Key Takeaways

- Expansion into new markets and investment in logistics are enhancing growth potential, operational efficiency, and competitive strength.

- Focus on digital innovation, private label growth, and value-driven membership is driving customer loyalty, higher revenues, and improved margins.

- BJ’s faces risks from limited e-commerce growth, regional concentration, demographic changes, margin pressures, and sustainability concerns that threaten long-term revenue and competitiveness.

Catalysts

About BJ's Wholesale Club Holdings- Operates membership warehouse clubs on the eastern half of the United States.

- Accelerated store expansion into high-growth suburban and secondary markets is poised to significantly increase BJ’s addressable customer base and drive sustained same-store sales and membership revenue growth, with new clubs delivering comp sales at more than double the chain average.

- Strong consumer sensitivity to value, especially during inflationary periods, supports continued robust membership acquisition and renewal rates as shoppers increasingly turn to warehouse clubs for savings, driving higher revenues and solidifying the recurring membership fee income stream.

- Investment in digital platforms—including buy-online-pick-up-in-club, same-day delivery, and a highly engaging mobile app—is consistently increasing digitally enabled sales and member engagement, fueling larger basket sizes and higher frequency of visits, thereby supporting revenue and margin growth.

- Substantial growth in BJ’s private label offerings, which account for over a quarter of merchandise sales and are targeting 30 percent, not only differentiates the assortment but also boosts gross margins and customer loyalty, enhancing both earnings and long-term profit potential.

- Proven ability to penetrate new, underserved geographic regions, combined with investments in logistics and distribution center infrastructure, strengthens BJ’s competitive position and scalability, setting the stage for accelerated footprint growth, operating leverage, and long-term earnings expansion.

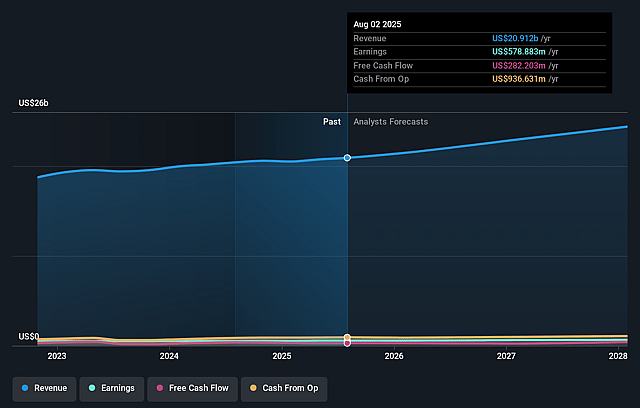

BJ's Wholesale Club Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on BJ's Wholesale Club Holdings compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming BJ's Wholesale Club Holdings's revenue will grow by 7.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 2.6% today to 2.7% in 3 years time.

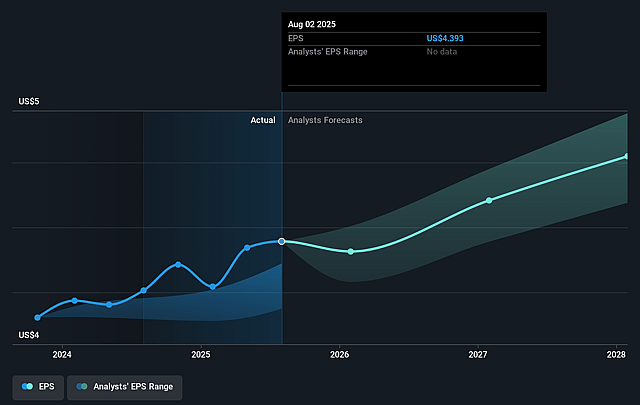

- The bullish analysts expect earnings to reach $693.3 million (and earnings per share of $5.39) by about April 2028, up from $534.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 30.1x on those 2028 earnings, up from 29.2x today. This future PE is greater than the current PE for the US Consumer Retailing industry at 25.1x.

- Analysts expect the number of shares outstanding to decline by 0.78% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.52%, as per the Simply Wall St company report.

BJ's Wholesale Club Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing shift toward e-commerce and digital-first retail poses a secular risk to BJ’s, as their growth in digitally enabled sales still relies largely on in-club order fulfillment; if BJ’s fails to further strengthen and scale their e-commerce capabilities, they risk losing market share and revenue growth to competitors with more advanced online platforms and logistics.

- BJ’s club expansion strategy remains concentrated in densely populated East Coast and adjacent markets, potentially exposing the company to regional economic downturns and limiting nationwide growth opportunities, which could constrain long-term revenue and earnings growth.

- The wholesale club model is particularly vulnerable to demographic shifts such as declining household sizes and an aging population, which may reduce demand for bulk goods and lead to a shrinking core customer base, negatively impacting future revenue potential.

- Persistent inflation, rising commodity and supplier costs, and the specter of tariffs are pressuring margins as BJ’s often chooses to absorb costs rather than fully pass price increases to members, risking sustained net margin compression and potentially limiting future earnings growth.

- As sustainability concerns gain prominence, negative perceptions around packaging waste and environmental impact of bulk retail could harm BJ’s brand and sales if the company does not adapt to changing consumer values, potentially reducing both revenue and customer retention over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for BJ's Wholesale Club Holdings is $135.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of BJ's Wholesale Club Holdings's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $135.0, and the most bearish reporting a price target of just $63.34.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $25.7 billion, earnings will come to $693.3 million, and it would be trading on a PE ratio of 30.1x, assuming you use a discount rate of 6.5%.

- Given the current share price of $118.45, the bullish analyst price target of $135.0 is 12.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on BJ's Wholesale Club Holdings?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.