Narratives are currently in beta

Key Takeaways

- The new hybrid teaching model and expanded campus development aim to boost operating efficiency and revenue by capturing untapped demand.

- Strategic partnerships and high-return program expansion align with industry needs, enhancing student value, job placement, and future earnings.

- The rollout of Lincoln 10.0 and investments in new campuses carry risks due to integration challenges, regulatory hurdles, and macroeconomic dependency impacting revenue stability.

Catalysts

About Lincoln Educational Services- Provides various career-oriented post-secondary education services to high school graduates and working adults in the United States.

- Lincoln Educational Services has initiated the rollout of their Lincoln 10.0 hybrid teaching model, which is expected to increase operating efficiencies and potentially improve operating margins as it is expanded to cover more of the student population, including the nursing programs by 2026.

- The new campus development strategy, illustrated by the success of the East Point campus and upcoming Nashville, Philadelphia, and Houston campuses, is anticipated to drive revenue growth by expanding capacity and capturing untapped market demand.

- The company's strategy of replicating high-return programs like HVAC and welding at existing campuses is expected to contribute an additional $1 million each in profitability by the third year of operation, benefiting future earnings.

- Lincoln's continued expansion of corporate partnerships, such as those with Hyundai, Genesis, and Tesla, can enhance revenue by aligning with industry demand and supplementing training at no cost to students, enhancing student value and job placement rates.

- The ongoing interest in skilled trades and alternative educational pathways, driven by societal shifts away from traditional college education, is likely to increase student starts and enrollment, fostering sustained revenue growth.

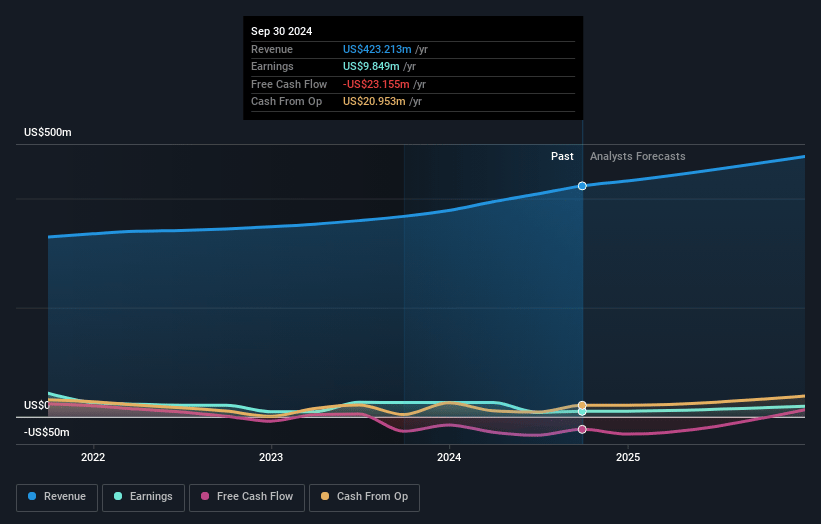

Lincoln Educational Services Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Lincoln Educational Services's revenue will grow by 9.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.3% today to 7.8% in 3 years time.

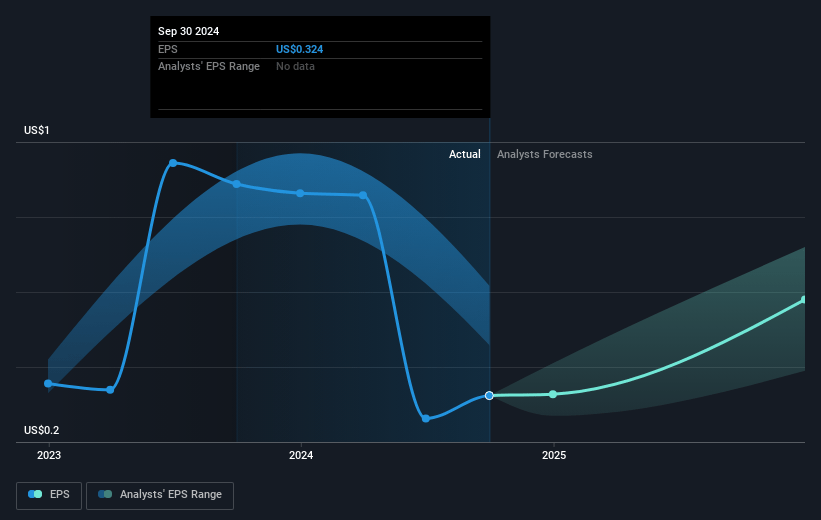

- Analysts expect earnings to reach $43.9 million (and earnings per share of $1.21) by about November 2027, up from $9.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.0x on those 2027 earnings, down from 52.6x today. This future PE is greater than the current PE for the US Consumer Services industry at 19.9x.

- Analysts expect the number of shares outstanding to grow by 4.93% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.81%, as per the Simply Wall St company report.

Lincoln Educational Services Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The implementation of the Lincoln 10.0 hybrid teaching model, while promising, is still in its rollout phase and might face challenges that could affect operational efficiencies and margins if not successfully integrated.

- The significant investment in new campus locations, totaling around $75 million, poses a risk if the expected similar results to the East Point campus do not materialize, potentially impacting future revenue growth and financial stability.

- The regulatory challenges associated with opening new campuses in states like New York might delay expansion plans and increase costs, which can negatively affect revenue projections and net income.

- The divestiture of the Euphoria Institute campus due to underperformance suggests potential instability in non-core programs, which might strain earnings and profitability if similar issues arise in other offerings.

- Although Lincoln has experienced robust student start growth, dependency on macroeconomic conditions like employment rates poses a risk, as any unfavorable changes could reduce enrollments and affect revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $20.0 for Lincoln Educational Services based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $562.1 million, earnings will come to $43.9 million, and it would be trading on a PE ratio of 20.0x, assuming you use a discount rate of 6.8%.

- Given the current share price of $16.46, the analyst's price target of $20.0 is 17.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives