Narratives are currently in beta

Key Takeaways

- Concerns about sustainable hotel booking growth, geopolitical events, and airline competition could impact revenue across various segments.

- Reliance on AI for customer service introduces uncertainties, while lack of share repurchase raises investor concerns on capital allocation.

- MakeMyTrip's robust revenue growth, driven by strong international demand, macroeconomic trends, and tech innovations, positions it for sustained success and earnings improvement.

Catalysts

About MakeMyTrip- An online travel company, sells travel products and services in India, the United States, Southeast Asia, Europe, and internationally.

- Investors might be cautious about the sustainability of hotel booking growth due to potential impacts from prolonged monsoon and unexpected rainfall, which could lead to concerns about consistent revenue growth in the accommodation segment.

- The company’s further reliance on AI-driven solutions for customer service may introduce uncertainties in cost efficiencies and operating margins, as the long-term impact of these technologies on earnings remains speculative.

- The geopolitical situation and global events impacting travel patterns could pose demand risks to certain international destinations, potentially affecting revenue growth in the international hotels and air ticketing business.

- Concerns about possible future competition from airline direct channels affecting MakeMyTrip's market share in air ticketing could impact revenue and net margins, as the company might need to increase customer acquisition costs or lower prices to maintain market position.

- Despite a robust cash position, the lack of significant share repurchase activity may worry investors about efficient capital allocation and future EPS growth, as the company could explore organic and inorganic opportunities that might not immediately translate into increased shareholder value.

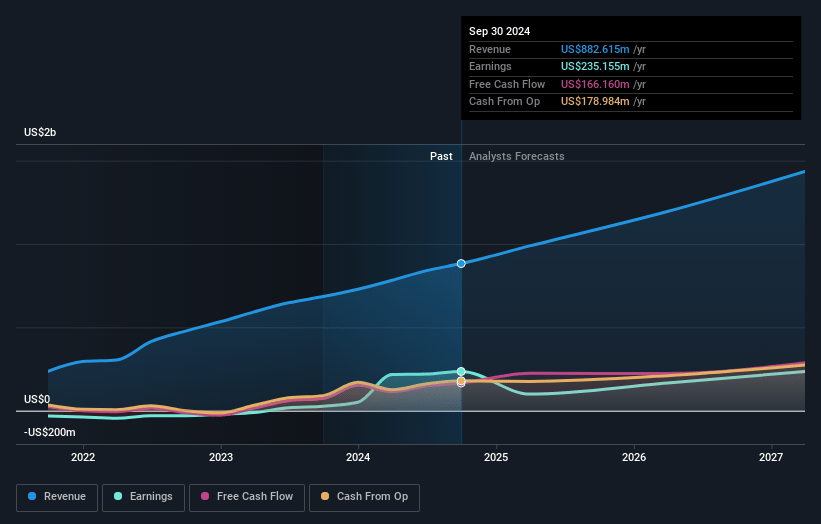

MakeMyTrip Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming MakeMyTrip's revenue will grow by 21.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 26.6% today to 13.7% in 3 years time.

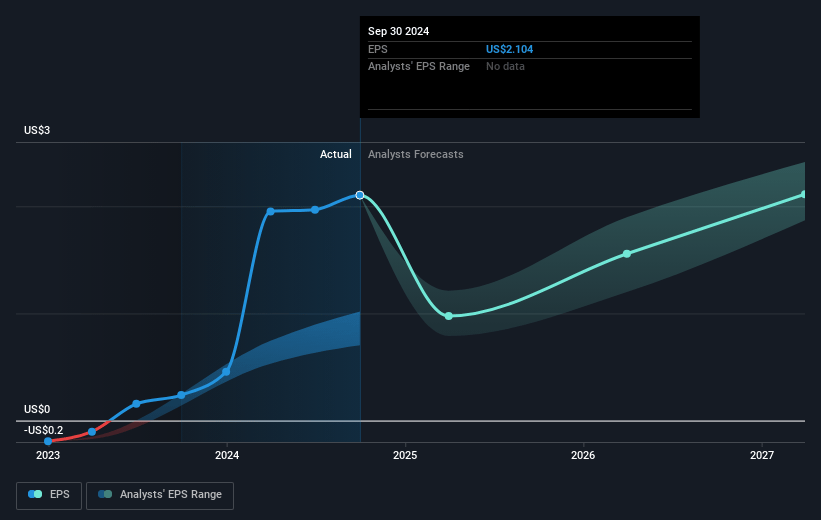

- Analysts expect earnings to reach $216.0 million (and earnings per share of $2.11) by about November 2027, down from $235.2 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $276.2 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 70.5x on those 2027 earnings, up from 48.7x today. This future PE is greater than the current PE for the US Hospitality industry at 24.4x.

- Analysts expect the number of shares outstanding to decline by 2.32% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.34%, as per the Simply Wall St company report.

MakeMyTrip Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- MakeMyTrip has reported strong business results with robust growth in both top line and bottom line, reflecting their ability to drive revenue growth even in challenging environments with a year-on-year growth of 24.3% in gross booking value. This indicates resilience in revenue despite potential threats.

- The company's international air ticketing and international hotel businesses have posted impressive growth, with 39% and 62% year-on-year revenue growth respectively, in constant currency terms. This demonstrates strong demand and execution which could positively impact earnings.

- India's strong economic growth trajectory and increasing discretionary spending, especially in the travel and tourism industry, positions MakeMyTrip to benefit significantly from this macroeconomic trend, promoting increased revenue.

- The expanding digital economy and government initiatives are increasing internet and e-commerce penetration, which MakeMyTrip is capitalizing on, suggesting potential for sustained revenue growth as these trends evolve.

- MakeMyTrip's deployment of AI and data-driven product features, including personalized recommendations and customer experience improvements, has led to productivity gains and helped reduce costs, thereby potentially improving net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $111.11 for MakeMyTrip based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $120.0, and the most bearish reporting a price target of just $74.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $1.6 billion, earnings will come to $216.0 million, and it would be trading on a PE ratio of 70.5x, assuming you use a discount rate of 10.3%.

- Given the current share price of $104.35, the analyst's price target of $111.11 is 6.1% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives