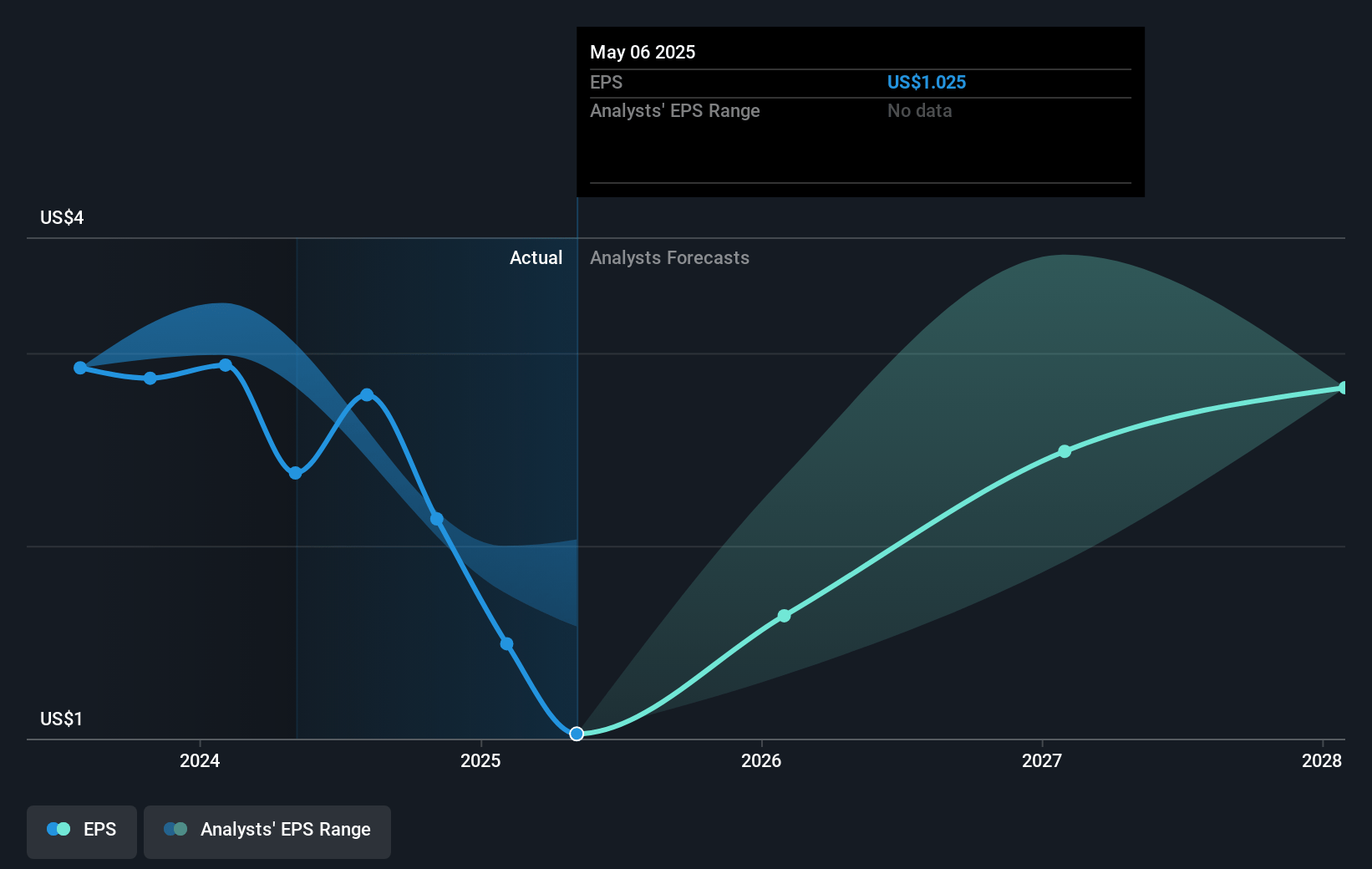

- The continued focus on share repurchases and the optimization of financial resources, including prudent capital spending and leveraging high free cash flow to support shareholder returns, are likely to positively impact earnings per share (EPS) and enhance shareholder value.

