Key Takeaways

- Expanding digital adoption and shifting consumer preferences support long-term growth in bookings, revenues, and market share for MakeMyTrip.

- Product innovation and integration of ancillary services drive improved margins, higher customer retention, and enhanced pricing power against smaller competitors.

- Heavy reliance on the Indian market, persistent high customer acquisition costs, and intensifying competition could constrain profitability and increase exposure to unpredictable demand shocks.

Catalysts

About MakeMyTrip- Operates as a travel service provider in India, the United States, Singapore, Malaysia, Thailand, the United Arab Emirates, Peru, Colombia, Vietnam, Cambodia, and Indonesia.

- Expanding online travel adoption, driven by continued growth in internet and smartphone penetration and increasing comfort with digital bookings-especially in underpenetrated tier-2 and tier-3 cities-is likely to further expand MakeMyTrip's addressable market and support sustained top-line revenue and booking volume growth.

- Rising disposable incomes and a structural shift in consumer preferences towards experiences and frequent travel-including growth in international outbound travel-offer a long runway for increased gross bookings and recurring revenues, as reflected in robust year-on-year growth in both domestic and international segments.

- Ongoing investment in product innovation, particularly in AI-powered personalization and user experience improvements, positions MakeMyTrip for higher conversion rates, better customer retention, and ultimately supports expanding net margins through improved operating leverage.

- Increasing integration of ancillary services (hotels, home stays, experiences, insurance, and ground transport) creates diversified and higher-margin revenue streams, which are showing high double-digit growth and driving improvements in overall net margins and adjusted operating profit.

- Sector formalization and industry consolidation are gradually phasing out smaller competitors, bolstering MakeMyTrip's market share and enhancing pricing power, which is expected to benefit long-term margin expansion and earnings growth as the company capitalizes on scale advantages.

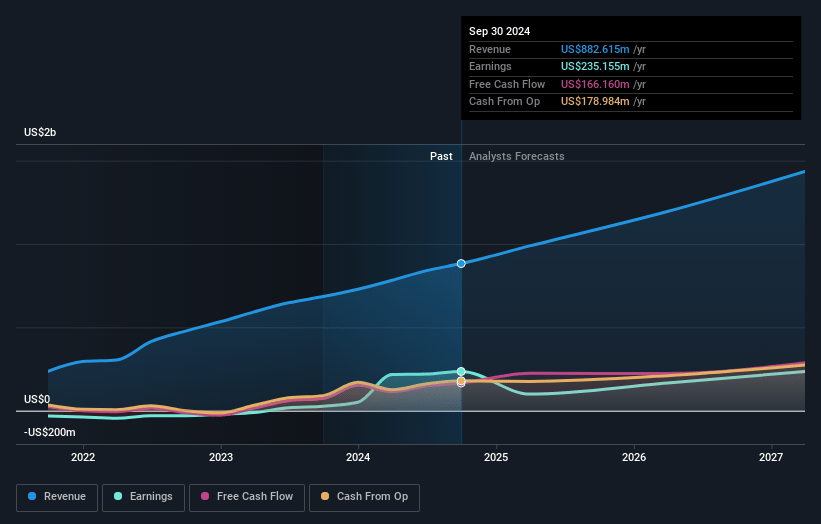

MakeMyTrip Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming MakeMyTrip's revenue will grow by 22.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.1% today to 16.6% in 3 years time.

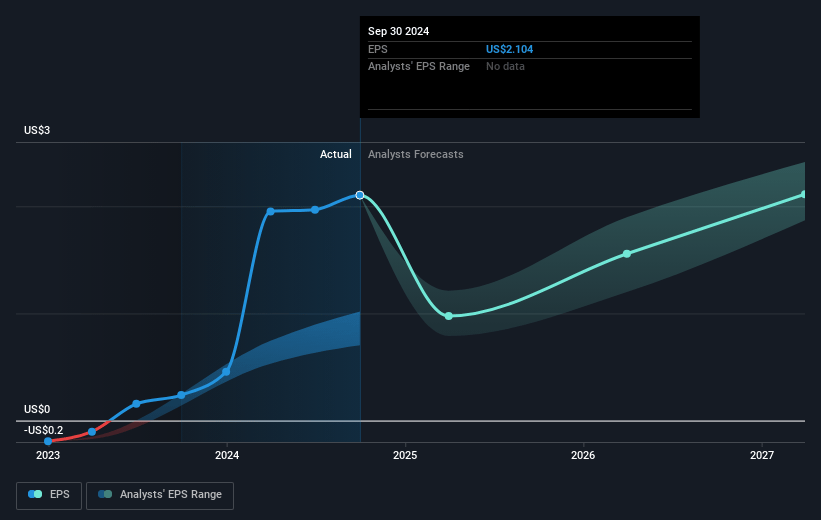

- Analysts expect earnings to reach $306.6 million (and earnings per share of $2.32) by about July 2028, up from $100.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 56.0x on those 2028 earnings, down from 95.5x today. This future PE is greater than the current PE for the US Hospitality industry at 24.5x.

- Analysts expect the number of shares outstanding to grow by 2.75% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.76%, as per the Simply Wall St company report.

MakeMyTrip Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying competition from both established global players (like Booking.com and Agoda in hotels) and aggressive domestic OTAs (such as iXiGO and AbhiBus) could compress MakeMyTrip's market share and take rates, especially as newer entrants seek growth through aggressive pricing and promotions-leading to pressure on revenue and net margins.

- Persistent increases in advertising and promotion (A&P) spending required to support growth and maintain brand awareness-even as repeat customer share increases-suggest that customer acquisition costs may remain structurally high, limiting margin expansion and putting pressure on earnings over the long term.

- The company's still-heavy focus and revenue dependence on India and its near-markets leaves it exposed to regional macroeconomic and geopolitical shocks (such as the recent Pahalgam incident, air crashes, or cross-border tensions), raising risks of demand volatility, revenue shocks, and unpredictable earnings.

- Rising incidence of demand disruptions from geopolitical events, supply-side shocks (such as air safety checks impacting flight availability), or macroeconomic headwinds (like tepid discretionary spending) demonstrate that leisure and holiday travel demand can be highly sensitive and cyclical, limiting predictability of long-term revenue growth.

- Airline and hotel suppliers are continually investing in direct-to-consumer channels and loyalty programs, potentially bypassing OTAs like MakeMyTrip and eroding their negotiating power, take rates, and long-term revenue share from core booking streams.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $119.411 for MakeMyTrip based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.8 billion, earnings will come to $306.6 million, and it would be trading on a PE ratio of 56.0x, assuming you use a discount rate of 11.8%.

- Given the current share price of $100.4, the analyst price target of $119.41 is 15.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.