Narratives are currently in beta

Key Takeaways

- Decreased customer acquisition costs and improved promotional efficiency are set to enhance net margins and earnings for DraftKings.

- Expansion in NBA offerings and legalization in Missouri are expected to drive customer engagement and future revenue growth.

- The competitive market and regulatory challenges, alongside reliance on promotions and customer behavior, pose considerable risks to DraftKings' revenue and profitability margins.

Catalysts

About DraftKings- Operates as a digital sports entertainment and gaming company in the United States and internationally.

- DraftKings has successfully decreased customer acquisition costs (CAC) by nearly 20% year-over-year while still acquiring more Sportsbook and iGaming customers. This improvement in efficiency is likely to positively impact net margins and earnings.

- The company is introducing new and exclusive NBA markets and expanding its Same Game Parlay offerings, which should enhance customer engagement and boost revenue growth.

- DraftKings achieved a significant boost in its promotional reinvestment rate, improving by 300 basis points as a percentage of gross gaming revenue, which indicates a more efficient use of promotions and should further support enhanced net margins.

- The recent legalization of online sports betting in Missouri offers DraftKings potential new revenue streams as the state represents around 2% of the U.S. population, contributing to future revenue growth.

- The company is projecting a significant adjusted EBITDA growth for fiscal year 2025, targeted between $900 million and $1 billion, supported by a guidance midpoint revenue growth of 31%, reflecting anticipated strong earnings growth.

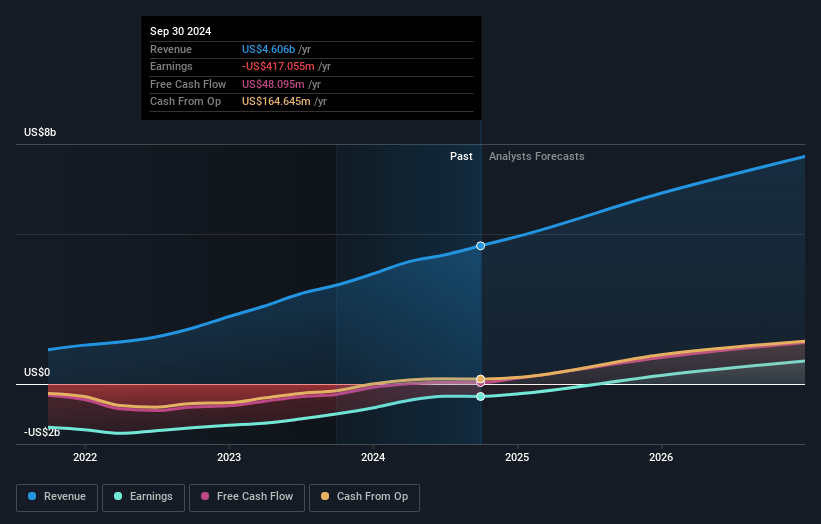

DraftKings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming DraftKings's revenue will grow by 23.2% annually over the next 3 years.

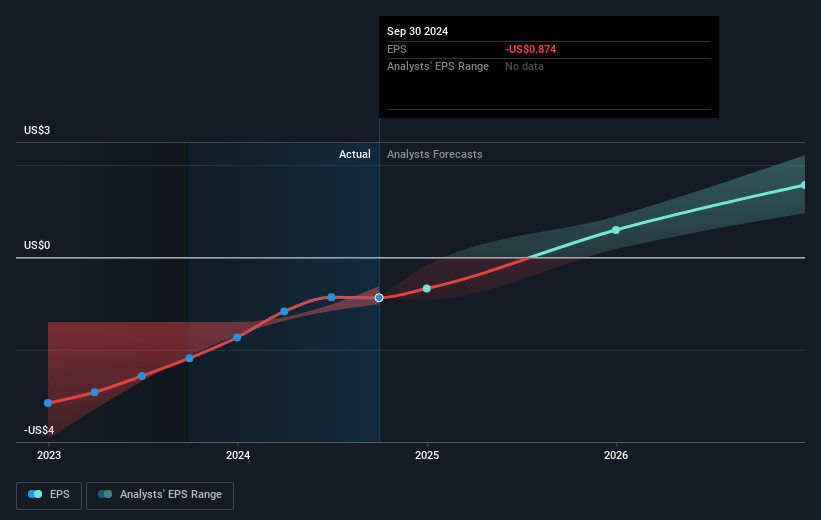

- Analysts assume that profit margins will increase from -9.1% today to 13.3% in 3 years time.

- Analysts expect earnings to reach $1.1 billion (and earnings per share of $2.51) by about November 2027, up from $-417.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 25.0x on those 2027 earnings, up from -50.5x today. This future PE is greater than the current PE for the US Hospitality industry at 24.4x.

- Analysts expect the number of shares outstanding to decline by 2.14% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.41%, as per the Simply Wall St company report.

DraftKings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Unexpectedly strong customer acquisition has led DraftKings to be more cautious about its future promotional budgeting, which could impact adjusted EBITDA margins if they have underestimated promotion costs.

- Customer-friendly sports outcomes have impacted DraftKings' short-term revenue and adjusted EBITDA for the fourth quarter, demonstrating the volatility and potential downside risk in earnings due to external factors.

- Regulatory changes, such as tax increases in states like Illinois, have necessitated adjustments in promotional strategies, which could impact net margins and profitability if such changes continue or worsen.

- DraftKings relies heavily on the parlay mix and specific sports seasons for driving hold percentage improvements, which carries the risk that changes in customer interest or behavior could impact revenue and gross margins.

- The highly competitive nature of the iGaming and Sportsbook markets, with reliance on promotional expenses to acquire and retain customers, poses a risk that increased competition could pressure net revenue growth and earnings margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $50.73 for DraftKings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $77.0, and the most bearish reporting a price target of just $33.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $8.6 billion, earnings will come to $1.1 billion, and it would be trading on a PE ratio of 25.0x, assuming you use a discount rate of 7.4%.

- Given the current share price of $43.21, the analyst's price target of $50.73 is 14.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives