Key Takeaways

- Enhanced platform technology and AI are poised to boost operational efficiency and expand Airbnb's services beyond short-term rentals, potentially improving net margins.

- Strategic global market focus and substantial investment in new businesses are expected to drive significant long-term revenue growth and market share expansion.

- Heavy reliance on core markets and evolving AI tech pose risks to Airbnb's profitability and growth amidst competitive and regulatory challenges.

Catalysts

About Airbnb- Operates a platform that enables hosts to offer stays and experiences to guests worldwide.

- Airbnb's introduction of over 535 features and product upgrades, along with high conversion rates from optimized search and merchandising, is expected to increase revenue by making it easier for guests to find and book the perfect stay. The foundation is being laid to support new offerings, which can drive further revenue growth.

- The expansion and optimization of Airbnb's platform technology stack, including the Co-Host Network, positions the company to innovate faster and scale new services. This can enhance net margins by creating operational efficiencies and expanding beyond short-term rentals.

- Airbnb's strategic focus on global markets outside the U.S., U.K., Canada, France, and Australia, with recent success in places like Brazil, suggests significant future revenue boosts. These localization efforts are growing at double the rate of core markets and can enhance overall market share.

- The commitment to investing $200 million to $250 million in new businesses is expected to drive long-term revenue growth. As these businesses scale over the coming years, they are anticipated to contribute significantly to Airbnb's revenue and enhance earnings.

- The implementation of AI-enhanced customer service and engineering productivity in 2025 is poised to improve cost management and operational efficiencies, potentially leading to higher net margins and stronger free cash flow conversion.

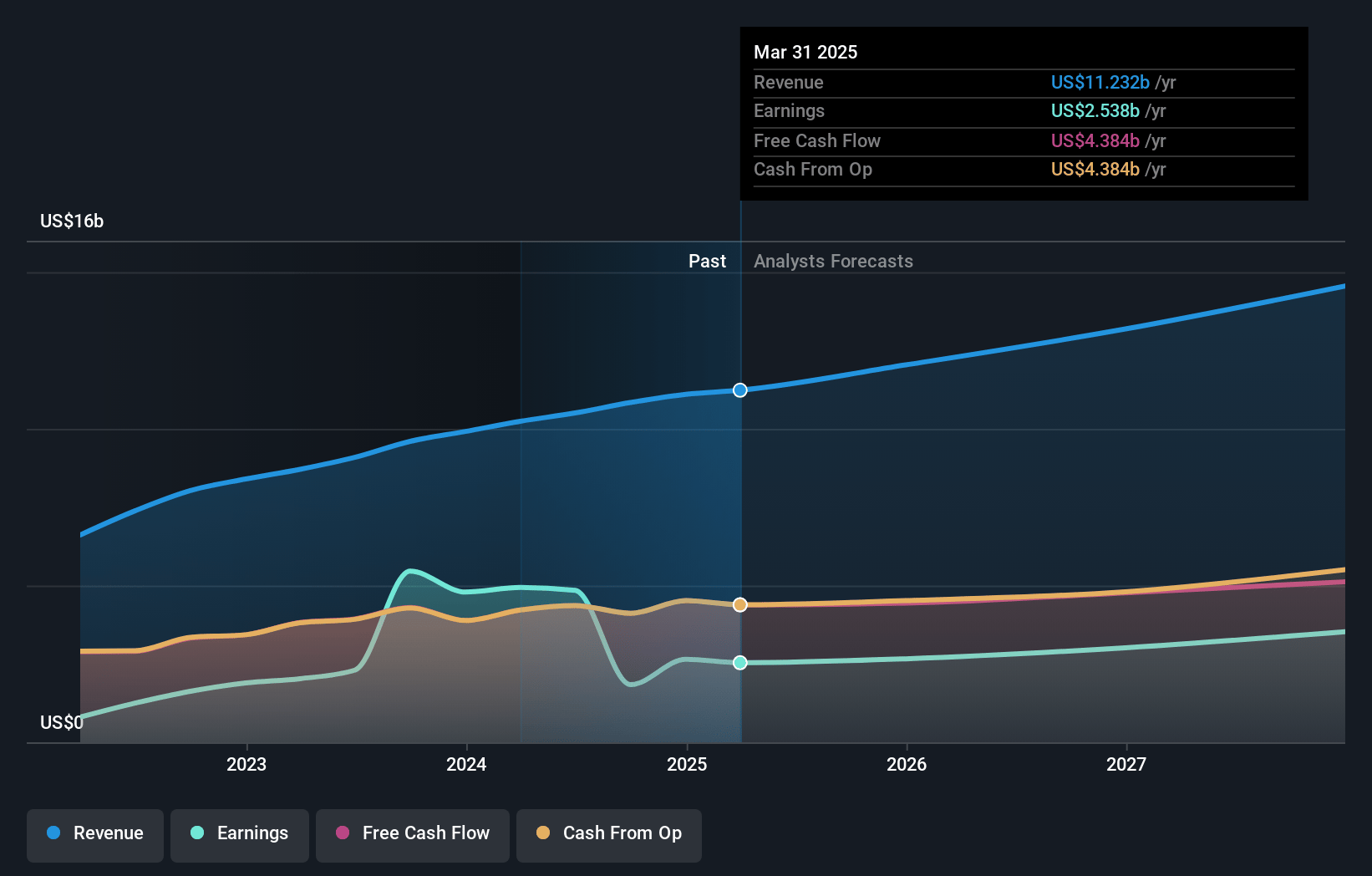

Airbnb Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Airbnb compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Airbnb's revenue will grow by 12.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 23.9% today to 27.9% in 3 years time.

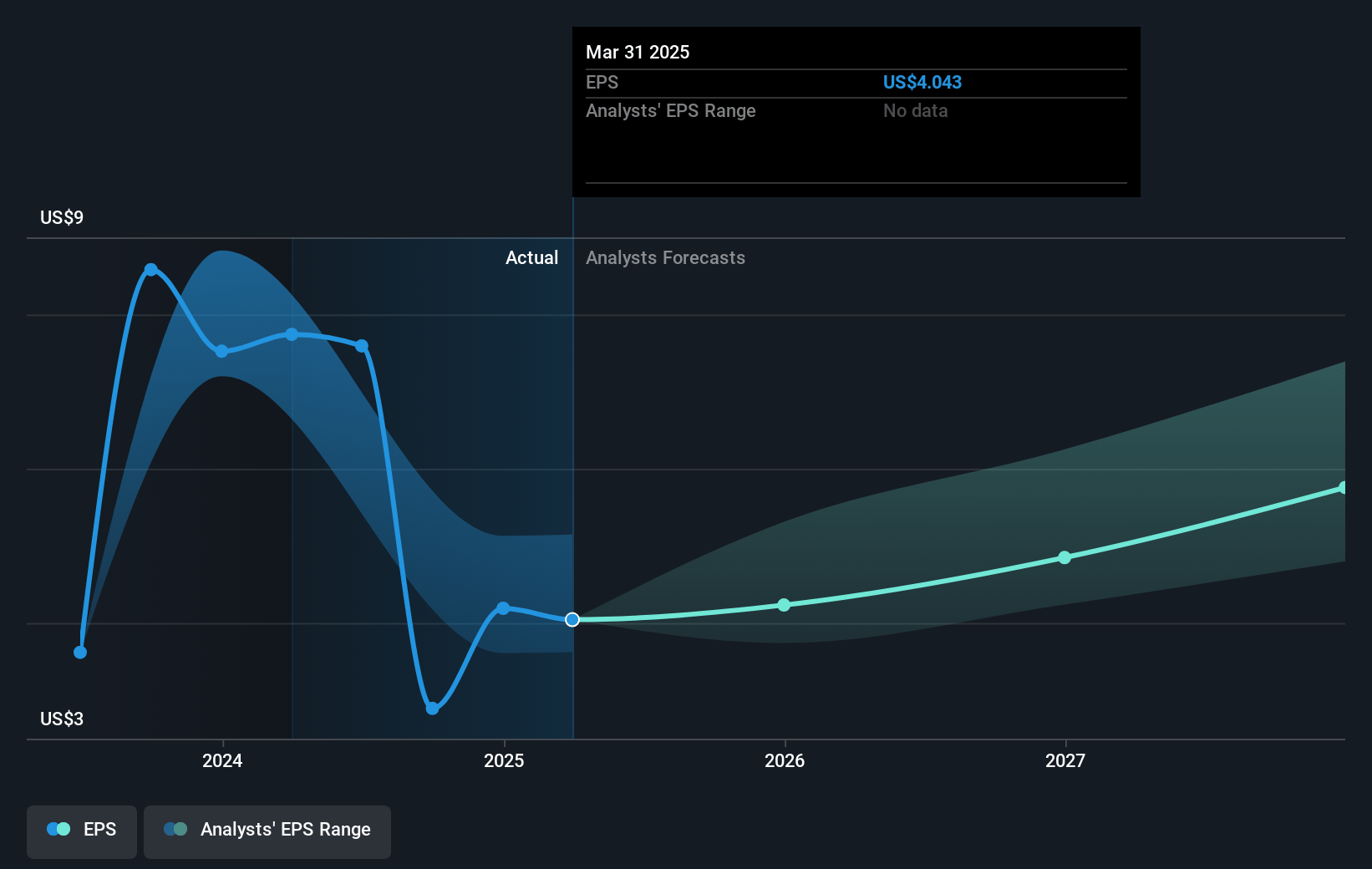

- The bullish analysts expect earnings to reach $4.4 billion (and earnings per share of $7.04) by about April 2028, up from $2.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 33.1x on those 2028 earnings, up from 29.4x today. This future PE is greater than the current PE for the US Hospitality industry at 22.6x.

- Analysts expect the number of shares outstanding to decline by 2.13% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.65%, as per the Simply Wall St company report.

Airbnb Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Airbnb's strategy to expand into new markets and offerings involves significant upfront investments, which, if not yielding expected returns, could strain profitability and slow revenue growth in the short term.

- The heavy reliance on its top 5 core markets, which comprise 70% of its gross booking value, poses a risk if any of these markets face economic downturns or increased competition, potentially impacting long-term revenue stability.

- While Airbnb is ambitious in its application of AI for customer service, the technology is still evolving, and any unexpected setbacks in implementing these AI advancements could increase operational costs and impact net margins.

- Despite positive growth in global markets, large competitors like hotels still dominate significant segments like North American urban areas, indicating a potential ceiling on Airbnb's growth in these lucrative spaces, which could affect revenue and market share.

- The reliance on successful regulatory partnerships, especially in pivotal markets, remains a risk. Any adverse legislative changes could constrain listing availability and lead to reduced earnings from these markets.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Airbnb is $200.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Airbnb's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $200.0, and the most bearish reporting a price target of just $95.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $15.8 billion, earnings will come to $4.4 billion, and it would be trading on a PE ratio of 33.1x, assuming you use a discount rate of 7.6%.

- Given the current share price of $125.49, the bullish analyst price target of $200.0 is 37.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NasdaqGS:ABNB. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.