Narratives are currently in beta

Key Takeaways

- Investments in digital platforms and same-day services are driving revenue growth amid consumer shifts towards online shopping and fast fulfillment.

- Expanding own brand offerings and enhancing supply-chain technologies are expected to increase margins and competitive differentiation.

- Target faces revenue and profit margin challenges due to consumer caution in spending, supply chain inefficiencies, and increased fulfillment costs.

Catalysts

About Target- Operates as a general merchandise retailer in the United States.

- Target is investing heavily in its digital platforms, with digital sales growing nearly 11% this quarter and same-day delivery powered by Target Circle 360 increasing by nearly 20%. This investment in digital and same-day services aims to drive further revenue growth as consumer preferences continue to shift towards online shopping and faster fulfillment options.

- The company is making strategic investments in its store base, including full remodels and new store openings, which are expected to enhance the shopping experience and improve store efficiency. These capital investments are likely to support revenue growth and improve net margins by optimizing operational efficiencies.

- Target's focus on expanding its own brand portfolio, which offers a unique blend of style and value, is expected to drive sales growth and increase its competitive differentiation. This strategy could lead to higher margins compared to selling national brands due to potentially lower cost structures and strong brand equity.

- The expansion and enhancement of the Target Circle loyalty program are designed to deepen customer engagement and drive incremental sales. By increasing member enrollment and engagement, Target can leverage customer data to tailor marketing and promotions effectively, potentially boosting long-term revenue and earnings.

- Target's robust pipeline of new store formats and technology investments, including AI, aims to enhance supply-chain efficiency and customer service. These initiatives are expected to lower costs and improve earnings, supporting margin expansion as operational efficiencies are realized.

Target Future Earnings and Revenue Growth

Assumptions

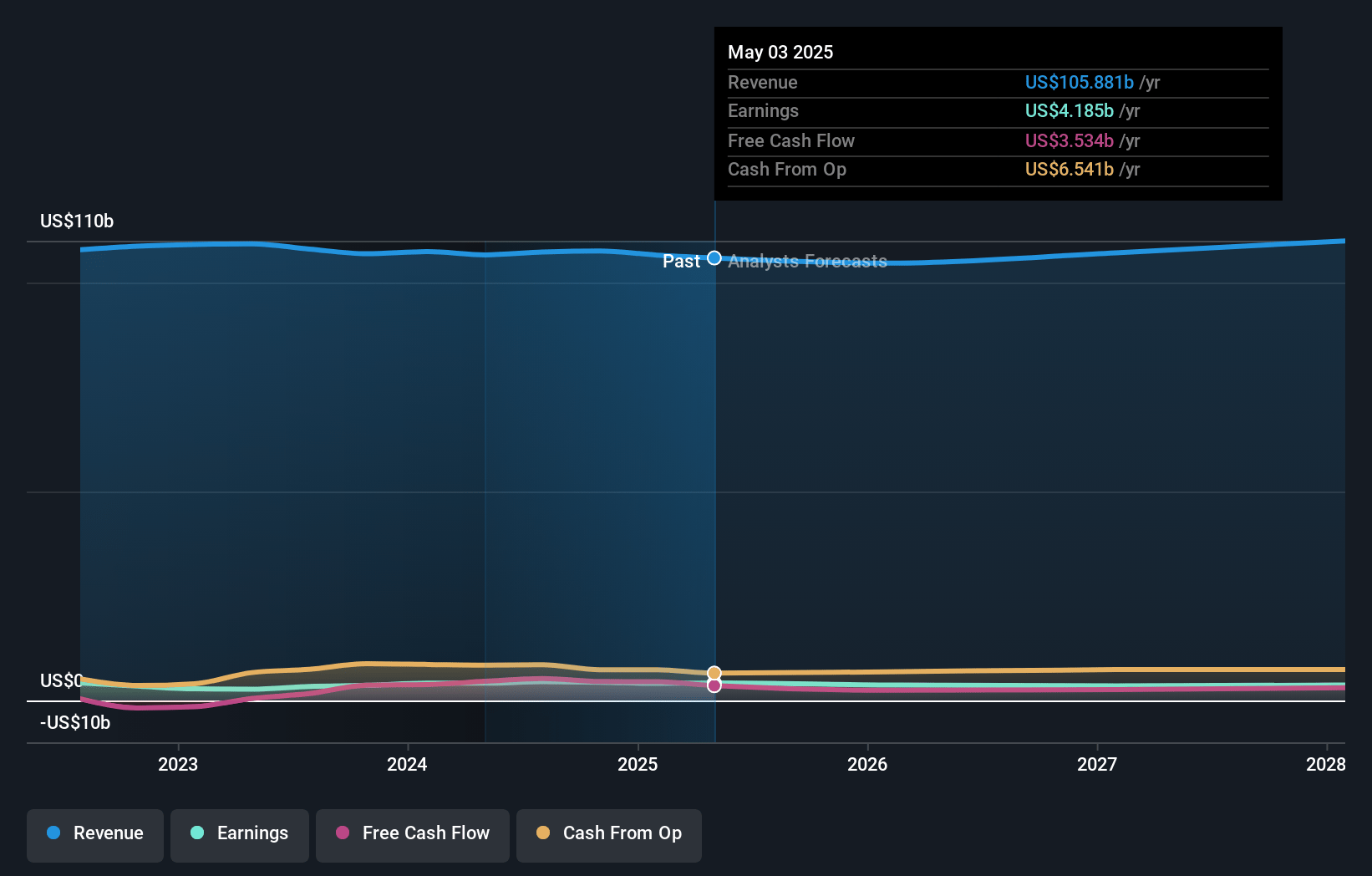

How have these above catalysts been quantified?- Analysts are assuming Target's revenue will grow by 2.8% annually over the next 3 years.

- Analysts are assuming Target's profit margins will remain the same at 4.1% over the next 3 years.

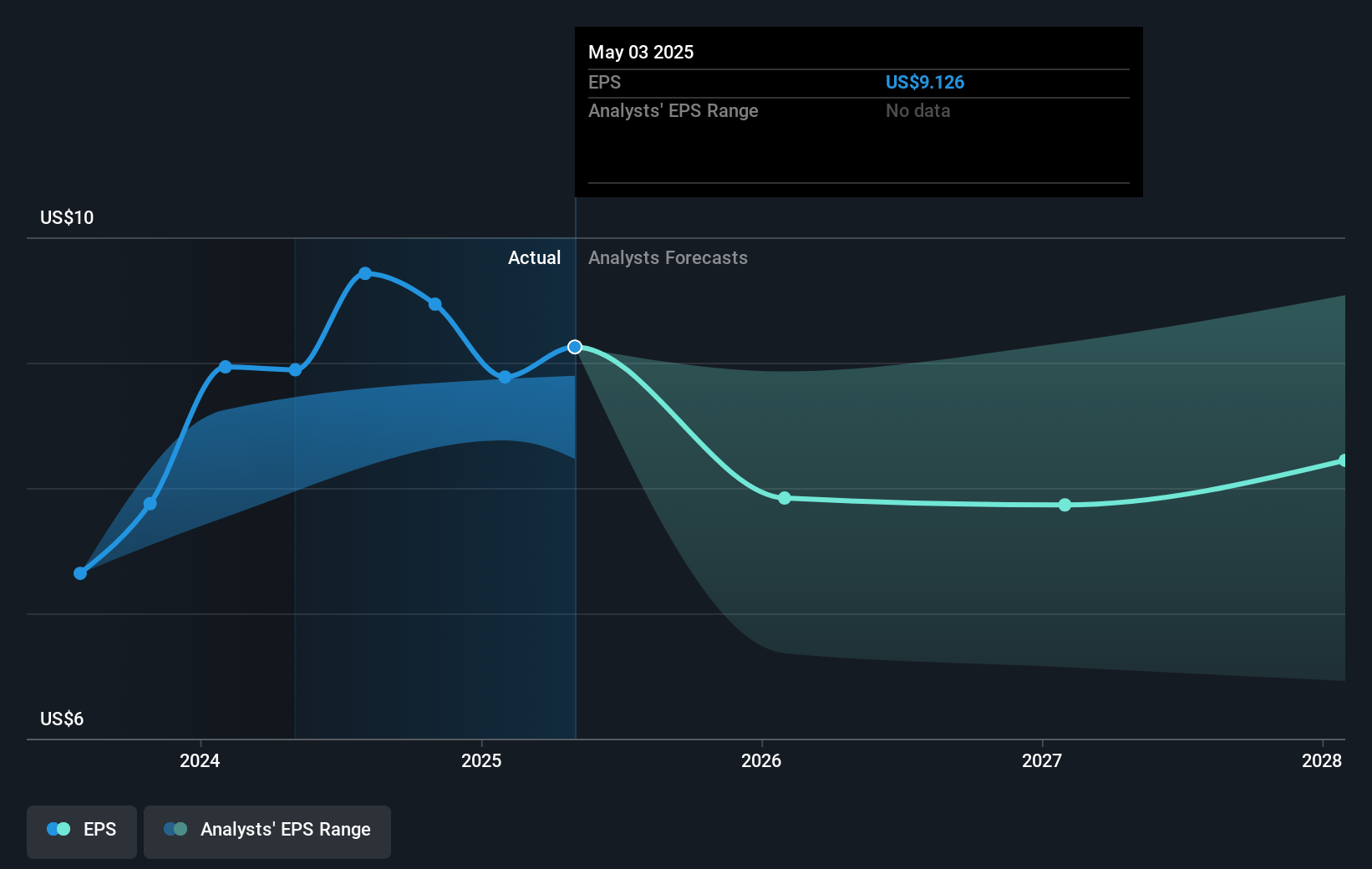

- Analysts expect earnings to reach $4.8 billion (and earnings per share of $11.01) by about January 2028, up from $4.4 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $3.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.6x on those 2028 earnings, up from 14.8x today. This future PE is lower than the current PE for the US Consumer Retailing industry at 27.1x.

- Analysts expect the number of shares outstanding to decline by 1.45% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.16%, as per the Simply Wall St company report.

Target Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Target experienced softness in discretionary categories, notably in apparel and home, due to consumers spending cautiously and focused on essentials, which may impact revenue growth.

- Elevated supply chain costs from rerouting shipments and dealing with port strikes, compounded by receipt timing issues, pressured margins and could impact net earnings.

- Increased volatility in receipt timing from Asian ports and higher-than-expected costs from supply chain inefficiencies were highlighted as significant financial pressures, potentially affecting profitability.

- Cost pressures from higher-than-expected general liability and healthcare expenses affected SG&A, pointing to risks in maintaining net margins at desired levels.

- Although Target saw growth in its digital platforms, the associated digital fulfillment and supply chain costs, which increased due to double-digit digital sales growth, present risks to maintaining robust profit margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $143.45 for Target based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $170.0, and the most bearish reporting a price target of just $103.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $116.9 billion, earnings will come to $4.8 billion, and it would be trading on a PE ratio of 15.6x, assuming you use a discount rate of 6.2%.

- Given the current share price of $141.06, the analyst's price target of $143.45 is 1.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives