Key Takeaways

- The introduction of numerous features and AI enhancements aims to boost user experience, drive revenue growth, and improve operational efficiency and margins.

- Global market expansion and new technology initiatives are poised to diversify revenue streams, potentially enhancing growth and net margins.

- Heavy reliance on top markets and competition from traditional accommodations threaten Airbnb's growth and profitability amid new market expansions and tech innovation challenges.

Catalysts

About Airbnb- Operates a platform that enables hosts to offer stays and experiences to guests worldwide.

- The introduction of 535 features and upgrades, including Guest Favorites, Co-Host Network, and enhanced search functionality, is aimed at improving user experience and increasing conversion rates, which is expected to drive future revenue growth.

- Airbnb's expansion into new global markets, such as Japan and other non-core regions, is expected to accelerate revenue growth as these regions are currently growing at double the rate of core markets.

- The development of a new technology stack is set to enable faster innovation and expansion into new offerings beyond short-term rentals, which could diversify revenue streams and potentially increase net margins.

- Investments of $200 million to $250 million planned for launching and scaling new businesses could significantly contribute to future revenue growth as these new offerings establish themselves in the market.

- AI-powered customer support and other AI-driven efficiencies are expected to improve operational effectiveness, leading to potential enhancements in net margins and free cash flow.

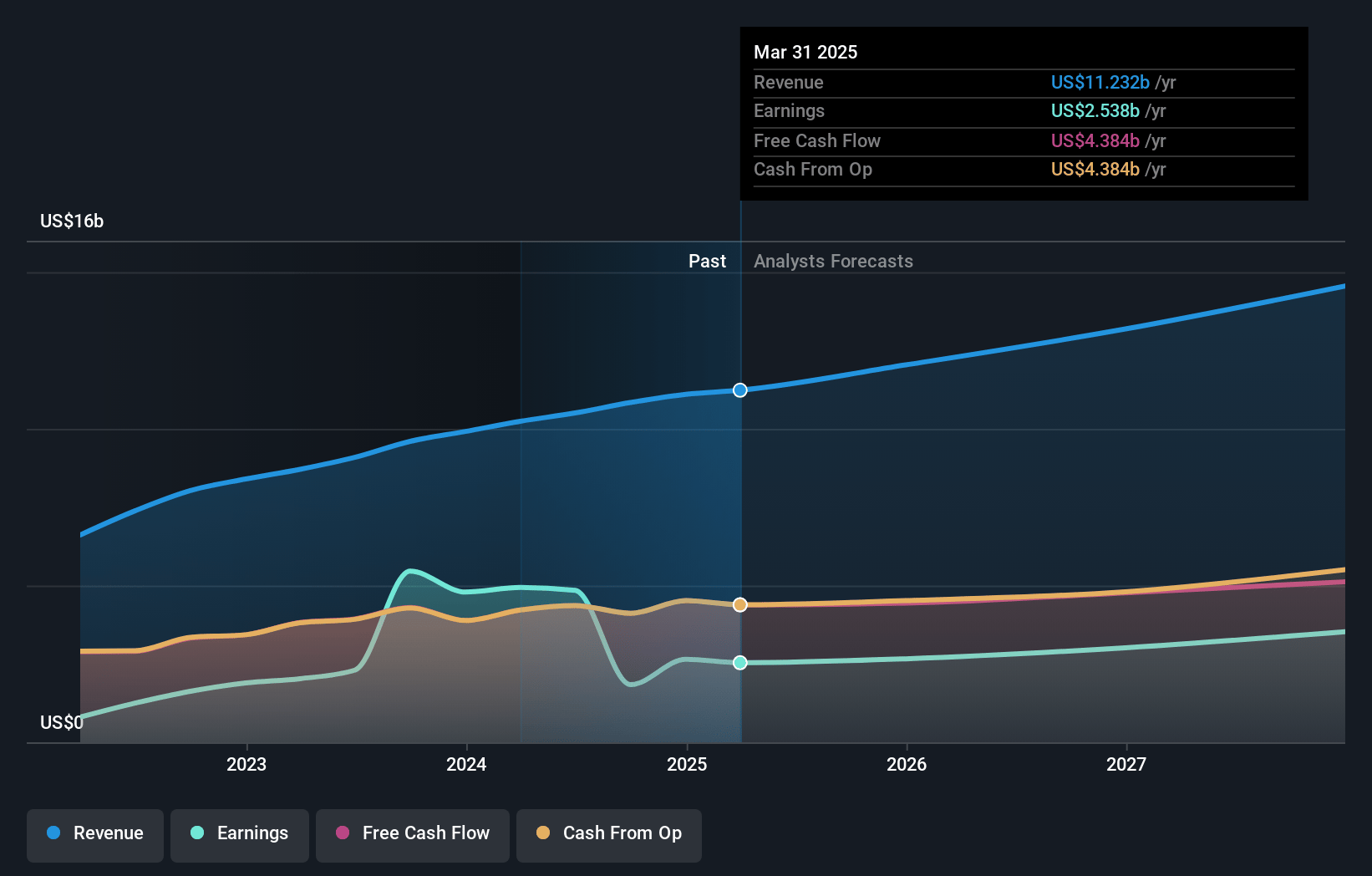

Airbnb Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Airbnb's revenue will grow by 10.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 23.9% today to 25.4% in 3 years time.

