Key Takeaways

- Digital investments and technology modernization are aimed at improving efficiency, customer engagement, and margins for sustained earnings growth.

- Portfolio streamlining and strategic market expansion target higher returns, operational focus, and new customer demographics for long-term revenue stability.

- Weakening demand, rising labor costs, digital transformation setbacks, Del Taco underperformance, and heightened financial risk threaten profitability and shareholder value.

Catalysts

About Jack in the Box- Operates and franchises quick-service restaurants under the Jack in the Box and Del Taco brands in the United States.

- Continued expansion and investment in digital ordering channels, including first-party platforms, mobile apps, and in-restaurant kiosks, are accelerating, with digital sales nearing 20% systemwide; these measures are expected to drive increased customer engagement, higher order frequency, and improved labor efficiency, which should support revenue growth and margin expansion.

- Ongoing unit development in urbanizing Sunbelt and Western U.S. markets, as well as franchisee-led growth in new regions such as Chicago, Louisville, Salt Lake City, and Florida, positions Jack in the Box to benefit from population growth and shifting demographics, boosting long-term store count, systemwide sales, and royalty revenue.

- Portfolio simplification actions, including potential divestiture of Del Taco and closure of underperforming units, are designed to enhance operational focus, free up capital, and support investments into higher-return initiatives—supporting improvements in net margin, earnings quality, and return on invested capital.

- Strategic price management and strong focus on value offerings (such as Munchie Meals and low-cost menu items) aim to capture ongoing demand for convenience and affordability among younger and value-conscious consumers, helping to defend and potentially grow same-store sales and stabilize revenue per store.

- Rapid modernization of legacy technology systems and further automation (POS integration, kiosk rollouts) are expected to alleviate recent operational disruptions, improve store-level throughput, and reduce labor intensity, supporting margin recovery and sustained earnings growth.

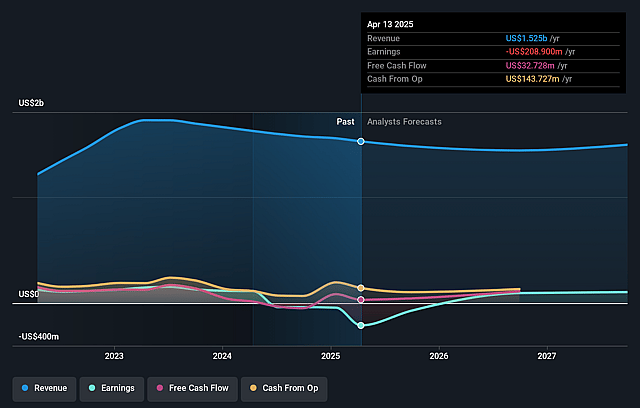

Jack in the Box Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Jack in the Box's revenue will decrease by 0.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from -13.7% today to 7.2% in 3 years time.

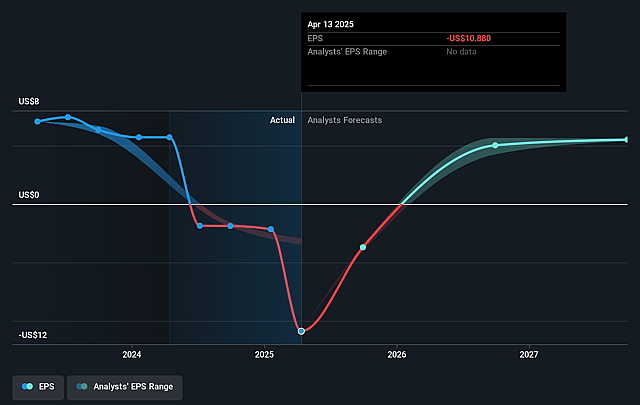

- Analysts expect earnings to reach $109.1 million (and earnings per share of $5.87) by about July 2028, up from $-208.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 6.8x on those 2028 earnings, up from -2.2x today. This future PE is lower than the current PE for the US Hospitality industry at 24.5x.

- Analysts expect the number of shares outstanding to decline by 1.29% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.6%, as per the Simply Wall St company report.

Jack in the Box Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Jack in the Box reported a 4.4% decline in same-store sales for the quarter, driven by falling transactions and negative mix, with both company-owned and franchised locations experiencing decreases, signaling weakened demand and ongoing negative sales trends that could continue to weigh on overall revenue growth.

- Persistent wage inflation, notably a 10.6% increase in labor costs for Jack in the Box and 11.7% for Del Taco (primarily due to recent California minimum wage hikes), has resulted in significantly compressed restaurant-level margins and threatens ongoing profitability as wage pressures are expected to intensify across the industry.

- Technology modernization efforts have been hampered by integration challenges with legacy systems, resulting in temporary but continuing negative sales impacts; potential ongoing digital infrastructure and execution lag versus competitors could limit Jack in the Box’s ability to capture digital/app-based demand and improve net margins.

- Significant asset impairment charges at Del Taco (a $203.2 million goodwill and intangible asset write-down this quarter) reflect ongoing underperformance and uncertain cash flows, while the exploration of strategic alternatives for the brand introduces integration/divestiture risk and earnings volatility for the consolidated company.

- A high net debt to EBITDA leverage ratio (5.5x), discontinued dividend, and halted share repurchases point to financial fragility, which, when combined with negative sales trends and store closures, increases the risk of adverse impacts on earnings, free cash flow, and shareholder value.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $29.444 for Jack in the Box based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $61.0, and the most bearish reporting a price target of just $19.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.5 billion, earnings will come to $109.1 million, and it would be trading on a PE ratio of 6.8x, assuming you use a discount rate of 11.6%.

- Given the current share price of $24.35, the analyst price target of $29.44 is 17.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.