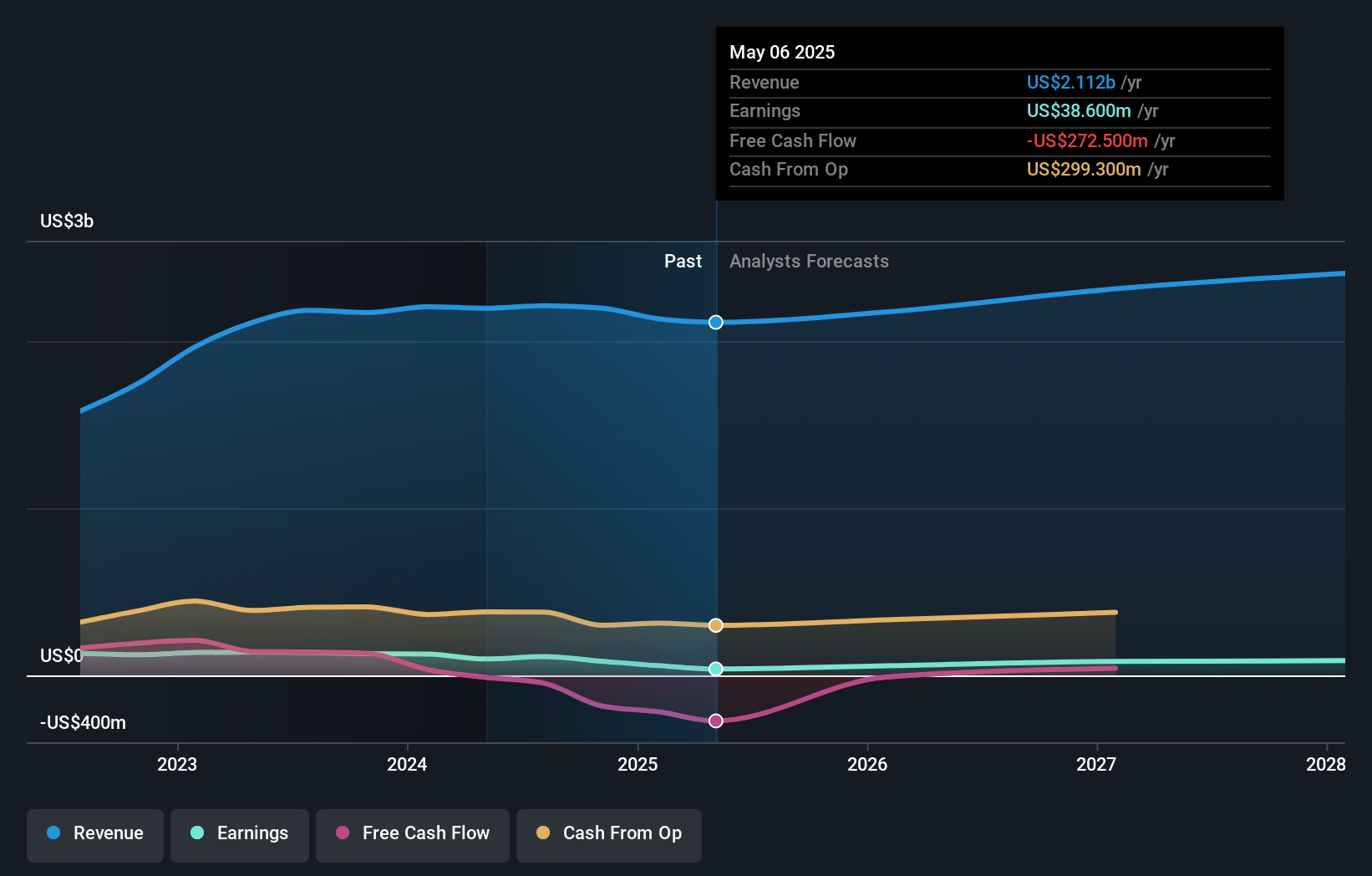

Dave & Buster's Entertainment Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Dave & Buster's Entertainment's revenue will grow by 3.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.7% today to 4.8% in 3 years time.

- Analysts expect earnings to reach $113.0 million (and earnings per share of $2.95) by about April 2028, up from $58.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.2x on those 2028 earnings, down from 10.8x today. This future PE is lower than the current PE for the US Hospitality industry at 22.4x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.41%, as per the Simply Wall St company report.

Dave & Buster's Entertainment Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The previous leadership's significant and ill-advised changes to marketing, operations, and investments have had a negative impact on business performance, which could continue to affect revenues and profit margins if not fully reversed or corrected.

- There was a notable decrease in comparable store sales by 9.4% in Q4, which highlights potential underlying issues with demand or competitive pressures that could persist and negatively impact future revenue and earnings.

- The company's remodel strategy and capital expenditure have faced execution challenges, including spending beyond budget and mixed results, posing a risk to future capital efficiency and return on investment, thereby impacting net margins.

- The leadership transition and ongoing CEO search create uncertainty around future strategic direction and execution, which could potentially unsettle investor confidence and affect the company's stock performance and financial results.

- Economic uncertainties and changes in consumer behavior, particularly among lower-income segments, could affect discretionary spending on entertainment, impacting Dave & Buster's revenue and profit margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $24.714 for Dave & Buster's Entertainment based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $35.0, and the most bearish reporting a price target of just $18.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.4 billion, earnings will come to $113.0 million, and it would be trading on a PE ratio of 8.2x, assuming you use a discount rate of 11.4%.

- Given the current share price of $18.29, the analyst price target of $24.71 is 26.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.