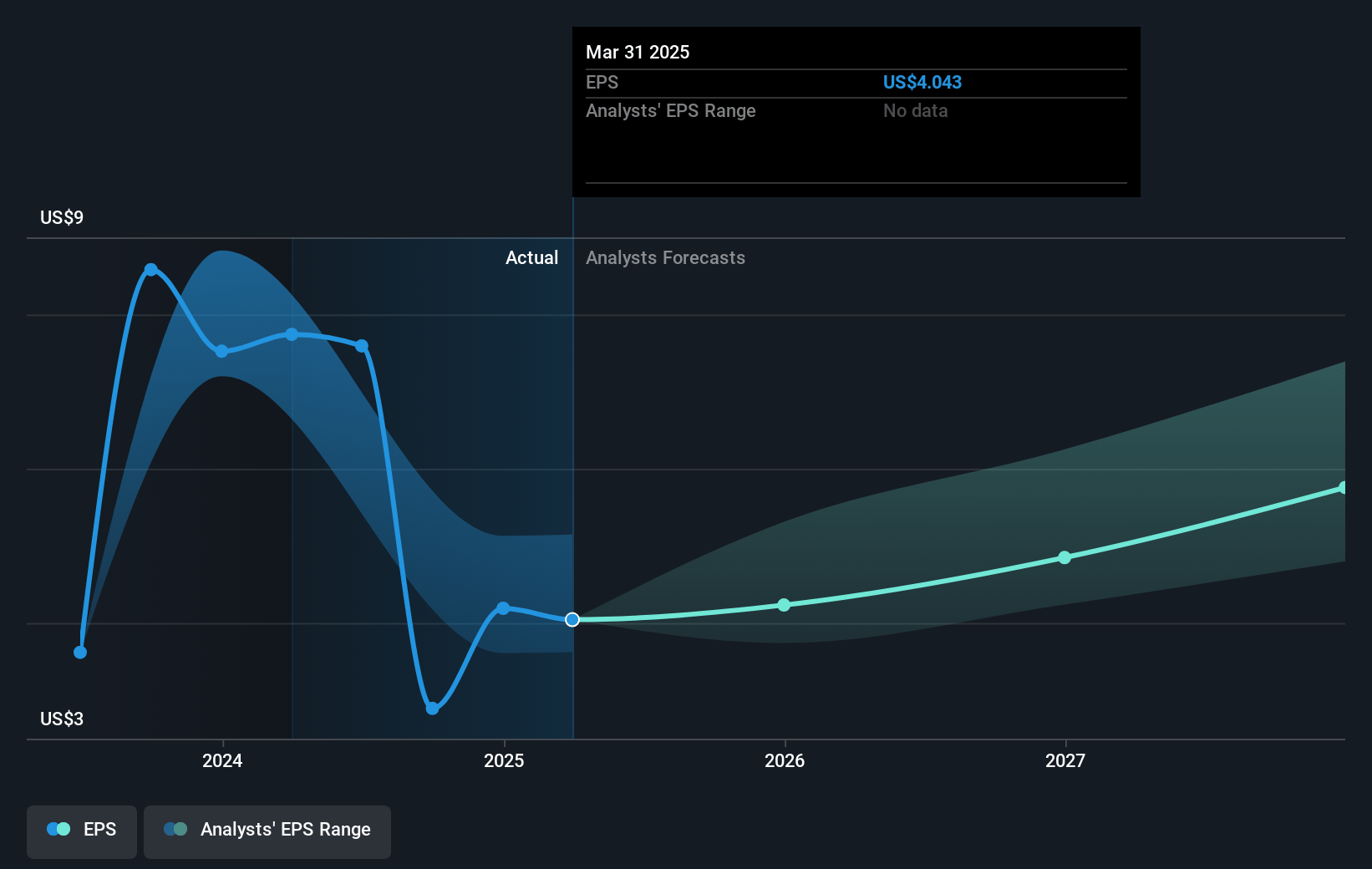

- Analysts expect earnings to reach $3.8 billion (and earnings per share of $6.09) by about March 2028, up from $2.6 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $4.8 billion in earnings, and the most bearish expecting $2.8 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 30.3x on those 2028 earnings, up from 29.2x today. This future PE is greater than the current PE for the US Hospitality industry at 23.3x.

- Analysts expect the number of shares outstanding to decline by 2.13% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.69%, as per the Simply Wall St company report.

Airbnb Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The localization and market expansion efforts, while potentially beneficial, may take time to pay off, and success may vary from market to market, impacting short-term revenue growth and profitability.

- Heavy reliance on the top 5 markets (U.S., U.K., Canada, France, and Australia) poses a risk if growth in these markets stalls or if there's economic downturns, potentially affecting revenue and earnings.

- Significant investments in launching and scaling new businesses could pressure the EBITDA margin in 2025, especially if these new ventures do not immediately contribute positively to revenue.

- Execution risks in evolving tech stack or new product launches could lead to delays or issues that impact user experience, affecting revenue growth and possibly net margins.

- Increasing competition from hotels and other accommodation services means Airbnb must continuously innovate and maintain affordability and service quality to protect and grow its market share, impacting revenue retention and growth potential.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $157.975 for Airbnb based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $200.0, and the most bearish reporting a price target of just $95.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $15.0 billion, earnings will come to $3.8 billion, and it would be trading on a PE ratio of 30.3x, assuming you use a discount rate of 7.7%.

- Given the current share price of $124.56, the analyst price target of $157.97 is 21.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives